Form a 3128 Claim for Refund of the Estimated Gross Income Tax Payment for the Sale of New Jersey Real Estate

Understanding the Form A 3128 for Claiming Refunds

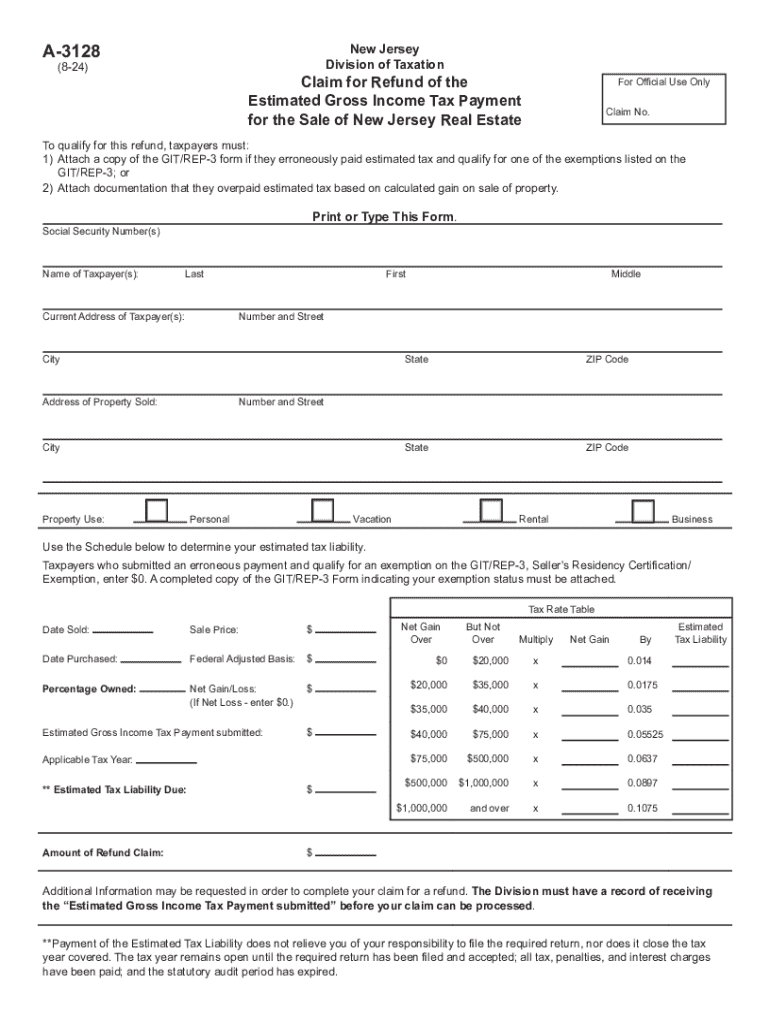

The Form A 3128, known as the Claim for Refund of the Estimated Gross Income Tax Payment for the Sale of New Jersey Real Estate, is designed for individuals who have sold property in New Jersey and have overpaid their estimated gross income tax. This form allows taxpayers to reclaim any excess payments made during the sale process. Understanding the purpose of this form is crucial for ensuring that you receive any refunds you may be entitled to.

Steps to Complete the Form A 3128

Completing the Form A 3128 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to the property sale, including the closing statement and any previous tax payments made. Next, fill out the form by providing your personal information, details about the property sold, and the amount of estimated tax paid. Be sure to double-check all entries for accuracy before submission. Finally, sign and date the form, and keep a copy for your records.

Obtaining the Form A 3128

The Form A 3128 can be obtained through the New Jersey Division of Taxation's official website or by contacting their office directly. It is available in a downloadable format, allowing you to print it out for completion. Ensure you are using the most current version of the form to avoid any issues with your submission.

Eligibility Criteria for Filing Form A 3128

To be eligible to file the Form A 3128, you must have sold real estate in New Jersey and made estimated gross income tax payments related to that sale. Additionally, you should have overpaid your estimated tax, which is the basis for claiming a refund. It is important to review the specific criteria outlined by the New Jersey Division of Taxation to confirm your eligibility before proceeding with the form.

Required Documents for Submission

When submitting the Form A 3128, certain documents are required to support your claim. These include a copy of the closing statement from the property sale, proof of estimated tax payments made, and any other relevant documentation that substantiates your claim for a refund. Having these documents ready will help streamline the process and ensure a smoother review by tax authorities.

Filing Deadlines for Form A 3128

It is essential to be aware of the filing deadlines for the Form A 3128 to avoid missing out on your refund. Generally, the form must be submitted within a specific timeframe following the sale of the property. Check the New Jersey Division of Taxation's guidelines for the exact deadlines applicable to your situation, as they can vary based on the date of the property sale and other factors.

Potential Penalties for Non-Compliance

Failing to comply with the requirements of the Form A 3128 can result in penalties, including the denial of your refund claim. It is crucial to ensure that all information is accurate and that you meet all eligibility criteria before filing. Understanding the potential consequences of non-compliance can help you take the necessary steps to avoid issues with your tax filings.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form a 3128 claim for refund of the estimated gross income tax payment for the sale of new jersey real estate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nj exit tax and how does it affect me?

The nj exit tax is a tax imposed on individuals who sell their property in New Jersey. It is designed to ensure that the state collects taxes owed on capital gains from the sale. Understanding this tax is crucial for anyone considering moving out of New Jersey, as it can signNowly impact your financial planning.

-

How can airSlate SignNow help with nj exit tax documentation?

airSlate SignNow provides a seamless way to eSign and manage documents related to the nj exit tax. Our platform allows you to easily create, send, and store necessary tax documents securely. This ensures that you have all your paperwork in order when dealing with the nj exit tax.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you're a small business or a large enterprise, you can find a plan that fits your budget while ensuring compliance with regulations like the nj exit tax. Our cost-effective solutions make it easy to manage your document signing needs.

-

Are there any features specifically for handling nj exit tax forms?

Yes, airSlate SignNow includes features that streamline the process of handling nj exit tax forms. You can customize templates, set reminders for important deadlines, and track the status of your documents. These features help ensure that you stay compliant with nj exit tax requirements.

-

Can I integrate airSlate SignNow with other tools for nj exit tax management?

Absolutely! airSlate SignNow integrates with various applications that can assist in managing nj exit tax processes. Whether you use accounting software or CRM systems, our integrations help you maintain a smooth workflow and keep all your documents organized.

-

What benefits does airSlate SignNow offer for businesses dealing with nj exit tax?

Using airSlate SignNow can save businesses time and reduce errors when dealing with nj exit tax documentation. Our platform simplifies the eSigning process, allowing for quick approvals and secure storage of important tax documents. This efficiency can lead to better compliance and peace of mind.

-

Is airSlate SignNow secure for handling sensitive nj exit tax information?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive nj exit tax information. We use advanced encryption and security protocols to protect your data. You can trust that your documents are secure while you manage your nj exit tax obligations.

Get more for Form A 3128 Claim For Refund Of The Estimated Gross Income Tax Payment For The Sale Of New Jersey Real Estate

- Application for missouri salvage business license form

- Form 2643 missouri tax registration application yumpu

- Supports waiver louisiana department of health and form

- Uc 018 unemployment tax and wage report form

- Form r 10606 supplemental worksheet for credit for taxes

- Treasury ampamp income tax officelansing mi official website form

- For official use only 625168085 form

- Wwwrevenuelouisianagovtaxforms1300401f oldl 4 employees withholding allowance certificate

Find out other Form A 3128 Claim For Refund Of The Estimated Gross Income Tax Payment For The Sale Of New Jersey Real Estate

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate