DR 1093 Annual Transmittal of State W 2 Forms DR 1093 If You Are Using a Screen Reader or Other Assistive Technology, Please Not

Overview of the DR 1093 Annual Transmittal of State W-2 Forms

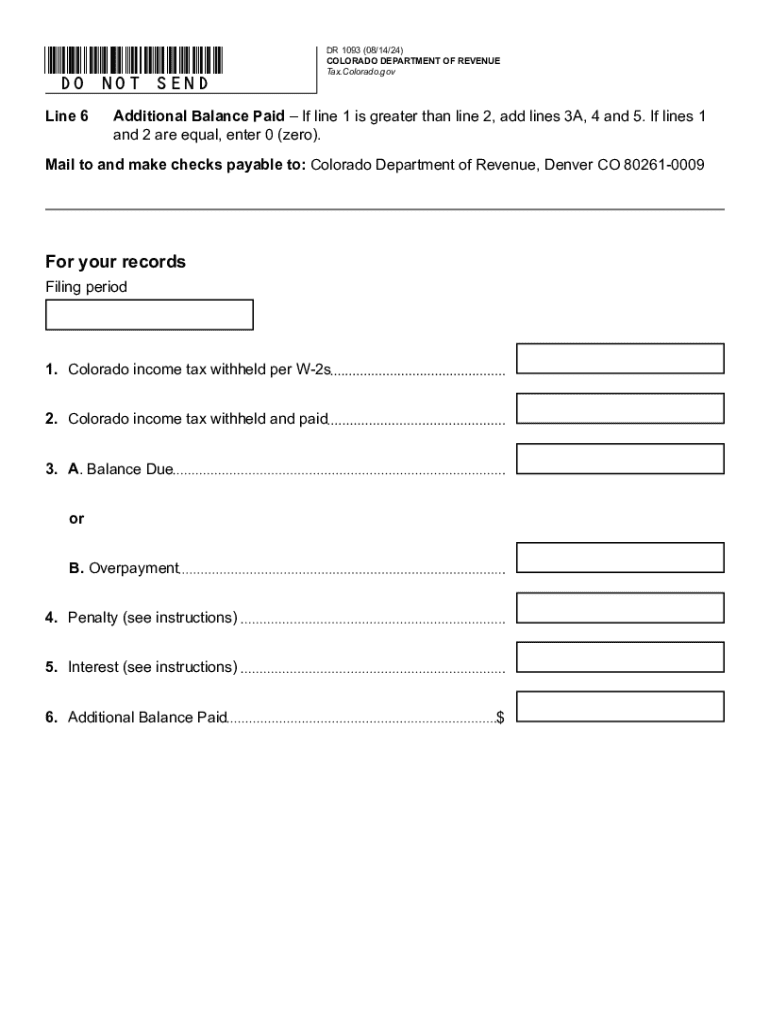

The Colorado Form DR 1093 is an essential document used for the annual transmittal of state W-2 forms. This form is submitted by employers to report wages paid and taxes withheld for their employees throughout the year. It ensures that the Colorado Department of Revenue receives accurate information for tax purposes. Employers must complete this form accurately to comply with state regulations and avoid potential penalties.

Steps to Complete the DR 1093 Form

Completing the DR 1093 involves several key steps:

- Gather all W-2 forms for your employees, ensuring that each form is accurate and complete.

- Fill out the DR 1093 form with the required information, including your business details and total amounts from the W-2 forms.

- Double-check all entries for accuracy to prevent errors that could lead to compliance issues.

- Submit the completed DR 1093 to the Colorado Department of Revenue by the specified deadline.

Filing Deadlines for the DR 1093

It is crucial for employers to be aware of the filing deadlines associated with the DR 1093. Typically, the form must be submitted by January 31 of the year following the tax year being reported. Employers should also be mindful of any changes in deadlines that may occur due to state regulations or specific circumstances.

Required Documents for Submission

When submitting the DR 1093, employers must include the following documents:

- Completed DR 1093 form with accurate totals.

- All W-2 forms for employees, which detail wages and withholding.

Ensuring that these documents are complete and accurate is vital for successful submission and compliance with Colorado tax laws.

Submission Methods for the DR 1093

Employers have several options for submitting the DR 1093 form:

- Online submission through the Colorado Department of Revenue's e-filing system.

- Mailing a paper copy of the completed form to the appropriate address.

- In-person delivery at designated Colorado Department of Revenue offices.

Choosing the right submission method can streamline the process and ensure timely compliance.

Penalties for Non-Compliance

Failure to submit the DR 1093 form on time or inaccuracies in the form can result in penalties. Employers may face fines or other consequences if they do not comply with the submission requirements. It is important to understand these penalties to maintain compliance and avoid unnecessary costs.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 1093 annual transmittal of state w 2 forms dr 1093 if you are using a screen reader or other assistive technology please

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dr 1093 colorado in relation to airSlate SignNow?

dr 1093 colorado refers to a specific regulatory framework that businesses in Colorado must adhere to when handling electronic signatures. airSlate SignNow complies with these regulations, ensuring that your eSigning processes are legally binding and secure.

-

How does airSlate SignNow support dr 1093 colorado compliance?

airSlate SignNow is designed to meet the requirements of dr 1093 colorado by providing secure and compliant electronic signature solutions. Our platform includes features such as audit trails and encryption to ensure that all signed documents are legally valid in Colorado.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including options for small businesses and enterprises. By choosing airSlate SignNow, you can ensure compliance with dr 1093 colorado while benefiting from a cost-effective solution.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features including customizable templates, automated workflows, and real-time tracking of document status. These features help streamline your document management processes while ensuring compliance with dr 1093 colorado.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow seamlessly integrates with various applications such as CRM systems, cloud storage services, and productivity tools. This integration capability enhances your workflow efficiency while adhering to dr 1093 colorado requirements.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Additionally, our platform ensures that your eSigning processes comply with dr 1093 colorado, making it a reliable choice for businesses.

-

Is airSlate SignNow suitable for all business sizes?

Absolutely! airSlate SignNow is designed to accommodate businesses of all sizes, from startups to large enterprises. Regardless of your business size, you can rely on airSlate SignNow to meet dr 1093 colorado compliance and streamline your document processes.

Get more for DR 1093 Annual Transmittal Of State W 2 Forms DR 1093 If You Are Using A Screen Reader Or Other Assistive Technology, Please Not

Find out other DR 1093 Annual Transmittal Of State W 2 Forms DR 1093 If You Are Using A Screen Reader Or Other Assistive Technology, Please Not

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy