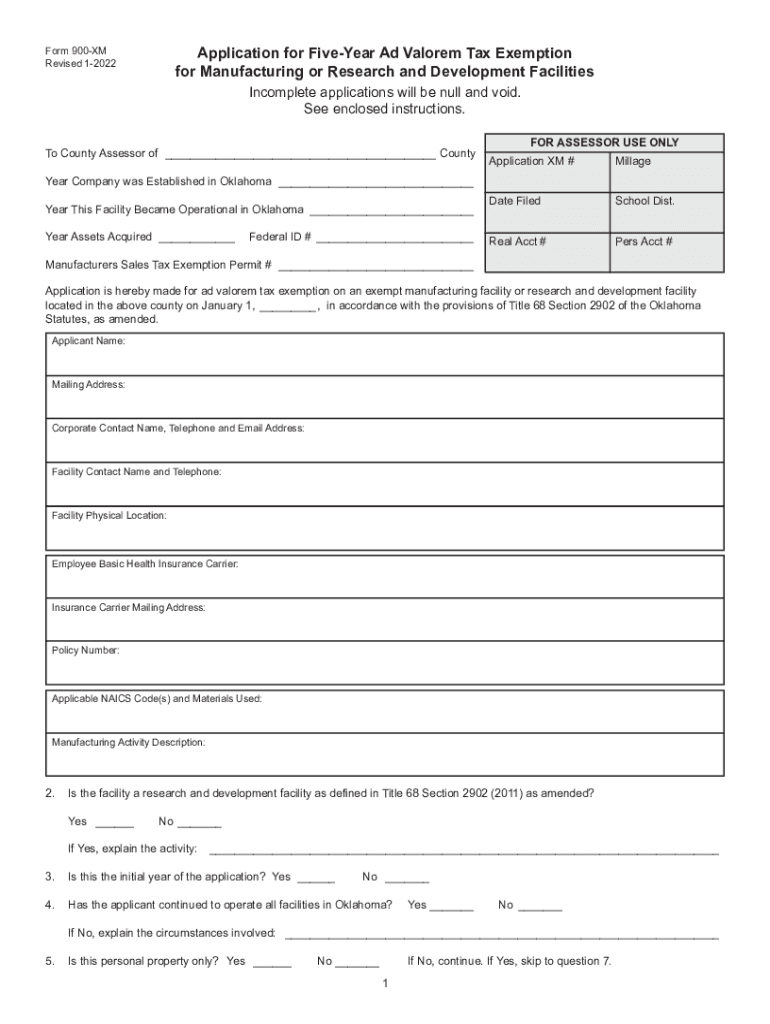

Form 900 XM Application for Five Year Ad Valorem Tax Exemption

What is the Oklahoma Exemption Certificate?

The Oklahoma exemption certificate, often referred to as the OTC Form 900 XM, is a crucial document for businesses seeking a five-year ad valorem tax exemption. This form is specifically designed for entities that meet certain eligibility criteria, allowing them to apply for tax relief on property taxes. Understanding the purpose of this certificate is essential for businesses that aim to reduce their tax liabilities while complying with state regulations.

Eligibility Criteria for the Oklahoma Exemption Certificate

To qualify for the Oklahoma exemption certificate, businesses must meet specific eligibility requirements. Generally, these include:

- Being a registered business entity in Oklahoma.

- Utilizing the property for manufacturing or agricultural purposes.

- Maintaining compliance with state tax regulations.

It is important for applicants to review these criteria thoroughly to ensure they meet all conditions before submitting their application.

Steps to Complete the Oklahoma Exemption Certificate

Completing the Oklahoma exemption certificate involves several key steps:

- Obtain the OTC Form 900 XM from the Oklahoma Tax Commission.

- Fill out the form with accurate business information, including the type of exemption being requested.

- Provide supporting documentation that verifies eligibility, such as proof of business registration and tax compliance.

- Submit the completed form to the appropriate county assessor’s office.

Following these steps carefully can help ensure a smooth application process.

Required Documents for the Oklahoma Exemption Certificate

When applying for the Oklahoma exemption certificate, certain documents must be included to support the application. These typically include:

- Proof of business registration in Oklahoma.

- Financial statements or tax returns demonstrating the business’s operations.

- Any additional documentation that may be required based on the specific exemption type.

Gathering these documents in advance can facilitate a more efficient application process.

Form Submission Methods for the Oklahoma Exemption Certificate

The Oklahoma exemption certificate can be submitted through various methods, including:

- Online submission via the Oklahoma Tax Commission’s website.

- Mailing the completed form to the appropriate county assessor’s office.

- In-person delivery at the local tax office.

Choosing the right submission method can depend on the applicant's preferences and the urgency of the request.

Legal Use of the Oklahoma Exemption Certificate

The legal use of the Oklahoma exemption certificate is governed by state tax laws. Businesses must ensure that they use the certificate in accordance with these regulations to avoid penalties. Misuse of the exemption can lead to significant financial repercussions, including back taxes and fines. It is advisable for businesses to consult with a tax professional to navigate these legal requirements effectively.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 900 xm application for five year ad valorem tax exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Oklahoma exemption certificate?

An Oklahoma exemption certificate is a document that allows certain purchases to be made without paying sales tax. This certificate is essential for qualifying organizations and individuals to ensure compliance with state tax regulations. By using an Oklahoma exemption certificate, businesses can save money on eligible purchases.

-

How can airSlate SignNow help with Oklahoma exemption certificates?

airSlate SignNow provides a streamlined platform for businesses to create, send, and eSign Oklahoma exemption certificates efficiently. With our user-friendly interface, you can easily manage your documents and ensure that all necessary signatures are obtained promptly. This helps in maintaining compliance and speeding up the process of tax exemption.

-

What are the pricing options for using airSlate SignNow for Oklahoma exemption certificates?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our plans are designed to be cost-effective, ensuring that you can manage your Oklahoma exemption certificates without breaking the bank. You can choose a plan that fits your needs and budget, allowing for efficient document management.

-

Are there any specific features for managing Oklahoma exemption certificates in airSlate SignNow?

Yes, airSlate SignNow includes features specifically designed for managing Oklahoma exemption certificates. These features include customizable templates, automated workflows, and secure eSigning capabilities. This ensures that your exemption certificates are processed quickly and securely.

-

Can I integrate airSlate SignNow with other software for managing Oklahoma exemption certificates?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage your Oklahoma exemption certificates alongside your existing tools. Whether you use CRM systems or accounting software, our platform can seamlessly connect to enhance your workflow.

-

What are the benefits of using airSlate SignNow for Oklahoma exemption certificates?

Using airSlate SignNow for Oklahoma exemption certificates provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our platform simplifies the eSigning process, allowing you to focus on your core business activities while ensuring that your exemption certificates are handled correctly.

-

Is airSlate SignNow secure for handling Oklahoma exemption certificates?

Yes, airSlate SignNow prioritizes security and compliance when handling Oklahoma exemption certificates. Our platform employs advanced encryption and security protocols to protect your sensitive information. You can trust that your documents are safe and secure throughout the signing process.

Get more for Form 900 XM Application For Five Year Ad Valorem Tax Exemption

- Keypass idapply for a keypass id australia post form

- Michigan estimated income tax form

- Wwwcourseherocom117326386application formdocapplication formdoc employment application form position

- Maxicare claim reimbursement form

- Ape form pdf

- Boehringer ingelheim patient assistance form pdf 612940162

- Water loss claim form

- Accrual model opinion of counsel form 27a

Find out other Form 900 XM Application For Five Year Ad Valorem Tax Exemption

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form