New Employee Forms

What is the New Employee Forms

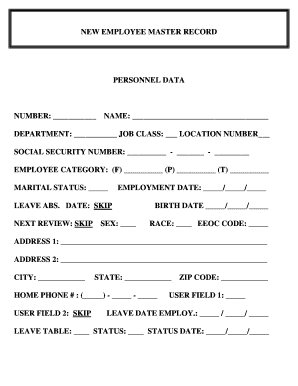

The New Employee Forms are essential documents that employers require from new hires to ensure compliance with federal and state regulations. These forms typically include information such as personal details, tax withholding preferences, and eligibility to work in the United States. Common forms in this category include the W-4 for tax withholding and the I-9 for employment eligibility verification. Properly completed New Employee Forms help streamline the onboarding process and ensure that both the employer and employee meet legal obligations.

Steps to complete the New Employee Forms

Completing the New Employee Forms involves several key steps to ensure accuracy and compliance. First, the new employee should gather necessary personal information, including their Social Security number and identification documents. Next, they should fill out the W-4 form, specifying their tax withholding preferences based on their financial situation. Following this, the employee must complete the I-9 form, providing proof of identity and eligibility to work. Finally, all forms should be reviewed for completeness and accuracy before submission to the employer.

How to obtain the New Employee Forms

New Employee Forms can be obtained through various channels. Employers often provide these forms directly to new hires during the onboarding process. Additionally, they can be accessed online through the official IRS website for tax-related forms or the U.S. Citizenship and Immigration Services website for the I-9 form. Many businesses also choose to use digital solutions, such as signNow, to facilitate the distribution and completion of these forms electronically, making the process more efficient.

Legal use of the New Employee Forms

The legal use of New Employee Forms is crucial for maintaining compliance with employment laws. Employers are required to collect specific information to ensure that they are withholding the correct amount of taxes and verifying the eligibility of their employees to work in the United States. Failure to properly collect or maintain these forms can result in penalties from regulatory agencies. Therefore, it is essential for both employers and employees to understand the legal implications of these documents and ensure they are filled out accurately and submitted on time.

Required Documents

When completing the New Employee Forms, several documents may be required to verify identity and eligibility. For the I-9 form, employees must present documents that establish both identity and employment authorization. Acceptable documents include a U.S. passport, a permanent resident card, or a combination of a driver's license and Social Security card. For the W-4 form, no additional documents are required, but employees should have their financial information ready to determine appropriate withholding allowances.

Form Submission Methods

New Employee Forms can be submitted through various methods, depending on the employer's preferences. Common submission methods include online platforms, where forms can be filled out and signed electronically, ensuring a quick and secure process. Alternatively, forms can be submitted via mail or in person at the employer's office. Each method has its advantages, and employers should provide guidance on the preferred submission process to ensure compliance and efficiency.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of New Employee Forms, particularly the W-4 form. Employers must ensure that the forms are collected before the first paycheck is issued to comply with tax withholding regulations. The IRS also updates the W-4 form periodically, so it is important for employers to stay informed about any changes that may affect their employees. Following IRS guidelines helps prevent issues related to tax liabilities and ensures that employees have the correct amount withheld from their paychecks.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new employee forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are New Employee Forms and why are they important?

New Employee Forms are essential documents that collect necessary information from new hires, such as personal details, tax information, and employment agreements. They streamline the onboarding process, ensuring that all required data is gathered efficiently. Using airSlate SignNow for these forms simplifies the process, making it easy for both employers and employees.

-

How does airSlate SignNow help with New Employee Forms?

airSlate SignNow provides a user-friendly platform for creating, sending, and eSigning New Employee Forms. With customizable templates, businesses can easily tailor forms to their specific needs. The platform also ensures secure storage and easy access to completed forms, enhancing the onboarding experience.

-

What features does airSlate SignNow offer for New Employee Forms?

airSlate SignNow offers features such as customizable templates, automated workflows, and real-time tracking for New Employee Forms. These features help streamline the onboarding process, reduce paperwork, and ensure compliance with legal requirements. Additionally, the platform supports multiple file formats, making it versatile for various business needs.

-

Is airSlate SignNow cost-effective for managing New Employee Forms?

Yes, airSlate SignNow is a cost-effective solution for managing New Employee Forms. With flexible pricing plans, businesses can choose a package that fits their budget while still accessing powerful features. This affordability, combined with the efficiency of electronic forms, can lead to signNow savings in time and resources.

-

Can I integrate airSlate SignNow with other HR tools for New Employee Forms?

Absolutely! airSlate SignNow offers seamless integrations with various HR tools and software, making it easy to manage New Employee Forms alongside your existing systems. This integration capability enhances workflow efficiency and ensures that all employee data is centralized and easily accessible.

-

How secure are New Employee Forms processed through airSlate SignNow?

Security is a top priority for airSlate SignNow. New Employee Forms are processed with advanced encryption and secure storage solutions to protect sensitive employee information. Compliance with industry standards ensures that your data remains safe and confidential throughout the onboarding process.

-

What benefits can businesses expect from using airSlate SignNow for New Employee Forms?

By using airSlate SignNow for New Employee Forms, businesses can expect faster onboarding, reduced paperwork, and improved accuracy in data collection. The platform's ease of use enhances the experience for both HR teams and new hires, leading to higher satisfaction rates. Overall, it streamlines the entire onboarding process, allowing businesses to focus on growth.

Get more for New Employee Forms

Find out other New Employee Forms

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form