PA Corporate Net Income Tax Declaration for a State E File Report PA 8453 C PA Department of Revenue Form

Understanding the PA Corporate Net Income Tax Declaration

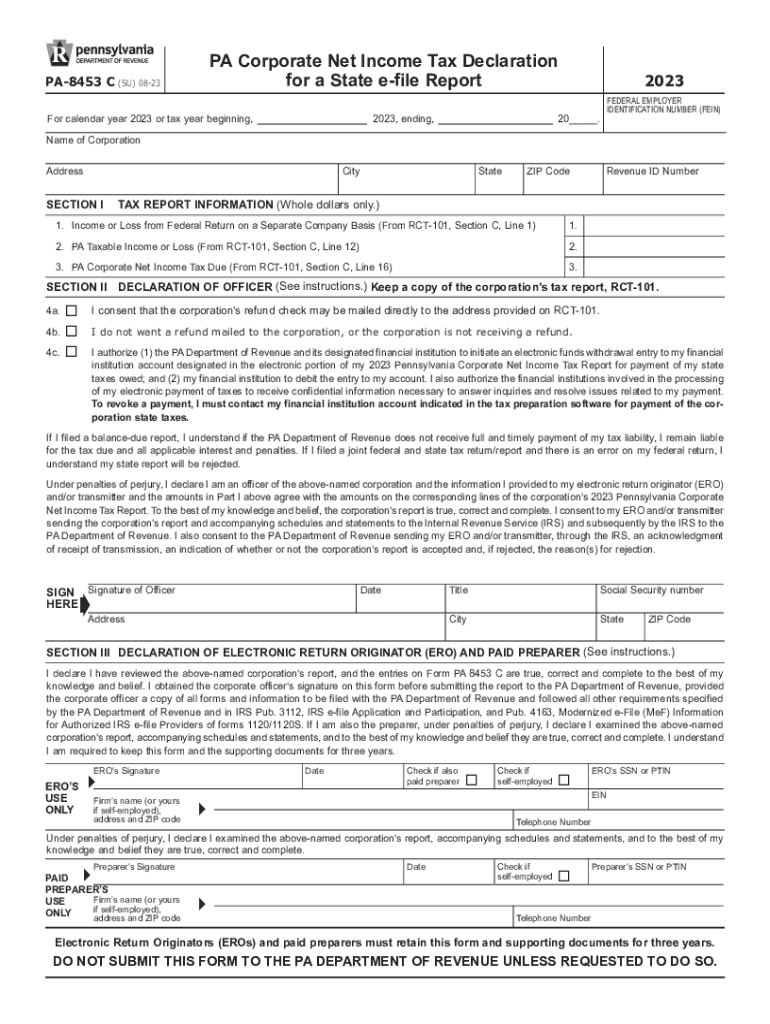

The PA Corporate Net Income Tax Declaration for a State E-file Report, known as PA 8453 C, is a crucial document for corporations operating in Pennsylvania. This form serves as a declaration of the corporate net income tax liability and is required for e-filing state tax returns. It ensures that businesses comply with state tax regulations, providing necessary information to the Pennsylvania Department of Revenue.

Steps to Complete the PA 8453 C Form

Completing the PA Corporate Net Income Tax Declaration involves several key steps:

- Gather all necessary financial documents, including income statements and balance sheets.

- Accurately calculate your corporation's net income based on the financial data.

- Fill out the PA 8453 C form with the calculated net income and other required information.

- Review the completed form for accuracy and ensure all necessary signatures are included.

- Submit the form electronically through the approved e-filing system.

Legal Use of the PA 8453 C Form

The PA Corporate Net Income Tax Declaration is legally binding and must be submitted in accordance with Pennsylvania tax laws. Failure to file this form can result in penalties and interest on unpaid taxes. It is essential for corporations to understand their obligations under state law to avoid legal repercussions.

Required Documents for Filing

When preparing to file the PA 8453 C, corporations must gather specific documents, including:

- Federal tax returns, which provide a basis for state tax calculations.

- Financial statements detailing income, expenses, and net income.

- Any additional documentation that supports deductions or credits claimed on the form.

Filing Deadlines for the PA 8453 C

Corporations must be aware of the filing deadlines for the PA Corporate Net Income Tax Declaration. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. Timely submission is crucial to avoid penalties.

Examples of Using the PA 8453 C Form

Understanding practical scenarios can help clarify the use of the PA 8453 C form. For instance, a corporation that has generated significant profits in a fiscal year must accurately report this income using the PA 8453 C. Conversely, a corporation that has incurred losses may also need to file the form to claim potential tax credits or deductions.

State-Specific Rules for the PA 8453 C

Pennsylvania has specific rules governing the completion and submission of the PA Corporate Net Income Tax Declaration. Corporations must adhere to these regulations, which include guidelines on allowable deductions, credits, and the calculation of taxable income. Understanding these rules is essential for accurate reporting and compliance.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa corporate net income tax declaration for a state e file report pa 8453 c pa department of revenue 732621542

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C?

The PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C is a form required by the Pennsylvania Department of Revenue for corporations to report their net income tax. This declaration is essential for compliance and ensures that businesses fulfill their tax obligations accurately and on time.

-

How can airSlate SignNow help with the PA Corporate Net Income Tax Declaration?

airSlate SignNow provides an efficient platform for businesses to prepare, sign, and submit the PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C. With our user-friendly interface, you can streamline the e-signing process, ensuring that your documents are completed quickly and securely.

-

What are the pricing options for using airSlate SignNow for tax declarations?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our cost-effective solutions allow you to manage the PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C without breaking the bank, ensuring you get the best value for your investment.

-

Are there any integrations available with airSlate SignNow for tax filing?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage your PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C. These integrations help streamline your workflow, allowing for efficient data transfer and document management.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a range of features designed to enhance document management, including customizable templates, secure e-signatures, and real-time tracking. These features are particularly beneficial for handling the PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C, ensuring that your documents are organized and accessible.

-

How secure is the airSlate SignNow platform for sensitive tax documents?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and compliance measures to protect your sensitive documents, including the PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C, ensuring that your data remains confidential and secure throughout the signing process.

-

Can I access airSlate SignNow on mobile devices?

Absolutely! airSlate SignNow is accessible on mobile devices, allowing you to manage your PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C on the go. This flexibility ensures that you can sign and send documents anytime, anywhere, enhancing your productivity.

Get more for PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C PA Department Of Revenue

Find out other PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C PA Department Of Revenue

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document