Year End Reminders for Employees Form

Understanding Year End Reminders For Employees

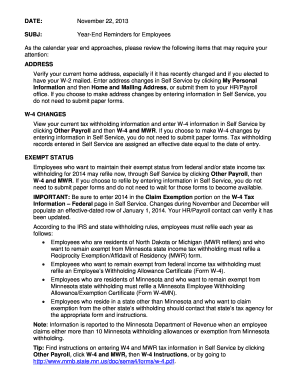

The Year End Reminders For Employees serve as essential guidelines for workers to ensure they complete necessary tasks before the calendar year concludes. These reminders typically cover various aspects such as tax documentation, benefits enrollment, and performance evaluations. Employees should familiarize themselves with these reminders to avoid any last-minute issues that could affect their financial and professional standing.

Steps to Complete Year End Reminders For Employees

To effectively manage Year End Reminders, employees can follow a structured approach:

- Review all relevant documents, including W-2s and 1099s, to ensure accuracy.

- Confirm that all necessary tax forms are submitted to the appropriate authorities.

- Enroll in or update benefits plans during open enrollment periods.

- Schedule performance reviews with supervisors to discuss achievements and areas for improvement.

- Set aside time for personal financial planning to prepare for the upcoming year.

Filing Deadlines and Important Dates

Staying aware of filing deadlines is crucial for compliance and avoiding penalties. Key dates include:

- January 31: Deadline for employers to send W-2 forms to employees.

- April 15: Tax filing deadline for individuals unless an extension is filed.

- Various deadlines for submitting benefits enrollment forms, often dictated by company policy.

Required Documents for Year End Reminders

Employees should gather specific documents to ensure they meet all requirements. Essential documents include:

- W-2 forms from employers, detailing annual earnings and taxes withheld.

- 1099 forms for any freelance or contract work completed during the year.

- Health insurance enrollment forms, if applicable.

- Retirement account statements to assess contributions and performance.

IRS Guidelines for Year End Reminders

Understanding IRS guidelines is vital for compliance. The IRS provides detailed instructions on tax filing and reporting requirements. Employees should consult the IRS website or a tax professional to ensure they adhere to all regulations, including:

- Correct reporting of income and deductions.

- Understanding eligibility for tax credits and deductions.

- Filing status determination based on personal circumstances.

Penalties for Non-Compliance

Failing to adhere to Year End Reminders can result in significant penalties. Common consequences include:

- Fines for late filing of tax returns or forms.

- Loss of benefits due to missed enrollment deadlines.

- Potential audits from the IRS for discrepancies in reported income.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the year end reminders for employees

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Year End Reminders For Employees?

Year End Reminders For Employees are essential notifications that help staff prepare for the end of the fiscal year. These reminders can include deadlines for submitting expenses, completing performance reviews, and updating personal information. Utilizing airSlate SignNow can streamline this process by allowing you to send and eSign important documents efficiently.

-

How can airSlate SignNow help with Year End Reminders For Employees?

airSlate SignNow simplifies the process of sending Year End Reminders For Employees by providing an easy-to-use platform for document management. You can create, send, and track reminders in real-time, ensuring that your employees receive timely notifications. This helps improve compliance and reduces the risk of missed deadlines.

-

What features does airSlate SignNow offer for managing Year End Reminders For Employees?

airSlate SignNow offers features such as customizable templates, automated workflows, and real-time tracking for Year End Reminders For Employees. These tools allow you to create personalized reminders that can be sent automatically based on your company's timeline. This ensures that all employees are informed and prepared for year-end tasks.

-

Is airSlate SignNow cost-effective for sending Year End Reminders For Employees?

Yes, airSlate SignNow is a cost-effective solution for sending Year End Reminders For Employees. With various pricing plans available, businesses can choose an option that fits their budget while still accessing powerful features. This affordability makes it accessible for companies of all sizes to enhance their year-end processes.

-

Can airSlate SignNow integrate with other tools for Year End Reminders For Employees?

Absolutely! airSlate SignNow integrates seamlessly with various tools and platforms, enhancing your ability to manage Year End Reminders For Employees. Whether you use HR software, project management tools, or email services, these integrations ensure that your reminders are synchronized and easily accessible.

-

What are the benefits of using airSlate SignNow for Year End Reminders For Employees?

Using airSlate SignNow for Year End Reminders For Employees offers numerous benefits, including increased efficiency, improved compliance, and enhanced communication. By automating the reminder process, you can save time and reduce errors, allowing your team to focus on more strategic tasks. This ultimately leads to a smoother year-end transition.

-

How secure is airSlate SignNow when handling Year End Reminders For Employees?

airSlate SignNow prioritizes security, ensuring that all Year End Reminders For Employees are handled with the utmost care. The platform employs advanced encryption and compliance measures to protect sensitive information. This commitment to security helps businesses maintain trust and confidentiality during the year-end process.

Get more for Year End Reminders For Employees

Find out other Year End Reminders For Employees

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors