DECLARATION of ESTIMATED PERSONAL INCOME TAX Form

What is the Declaration of Estimated Personal Income Tax

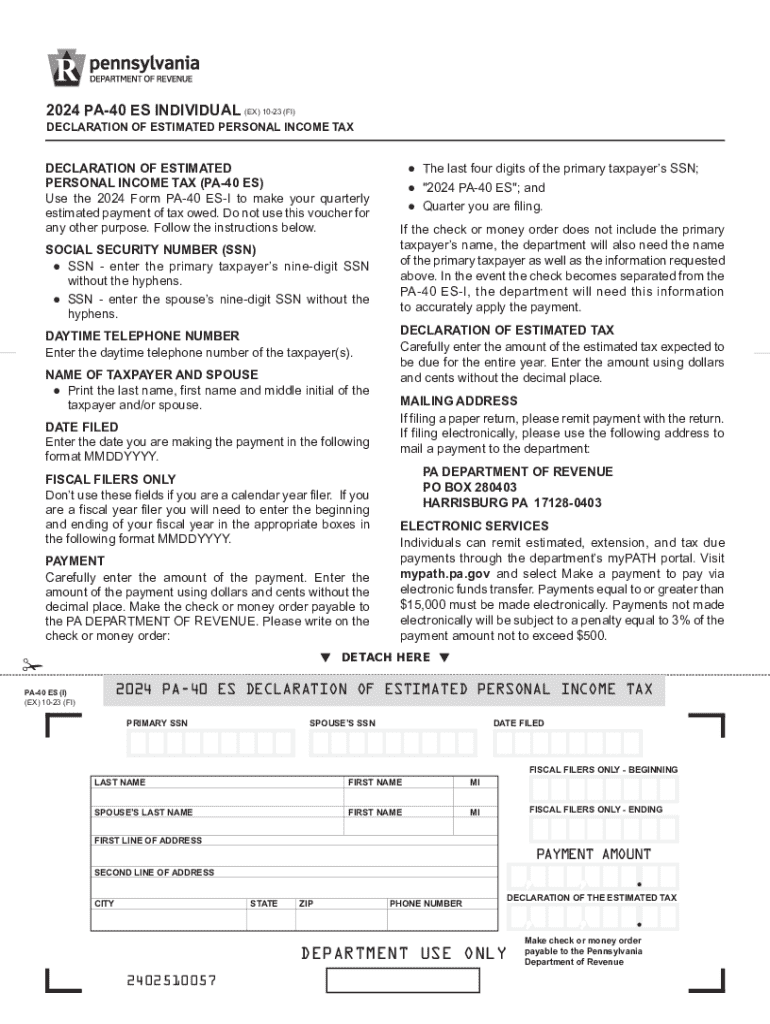

The Declaration of Estimated Personal Income Tax, commonly referred to as the PA-40 ES, is a form used by residents of Pennsylvania to report and pay estimated income taxes. This form is essential for individuals who expect to owe tax of $1,000 or more when they file their annual return. It allows taxpayers to make timely payments throughout the year, helping to avoid penalties and interest that may accrue from underpayment.

How to Use the Declaration of Estimated Personal Income Tax

Using the PA-40 ES involves calculating your expected income tax liability for the year and determining the amount you need to pay quarterly. Taxpayers can use their previous year's tax return as a guideline for estimating their current year's income. It's important to keep track of any changes in income or deductions that may affect your tax liability. Payments can be made online, by mail, or in person, ensuring flexibility for taxpayers.

Steps to Complete the Declaration of Estimated Personal Income Tax

Completing the PA-40 ES requires several steps:

- Gather your financial information, including income sources and deductions.

- Calculate your expected annual income tax liability.

- Divide your total estimated tax by four to determine your quarterly payment amount.

- Fill out the PA-40 ES form accurately, ensuring all information is correct.

- Submit the form and make your payment by the due date.

Filing Deadlines / Important Dates

Filing deadlines for the PA-40 ES are crucial to avoid penalties. Estimated tax payments are typically due on the 15th of April, June, September, and January of the following year. It is important to mark these dates on your calendar to ensure timely submissions. Missing a deadline can result in additional charges, so staying organized is key.

Required Documents

Before completing the PA-40 ES, gather the necessary documents. This includes your previous year's tax return, W-2 forms, 1099 forms, and any other documentation related to income and deductions. Having these documents on hand will streamline the process and help ensure accuracy in your estimations.

Penalties for Non-Compliance

Failure to file the PA-40 ES or to make the required estimated payments can lead to penalties. Pennsylvania imposes a penalty for underpayment of estimated tax, which can add up over time. Taxpayers may also face interest on unpaid amounts. Understanding these consequences can motivate timely compliance and accurate reporting.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the declaration of estimated personal income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pa 40 es feature in airSlate SignNow?

The pa 40 es feature in airSlate SignNow allows users to easily manage and sign documents electronically. This feature streamlines the signing process, making it faster and more efficient for businesses. With pa 40 es, you can ensure that your documents are signed securely and in compliance with legal standards.

-

How does airSlate SignNow's pricing work for pa 40 es?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including the pa 40 es feature. You can choose from monthly or annual subscriptions, with options that scale based on the number of users and features required. This ensures that you get the best value for your investment in document management.

-

What are the benefits of using pa 40 es for document signing?

Using pa 40 es for document signing provides numerous benefits, including increased efficiency and reduced turnaround time. It eliminates the need for physical paperwork, allowing for a more eco-friendly approach. Additionally, the security features of pa 40 es ensure that your documents are protected throughout the signing process.

-

Can I integrate pa 40 es with other software?

Yes, airSlate SignNow's pa 40 es feature can be easily integrated with various software applications. This includes popular tools like CRM systems, project management software, and cloud storage services. These integrations enhance workflow efficiency and allow for seamless document management across platforms.

-

Is pa 40 es suitable for small businesses?

Absolutely! The pa 40 es feature is designed to be user-friendly and cost-effective, making it ideal for small businesses. It helps streamline document signing processes without the need for extensive resources, allowing small businesses to operate more efficiently and focus on growth.

-

What types of documents can I sign using pa 40 es?

With pa 40 es, you can sign a wide variety of documents, including contracts, agreements, and forms. The versatility of this feature allows businesses to handle all their signing needs in one place. This capability ensures that you can manage both simple and complex documents with ease.

-

How secure is the pa 40 es signing process?

The pa 40 es signing process is highly secure, utilizing advanced encryption and authentication methods. airSlate SignNow complies with industry standards to protect your sensitive information. This ensures that your documents remain confidential and secure throughout the signing process.

Get more for DECLARATION OF ESTIMATED PERSONAL INCOME TAX

Find out other DECLARATION OF ESTIMATED PERSONAL INCOME TAX

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation