Request for Transcript of Individual Income Tax Returns Form

What is the Request For Transcript Of Individual Income Tax Returns Form

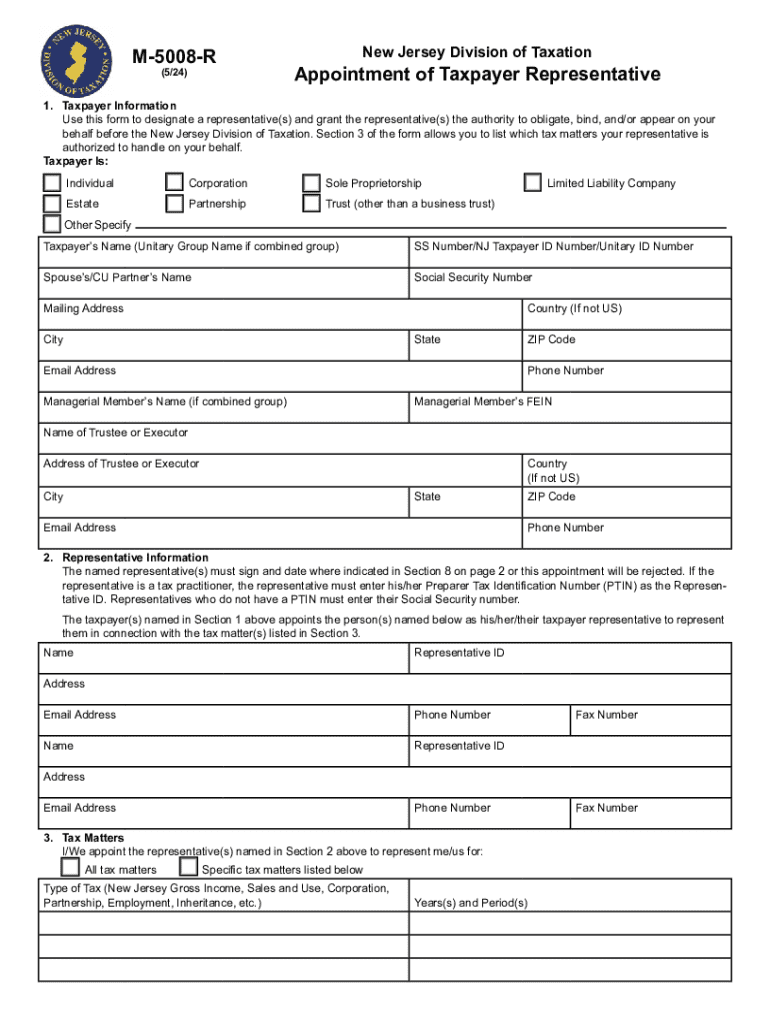

The Request For Transcript Of Individual Income Tax Returns Form, commonly referred to as the form M-5008 R, is a document used by individuals to request a transcript of their tax returns from the Internal Revenue Service (IRS). This form is essential for taxpayers who need to verify their income, especially when applying for loans, mortgages, or other financial assistance. The transcript provides a summary of the taxpayer's return, including income, deductions, and tax liabilities.

How to use the Request For Transcript Of Individual Income Tax Returns Form

To utilize the M-5008 R form effectively, individuals must fill it out with accurate personal information, including their Social Security number, address, and the tax years for which they are requesting transcripts. Once completed, the form can be submitted to the IRS via mail or fax. It is important to ensure that all details are correct to avoid delays in processing. The IRS typically processes requests within five to ten business days, depending on the method of submission.

Steps to complete the Request For Transcript Of Individual Income Tax Returns Form

Completing the M-5008 R form involves several straightforward steps:

- Begin by entering your personal information, including your full name, Social Security number, and current address.

- Select the type of transcript you need, such as tax return or account transcript.

- Indicate the tax years for which you are requesting transcripts.

- Provide your signature and date to certify that the information is accurate.

- Submit the form via the preferred method, either by mailing it to the IRS or faxing it to the appropriate number.

Key elements of the Request For Transcript Of Individual Income Tax Returns Form

The M-5008 R form includes several key elements that are crucial for successful submission:

- Personal Information: Accurate details about the taxpayer, including name and Social Security number.

- Transcript Type: Options to choose between different types of transcripts based on the taxpayer's needs.

- Tax Years: Specification of the years for which transcripts are requested.

- Signature: A required signature to validate the request.

Legal use of the Request For Transcript Of Individual Income Tax Returns Form

The M-5008 R form serves a legal purpose in verifying income for various financial transactions. It is often required by lenders and financial institutions when individuals apply for loans or mortgages. The information provided in the transcript can help establish a taxpayer's financial history and credibility. Proper use of this form ensures compliance with IRS regulations and protects the taxpayer's rights to access their financial information.

Form Submission Methods (Online / Mail / In-Person)

Individuals can submit the M-5008 R form through various methods, depending on their preference and urgency:

- Online: While the form itself cannot be submitted online, taxpayers can use the IRS website to request transcripts directly.

- Mail: The completed form can be mailed to the IRS address specified on the form.

- Fax: For quicker processing, the form can be faxed to the IRS, provided the taxpayer includes a valid fax number.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the request for transcript of individual income tax returns form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the new jersey m 5008 r and how does it work?

The new jersey m 5008 r is a document management solution that allows businesses to streamline their eSigning processes. It enables users to send, sign, and manage documents electronically, ensuring a faster and more efficient workflow. With its user-friendly interface, the new jersey m 5008 r simplifies the signing experience for both senders and recipients.

-

What are the pricing options for the new jersey m 5008 r?

The new jersey m 5008 r offers competitive pricing plans tailored to meet the needs of various businesses. Pricing typically depends on the number of users and features required. For detailed pricing information, it's best to visit the airSlate SignNow website or contact their sales team directly.

-

What features does the new jersey m 5008 r offer?

The new jersey m 5008 r includes features such as customizable templates, real-time tracking, and secure cloud storage. Additionally, it supports multiple file formats and integrates seamlessly with other applications. These features make the new jersey m 5008 r a comprehensive solution for document management.

-

How can the new jersey m 5008 r benefit my business?

Implementing the new jersey m 5008 r can signNowly enhance your business's efficiency by reducing the time spent on document processing. It allows for quicker turnaround times on contracts and agreements, which can lead to improved customer satisfaction. Moreover, the new jersey m 5008 r helps in minimizing paper usage, contributing to a more sustainable business model.

-

Is the new jersey m 5008 r secure for sensitive documents?

Yes, the new jersey m 5008 r prioritizes security with advanced encryption and compliance with industry standards. It ensures that all documents are securely stored and transmitted, protecting sensitive information from unauthorized access. Businesses can trust the new jersey m 5008 r to handle their confidential documents safely.

-

Can the new jersey m 5008 r integrate with other software?

The new jersey m 5008 r is designed to integrate seamlessly with various software applications, enhancing its functionality. This includes popular CRM systems, cloud storage solutions, and productivity tools. By integrating the new jersey m 5008 r with your existing software, you can create a more cohesive workflow.

-

What types of businesses can benefit from the new jersey m 5008 r?

The new jersey m 5008 r is suitable for a wide range of businesses, from small startups to large enterprises. Any organization that requires efficient document management and eSigning can benefit from its features. Whether in real estate, finance, or healthcare, the new jersey m 5008 r can streamline processes across various industries.

Get more for Request For Transcript Of Individual Income Tax Returns Form

Find out other Request For Transcript Of Individual Income Tax Returns Form

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile