Ifta 101 Form

What is the IFTA 101?

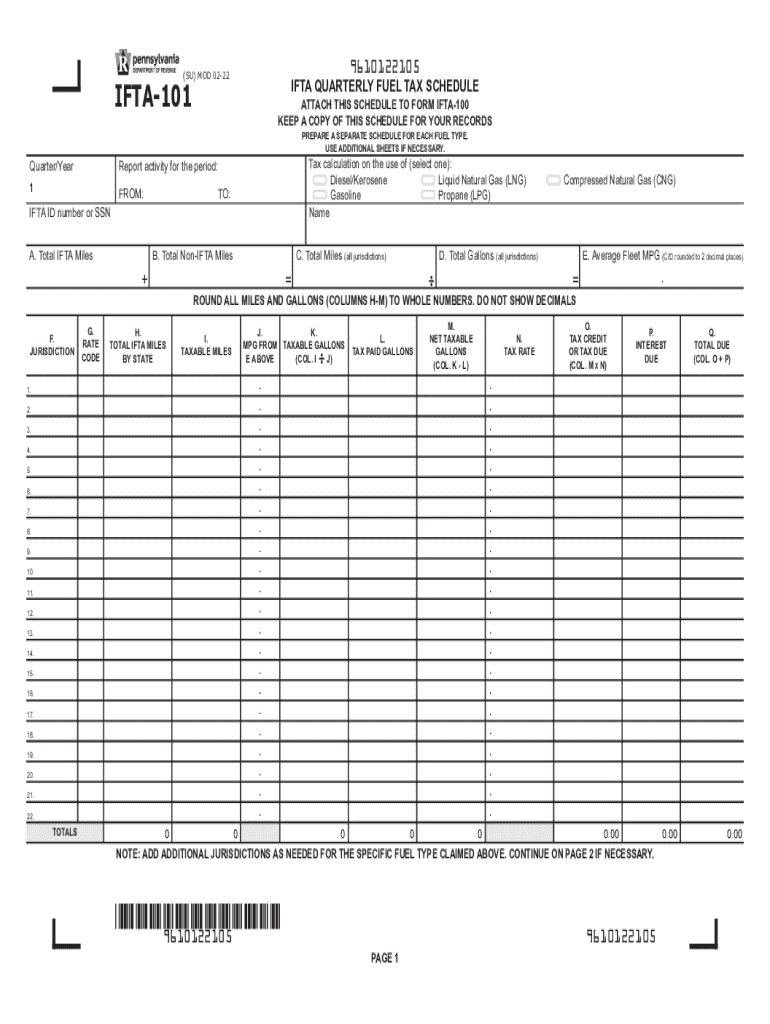

The IFTA 101 form is a critical document used by motor carriers operating in multiple jurisdictions to report their fuel usage and calculate the tax owed to each state. This form is part of the International Fuel Tax Agreement (IFTA), which simplifies the reporting of fuel taxes for interstate commercial vehicles. By using the IFTA 101, carriers can streamline their fuel tax reporting process, ensuring compliance with state regulations while minimizing administrative burdens.

How to Complete the IFTA 101

Completing the IFTA 101 involves several key steps. First, gather all necessary data, including fuel purchases and mileage traveled in each jurisdiction. Next, accurately fill in the form by entering the total gallons of fuel consumed and the miles driven in each state. It is essential to ensure that all figures are correct to avoid discrepancies. After completing the form, review it for accuracy before submission to the appropriate state agency.

Filing Deadlines for the IFTA 101

Timely filing of the IFTA 101 is crucial for compliance. The form must be submitted quarterly, with specific deadlines varying by state. Generally, the due dates are the last day of the month following the end of each quarter. For example, the deadlines for the first quarter (January to March) are typically due by April 30. It is important to check with your state’s regulations to confirm the exact dates and avoid penalties.

Required Documents for the IFTA 101

To successfully file the IFTA 101, certain documents are required. These include records of fuel purchases, mileage logs, and any previous IFTA returns. It is advisable to maintain accurate and detailed records to support the information reported on the form. Having these documents readily available can facilitate a smoother filing process and ensure compliance with state regulations.

Penalties for Non-Compliance with IFTA Regulations

Failing to comply with IFTA regulations can result in significant penalties. These may include fines, interest on unpaid taxes, and potential audits. Each state has its own enforcement policies, and penalties can vary based on the severity of the non-compliance. It is crucial for carriers to adhere to filing deadlines and accurately report their fuel usage to avoid these consequences.

Form Submission Methods for the IFTA 101

The IFTA 101 can be submitted through various methods, depending on state regulations. Common submission options include online filing through state tax agency websites, mailing a paper form, or delivering it in person. Each method has its own advantages, such as immediate confirmation of receipt for online submissions or the ability to maintain a physical copy when mailed. Carriers should choose the method that best suits their operational needs.

Key Elements of the IFTA 101

Understanding the key elements of the IFTA 101 is essential for accurate completion. The form typically includes sections for reporting total miles driven, gallons of fuel purchased, and tax rates for each jurisdiction. Additionally, it may require information about the vehicle and the carrier. Familiarity with these elements can help ensure that all necessary information is included, reducing the risk of errors during filing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ifta 101

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are IFTA 100 and 101 quarterly fuel tax forms PA?

The IFTA 100 and 101 quarterly fuel tax forms PA are essential documents for reporting fuel use by interstate carriers. These forms help ensure compliance with the International Fuel Tax Agreement (IFTA) and simplify the tax reporting process for businesses operating in Pennsylvania.

-

How can airSlate SignNow help with IFTA 100 and 101 quarterly fuel tax forms PA?

airSlate SignNow provides an efficient platform for completing and eSigning IFTA 100 and 101 quarterly fuel tax forms PA. Our user-friendly interface allows businesses to easily fill out, sign, and send these forms, ensuring timely submission and compliance.

-

What features does airSlate SignNow offer for managing IFTA forms?

With airSlate SignNow, you can access templates specifically designed for IFTA 100 and 101 quarterly fuel tax forms PA. Features include customizable fields, secure eSigning, and automated reminders to help you stay on track with your tax obligations.

-

Is there a cost associated with using airSlate SignNow for IFTA forms?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our cost-effective solutions ensure that you can manage your IFTA 100 and 101 quarterly fuel tax forms PA without breaking the bank, providing great value for your investment.

-

Can I integrate airSlate SignNow with other software for IFTA reporting?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software, making it easier to manage your IFTA 100 and 101 quarterly fuel tax forms PA. This integration streamlines your workflow and enhances efficiency in your tax reporting process.

-

What are the benefits of using airSlate SignNow for IFTA forms?

Using airSlate SignNow for your IFTA 100 and 101 quarterly fuel tax forms PA offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our platform simplifies the entire process, allowing you to focus on your core business operations.

-

How secure is airSlate SignNow for handling sensitive tax documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure storage protocols to protect your IFTA 100 and 101 quarterly fuel tax forms PA and other sensitive documents, ensuring that your information remains confidential and safe.

Get more for Ifta 101

Find out other Ifta 101

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA