Local Services Tax LST 1 FAQ Form

What is the Local Services Tax (LST) Form 1?

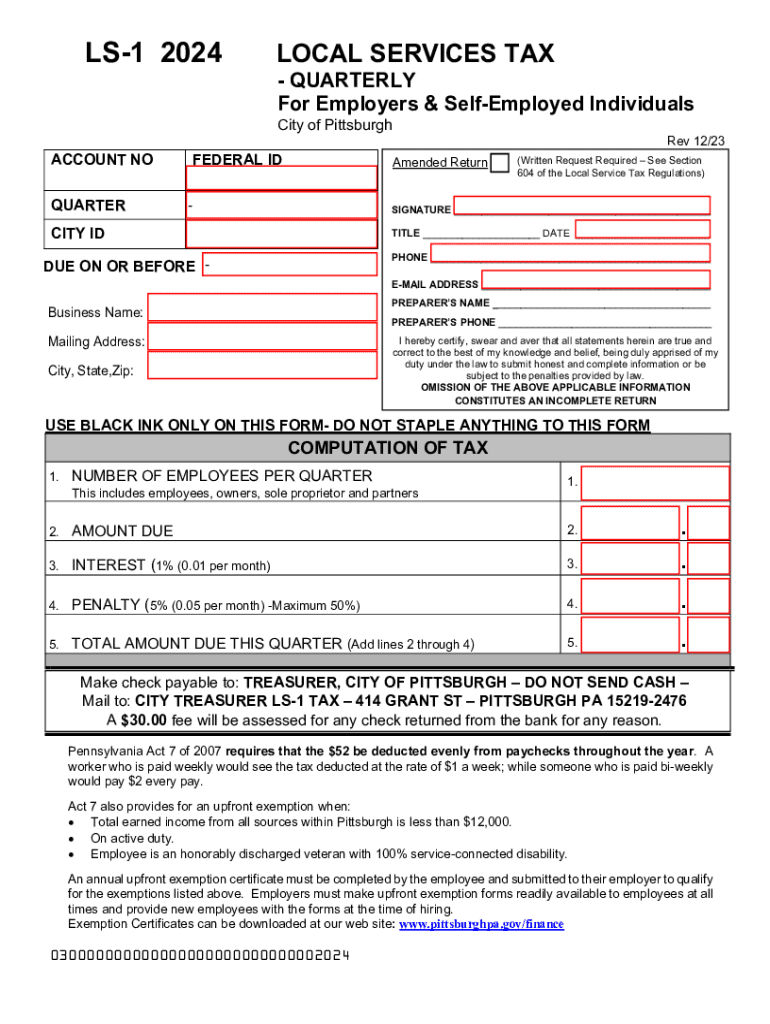

The Local Services Tax (LST) Form 1 is a tax form used primarily in Pennsylvania to collect local services tax from individuals who work within certain jurisdictions. This tax is applicable to employees and self-employed individuals who earn income in municipalities that impose this tax. The LST is typically a small annual fee, designed to help fund local services such as emergency services, road maintenance, and other community programs.

Key Elements of the Local Services Tax (LST) Form 1

The LST Form 1 includes several critical components that taxpayers must complete accurately. These elements typically consist of:

- Personal Information: Name, address, and Social Security number of the taxpayer.

- Employer Information: Name and address of the employer, if applicable.

- Income Details: Total income earned within the jurisdiction for the tax year.

- Tax Calculation: The amount of local services tax owed based on income.

Completing these sections correctly is essential to ensure compliance and avoid penalties.

Steps to Complete the Local Services Tax (LST) Form 1

Filling out the LST Form 1 involves a straightforward process. Here are the steps to ensure accurate completion:

- Gather necessary documents, including your Social Security number and income statements.

- Fill in your personal information in the designated fields.

- If employed, provide your employer's details accurately.

- Calculate your total income earned in the jurisdiction for the year.

- Determine the amount of local services tax owed based on your income.

- Review the form for accuracy before submission.

Following these steps will help facilitate a smooth filing process.

Filing Deadlines and Important Dates for the Local Services Tax (LST) Form 1

It is essential to be aware of the filing deadlines associated with the LST Form 1 to avoid penalties. Generally, the form must be submitted annually, and the deadline is often aligned with the tax year. For most taxpayers, this means filing by April 15 of the following year. However, specific municipalities may have different deadlines, so checking local regulations is advisable.

Penalties for Non-Compliance with the Local Services Tax (LST) Form 1

Failure to file the LST Form 1 or pay the associated tax can result in penalties. These may include:

- Late Fees: Additional charges for late submission of the form.

- Interest: Accrued interest on unpaid taxes.

- Legal Action: In severe cases, municipalities may pursue legal action to collect overdue taxes.

Understanding these penalties underscores the importance of timely and accurate filing.

Who Issues the Local Services Tax (LST) Form 1?

The LST Form 1 is typically issued by local municipalities in Pennsylvania that impose the local services tax. Each municipality may have its own version of the form, and it is crucial for taxpayers to obtain the correct form from their local tax authority. This ensures compliance with specific local regulations and requirements.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the local services tax lst 1 faq

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ls 1 form and how does it work?

The ls 1 form is a digital document that allows users to easily create, send, and eSign important paperwork. With airSlate SignNow, you can fill out the ls 1 form online, ensuring a streamlined process that saves time and reduces errors. This user-friendly solution is designed to enhance your document management experience.

-

How much does it cost to use the ls 1 form with airSlate SignNow?

Pricing for using the ls 1 form with airSlate SignNow varies based on the plan you choose. We offer flexible pricing options to accommodate businesses of all sizes, ensuring you get the best value for your investment. Visit our pricing page for detailed information on plans and features.

-

What features are included with the ls 1 form?

The ls 1 form includes features such as customizable templates, real-time tracking, and secure eSigning capabilities. With airSlate SignNow, you can also integrate the ls 1 form with other applications to enhance your workflow. These features make it easy to manage your documents efficiently.

-

What are the benefits of using the ls 1 form for my business?

Using the ls 1 form can signNowly improve your business's efficiency by reducing the time spent on paperwork. airSlate SignNow provides a secure and reliable platform for eSigning, which helps in accelerating the approval process. Additionally, it enhances collaboration among team members and clients.

-

Can I integrate the ls 1 form with other software?

Yes, airSlate SignNow allows seamless integration of the ls 1 form with various software applications, including CRM and project management tools. This integration helps streamline your workflow and ensures that all your documents are easily accessible. Check our integration options to see how you can connect your favorite tools.

-

Is the ls 1 form secure for sensitive information?

Absolutely! The ls 1 form is designed with security in mind, utilizing encryption and secure storage to protect your sensitive information. airSlate SignNow complies with industry standards to ensure that your documents are safe from unauthorized access. You can trust us to keep your data secure.

-

How can I get started with the ls 1 form?

Getting started with the ls 1 form is easy! Simply sign up for an account on airSlate SignNow, and you can begin creating and sending your ls 1 forms right away. Our user-friendly interface guides you through the process, making it simple to manage your documents.

Get more for Local Services Tax LST 1 FAQ

Find out other Local Services Tax LST 1 FAQ

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors