P40202303A Form

What is the WV State Tax Schedule M?

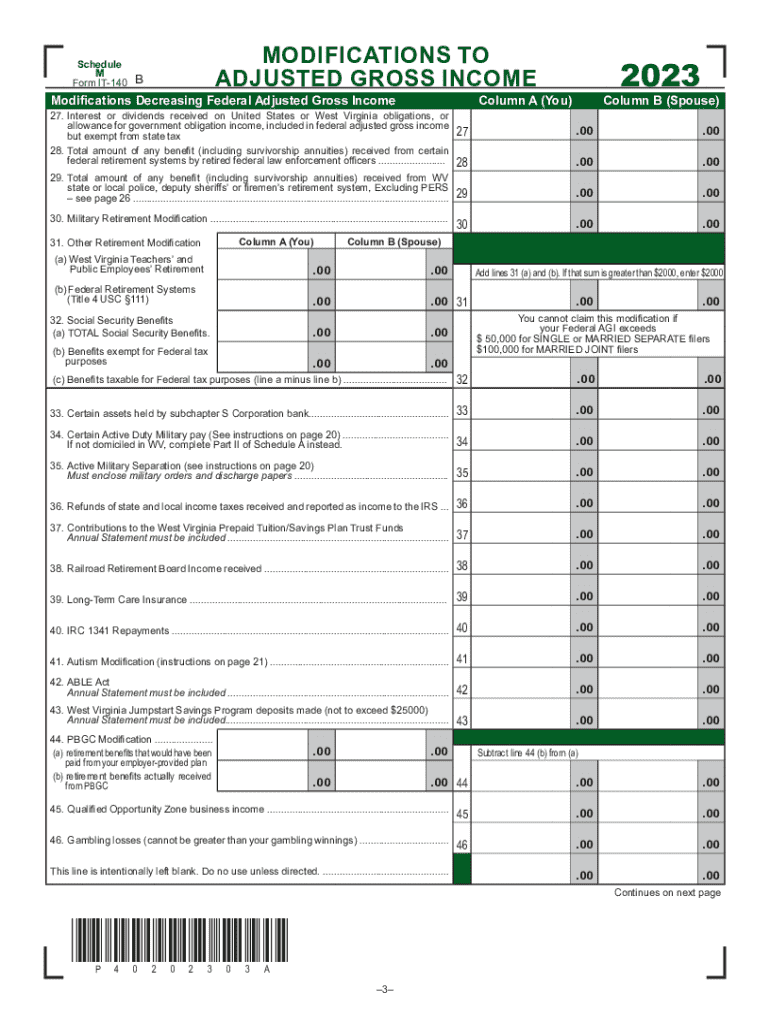

The WV State Tax Schedule M is a form used by taxpayers in West Virginia to report modifications to their federal taxable income. This form is essential for calculating the state tax liability accurately. It allows taxpayers to adjust their income based on specific state rules and regulations. Understanding the purpose of this form is crucial for ensuring compliance with state tax laws.

How to Use the WV State Tax Schedule M

To use the WV State Tax Schedule M effectively, begin by gathering your federal tax return and any necessary documentation regarding income adjustments. The form requires you to list modifications that either increase or decrease your taxable income. Fill out the form carefully, ensuring all entries are accurate and complete. Once completed, the Schedule M should be submitted along with your West Virginia income tax return (WV IT-140).

Steps to Complete the WV State Tax Schedule M

Completing the WV State Tax Schedule M involves several steps:

- Obtain the latest version of the form, which can be found on the West Virginia State Tax Department website.

- Review your federal tax return to identify any necessary modifications.

- Fill out the form by entering your modifications in the appropriate sections.

- Double-check all entries for accuracy.

- Attach the completed Schedule M to your WV IT-140 when filing your state tax return.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the WV State Tax Schedule M. Typically, the deadline for submitting your West Virginia income tax return, including Schedule M, is April 15. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any changes in deadlines due to legislative updates or other state announcements.

Required Documents

When completing the WV State Tax Schedule M, you will need several documents to ensure accuracy:

- Your federal tax return (Form 1040 or similar).

- Documentation for any income modifications, such as W-2s, 1099s, or other income statements.

- Records of any deductions or credits that may affect your taxable income.

Penalties for Non-Compliance

Failing to complete and submit the WV State Tax Schedule M correctly can result in penalties. These may include fines, interest on unpaid taxes, and potential audits by the state tax authorities. It is essential to ensure that all modifications are reported accurately to avoid these consequences. Taxpayers should also be aware that late submissions may incur additional penalties.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the p40202303a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the wv state tax schedule m and why is it important?

The wv state tax schedule m is a crucial document for taxpayers in West Virginia, detailing the state's tax obligations. Understanding this schedule helps ensure compliance and accurate tax filing, which can prevent penalties. Utilizing tools like airSlate SignNow can streamline the process of managing and signing these documents.

-

How can airSlate SignNow assist with the wv state tax schedule m?

airSlate SignNow provides an efficient platform for electronically signing and managing the wv state tax schedule m. With its user-friendly interface, you can easily send, sign, and store your tax documents securely. This not only saves time but also enhances the accuracy of your submissions.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including options for individuals and teams. Each plan includes features that support the management of documents like the wv state tax schedule m. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage. These tools are particularly beneficial for managing important documents like the wv state tax schedule m. The platform ensures that your documents are organized and easily accessible.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers integrations with various software applications, enhancing its functionality. This allows you to seamlessly connect with tools you already use, making it easier to manage documents like the wv state tax schedule m. Integrations can streamline your workflow and improve efficiency.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents, including the wv state tax schedule m, provides numerous benefits such as increased efficiency and reduced paperwork. The platform allows for quick electronic signatures, which can expedite the filing process. Additionally, it enhances security and compliance for sensitive tax information.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely, airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents. This is especially important for sensitive information like the wv state tax schedule m. You can trust that your data is safe while using our platform.

Get more for P40202303A

- Simplii financial pre authorized debit form

- Pag ibig request slip form

- Chelsea football academy registration form

- Icici demat account closure form

- Odsp rental agreement form

- Boc password reset form

- How to watch stream the krewe of aurora grand parade form

- Fillable online job application form template manor

Find out other P40202303A

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template