ET1 2024PAYROLL EXPENSE TAXEmployerSole Proprieto Form

Understanding the ET-1 Payroll Expense Tax

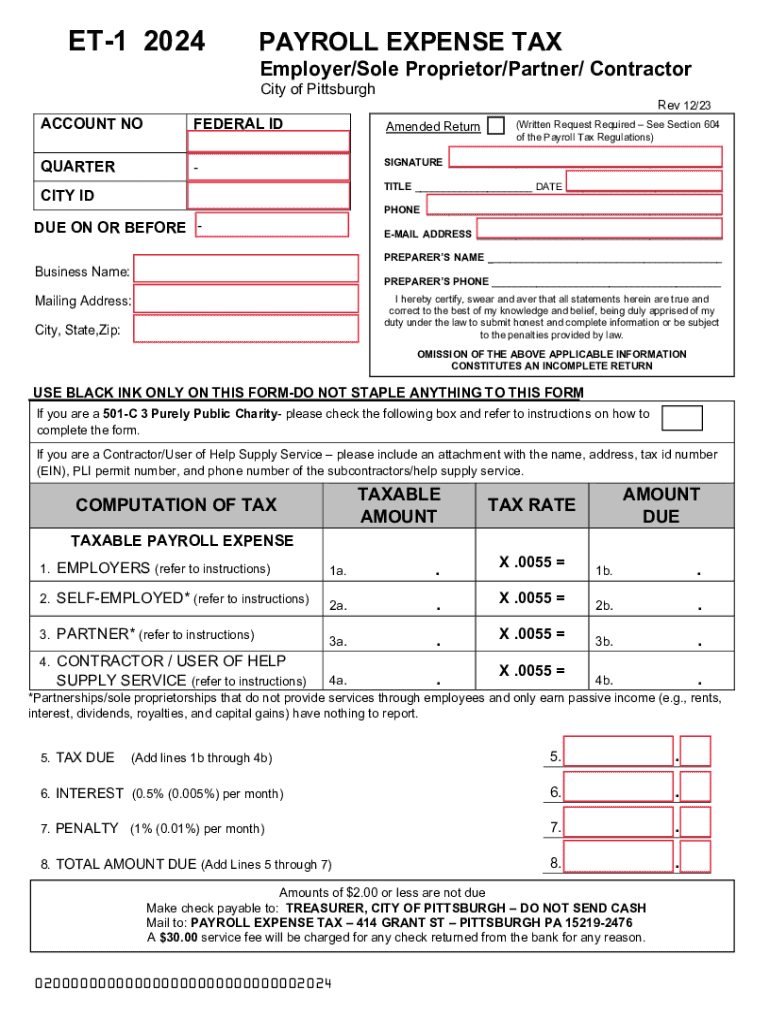

The ET-1 Payroll Expense Tax is a specific tax levied by the City of Pittsburgh on employers based on their payroll expenses. This tax is applicable to businesses operating within the city limits and is designed to fund local services. Employers are required to calculate their payroll expenses accurately to ensure compliance with city regulations. The tax is assessed on the total payroll, which includes wages, salaries, and other compensation paid to employees.

Steps to Complete the ET-1 Payroll Expense Tax Form

Completing the ET-1 form involves several steps to ensure accuracy and compliance. First, gather all necessary payroll records for the reporting period. This includes total wages, bonuses, and any other compensations. Next, calculate your total payroll expenses for the period. After that, fill out the ET-1 form with the required information, ensuring that all figures are accurate. Finally, review the form for any errors before submission to avoid penalties.

Filing Deadlines and Important Dates

It is crucial to adhere to the filing deadlines for the ET-1 Payroll Expense Tax to avoid late fees. The tax is typically due quarterly, with specific deadlines set by the City of Pittsburgh. Employers should mark their calendars for these dates to ensure timely submission. Missing a deadline can result in penalties and interest on the unpaid tax amount.

Required Documents for ET-1 Submission

When submitting the ET-1 Payroll Expense Tax form, employers must include several key documents. These typically include detailed payroll records for the reporting period, any supporting documentation that verifies payroll expenses, and prior tax returns if applicable. Having these documents ready can streamline the filing process and reduce the likelihood of errors.

Penalties for Non-Compliance with ET-1 Requirements

Failure to comply with the ET-1 Payroll Expense Tax regulations can lead to significant penalties. Employers may face fines based on the amount of unpaid tax, as well as interest on late payments. Additionally, consistent non-compliance can result in further legal action from the city. It is essential for businesses to understand these consequences and ensure timely and accurate filings.

Examples of ET-1 Payroll Expense Tax Scenarios

Understanding how the ET-1 Payroll Expense Tax applies in various scenarios can help employers navigate their obligations. For instance, a small business with a payroll of $100,000 would calculate its tax based on that total. Conversely, a larger corporation with multiple locations in Pittsburgh would need to aggregate payroll expenses across all locations. Each scenario requires careful calculation to ensure compliance with city tax laws.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the et1 2024payroll expense taxemployersole proprieto

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is city payroll and how can airSlate SignNow help?

City payroll refers to the process of managing employee compensation within municipal organizations. airSlate SignNow streamlines this process by allowing you to easily send and eSign payroll documents, ensuring compliance and efficiency. Our platform simplifies the management of city payroll, making it easier for HR departments to handle documentation.

-

How does airSlate SignNow ensure the security of city payroll documents?

Security is a top priority for airSlate SignNow, especially when handling sensitive city payroll documents. We utilize advanced encryption methods and secure cloud storage to protect your data. Additionally, our platform complies with industry standards to ensure that your city payroll information remains confidential and secure.

-

What features does airSlate SignNow offer for managing city payroll?

airSlate SignNow offers a range of features tailored for city payroll management, including customizable templates, automated workflows, and real-time tracking of document status. These features help streamline the payroll process, reduce errors, and enhance overall efficiency. With airSlate SignNow, managing city payroll becomes a hassle-free experience.

-

Is airSlate SignNow cost-effective for city payroll solutions?

Yes, airSlate SignNow is designed to be a cost-effective solution for city payroll management. Our pricing plans are flexible and cater to organizations of all sizes, ensuring that you only pay for what you need. By reducing paperwork and administrative tasks, airSlate SignNow can help save your city payroll department both time and money.

-

Can airSlate SignNow integrate with existing city payroll systems?

Absolutely! airSlate SignNow offers seamless integrations with various city payroll systems and software. This allows you to enhance your existing workflows without disrupting your current processes. Our integration capabilities ensure that your city payroll operations remain efficient and connected.

-

What are the benefits of using airSlate SignNow for city payroll?

Using airSlate SignNow for city payroll provides numerous benefits, including increased efficiency, reduced paperwork, and improved compliance. Our platform allows for quick document turnaround times, which is crucial for timely payroll processing. Additionally, the ease of eSigning helps ensure that all necessary approvals are obtained swiftly.

-

How can I get started with airSlate SignNow for city payroll?

Getting started with airSlate SignNow for city payroll is simple. You can sign up for a free trial on our website to explore the features and benefits firsthand. Once you're ready, our user-friendly interface will guide you through setting up your city payroll documents and workflows.

Get more for ET1 2024PAYROLL EXPENSE TAXEmployerSole Proprieto

- Amadeus quick reference guide 2022 pdf form

- Engineering mathematics 1 by dr ksc download form

- Statics and strength of materials 7th edition pdf form

- Australian medicines handbook 2022 pdf download form

- Business practice level 2 textbook pdf form

- Spot on english grade 9 teachers guide pdf download form

- Solutions for all english home language grade 7 pdf form

- Information processing n4 study guide pdf

Find out other ET1 2024PAYROLL EXPENSE TAXEmployerSole Proprieto

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist