Drake Tax2023 Form Availability and Tax Changes Illinois

Understanding the Schedule 1299-D Form

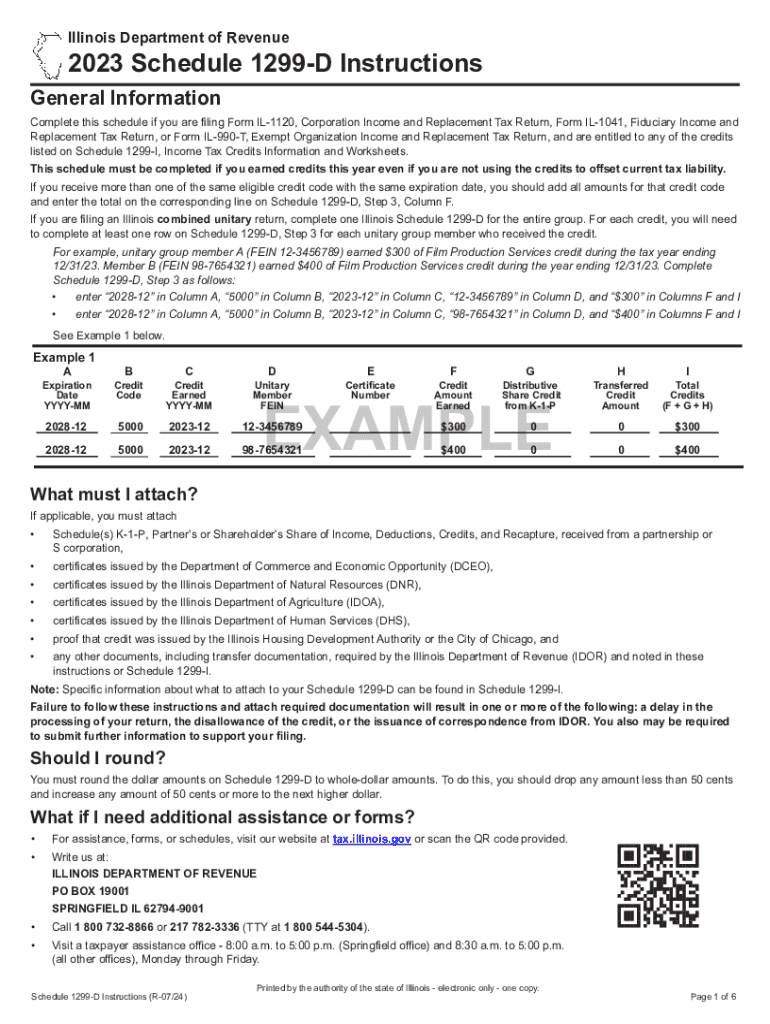

The Schedule 1299-D is a tax form used in the United States, specifically for reporting certain tax credits and adjustments. It is essential for taxpayers who are claiming specific credits related to their tax obligations. This form is typically associated with the Illinois Department of Revenue and is crucial for ensuring compliance with state tax laws. Understanding its purpose can help taxpayers maximize their benefits and avoid potential issues with tax filings.

Steps to Complete the Schedule 1299-D

Filling out the Schedule 1299-D requires careful attention to detail. Here are the key steps to ensure accurate completion:

- Gather necessary documentation, including previous tax returns and any relevant financial statements.

- Begin by entering your personal information, such as your name, address, and Social Security number.

- Follow the form’s instructions to report your income and any applicable deductions.

- Carefully calculate any credits you are eligible for, ensuring that you reference the correct lines on the form.

- Review your completed form for accuracy before submission.

Required Documents for Schedule 1299-D

To successfully complete the Schedule 1299-D, you will need several key documents. These include:

- Your most recent federal and state tax returns.

- Documentation of income, such as W-2 forms or 1099 forms.

- Records of any tax credits claimed in previous years.

- Supporting documents for deductions, including receipts and bank statements.

Filing Deadlines for Schedule 1299-D

Timely filing of the Schedule 1299-D is crucial to avoid penalties. The typical deadline for submitting this form aligns with the federal tax filing deadline, which is usually April fifteenth. If you require an extension, ensure that you also extend your state tax filing to avoid late fees.

IRS Guidelines for Schedule 1299-D

The Internal Revenue Service (IRS) provides guidelines that can assist in the completion and submission of the Schedule 1299-D. It is important to review these guidelines to ensure compliance with federal and state tax laws. Adhering to IRS instructions can help prevent errors that may lead to audits or penalties.

Penalties for Non-Compliance with Schedule 1299-D

Failure to file the Schedule 1299-D accurately and on time can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action from the state. It is advisable to ensure that all information is correct and submitted by the deadline to avoid these consequences.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the drake tax2023 form availability and tax changes illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the schedule 1299 d instructions?

The schedule 1299 d instructions provide detailed guidelines on how to complete the form accurately. This includes information on required fields, eligibility criteria, and submission processes. Understanding these instructions is crucial for ensuring compliance and avoiding delays in processing.

-

How can airSlate SignNow help with schedule 1299 d instructions?

airSlate SignNow simplifies the process of managing schedule 1299 d instructions by allowing users to eSign and send documents securely. Our platform ensures that all necessary forms are completed correctly and efficiently. This helps businesses save time and reduce errors in their submissions.

-

Are there any costs associated with using airSlate SignNow for schedule 1299 d instructions?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan provides access to features that streamline the completion of schedule 1299 d instructions. You can choose a plan that fits your budget while benefiting from our comprehensive eSigning solutions.

-

What features does airSlate SignNow offer for managing schedule 1299 d instructions?

airSlate SignNow includes features such as customizable templates, automated workflows, and real-time tracking for schedule 1299 d instructions. These tools enhance efficiency and ensure that all parties involved can easily access and sign documents. Our platform is designed to make document management seamless.

-

Can I integrate airSlate SignNow with other applications for schedule 1299 d instructions?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow for schedule 1299 d instructions. Whether you use CRM systems, cloud storage, or project management tools, our platform can connect with them to enhance your document handling processes.

-

What are the benefits of using airSlate SignNow for schedule 1299 d instructions?

Using airSlate SignNow for schedule 1299 d instructions provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored securely, minimizing the risk of loss or unauthorized access. This allows businesses to focus on their core operations.

-

Is airSlate SignNow user-friendly for completing schedule 1299 d instructions?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete schedule 1299 d instructions. The intuitive interface guides users through the process, ensuring that even those with minimal technical skills can navigate the platform effectively. Training resources are also available for additional support.

Get more for Drake Tax2023 Form Availability And Tax Changes Illinois

- Think sheet form

- Udan medical surgical nursing pdf form

- Joining form pdf

- Near miss log pharmacy template form

- Eaglemark savings bank lien release form

- Project management absolute beginners guide 4th edition pdf form

- Systems analysis and design 11th edition pdf form

- Tceq form pi 1r general application for air permit renewals tceq state tx

Find out other Drake Tax2023 Form Availability And Tax Changes Illinois

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure