DR 6596 Statement of Economic Hardship Colorado Tax Form

What is the DR 6596 Statement of Economic Hardship?

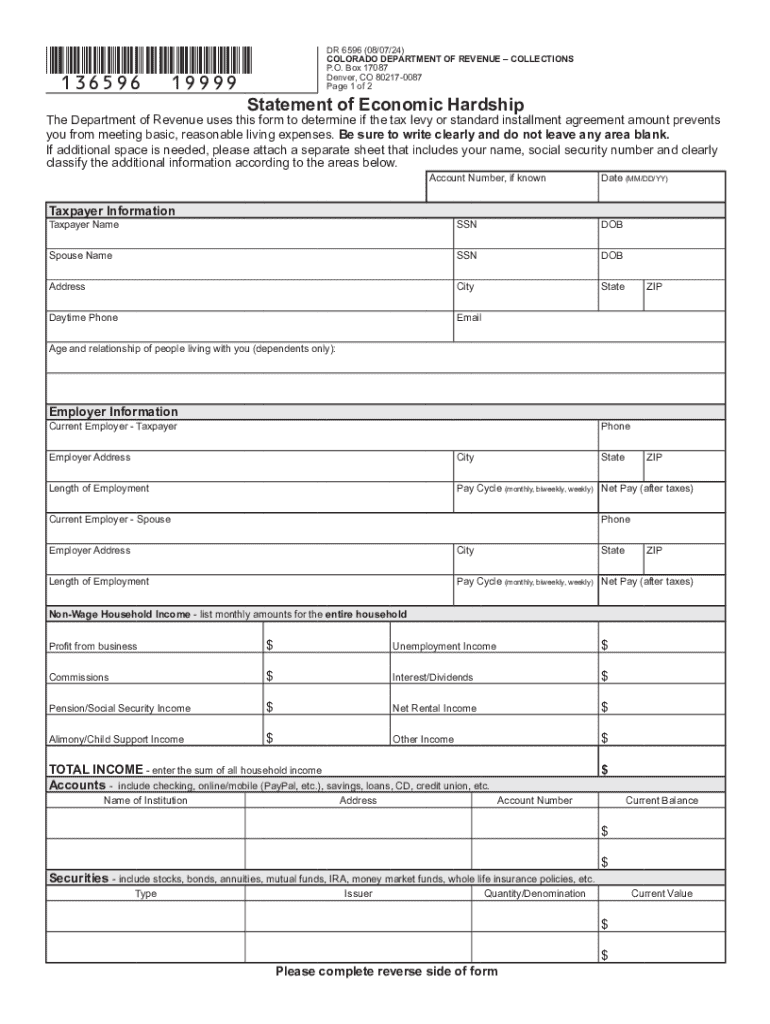

The DR 6596 is a form issued by the Colorado Department of Revenue, specifically designed to help individuals demonstrate economic hardship. This form is crucial for those seeking tax relief or assistance due to financial difficulties. By providing a detailed account of income and expenses, taxpayers can illustrate their current financial situation to the state authorities.

How to Use the DR 6596 Statement of Economic Hardship

To effectively use the DR 6596, individuals must accurately fill out the form with their financial information. This includes documenting all sources of income and listing necessary expenses. The completed form serves as a formal request for consideration of economic hardship, which may lead to various forms of tax relief or adjustments. Understanding the implications of the information provided is essential, as it will be reviewed by the Colorado Department of Revenue.

Steps to Complete the DR 6596 Statement of Economic Hardship

Completing the DR 6596 involves several key steps:

- Gather all necessary financial documents, including pay stubs, bank statements, and bills.

- Carefully fill out the form, ensuring all income sources are listed accurately.

- Detail your monthly expenses, categorizing them appropriately.

- Review the form for accuracy and completeness before submission.

Once completed, the form can be submitted to the Colorado Department of Revenue for review.

Eligibility Criteria for the DR 6596 Statement of Economic Hardship

Eligibility for using the DR 6596 typically involves demonstrating a significant financial burden. This may include situations such as job loss, reduced income, or unexpected expenses. Individuals must provide sufficient evidence to support their claims of economic hardship, which may be assessed by the Colorado Department of Revenue during the review process.

Required Documents for the DR 6596 Statement of Economic Hardship

When submitting the DR 6596, individuals should include supporting documents to validate their claims. Required documents may include:

- Proof of income, such as recent pay stubs or tax returns.

- Documentation of monthly expenses, including rent, utilities, and medical bills.

- Any relevant correspondence from financial institutions or creditors.

Providing comprehensive documentation helps to strengthen the case for economic hardship.

Form Submission Methods for the DR 6596 Statement of Economic Hardship

The DR 6596 can be submitted through various methods, ensuring convenience for taxpayers. Options include:

- Online submission via the Colorado Department of Revenue's website.

- Mailing the completed form to the designated address provided on the form.

- In-person submission at local Department of Revenue offices.

Choosing the right submission method can expedite the review process and facilitate quicker responses.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 6596 statement of economic hardship colorado tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dr 6596 and how does it relate to airSlate SignNow?

dr 6596 is a unique identifier for a specific feature within airSlate SignNow that enhances document management. This feature allows users to streamline their eSigning process, making it more efficient and user-friendly. By utilizing dr 6596, businesses can ensure that their document workflows are optimized for speed and accuracy.

-

What are the pricing options for airSlate SignNow with dr 6596?

airSlate SignNow offers competitive pricing plans that include access to the dr 6596 feature. Depending on your business needs, you can choose from various subscription tiers that provide different levels of functionality. Each plan is designed to be cost-effective while delivering the essential tools for document signing and management.

-

What features does dr 6596 offer to enhance document signing?

The dr 6596 feature in airSlate SignNow includes advanced options such as customizable templates, automated workflows, and real-time tracking of document status. These features help businesses manage their signing processes more effectively. By leveraging dr 6596, users can improve their overall productivity and reduce turnaround times.

-

How can dr 6596 benefit my business?

Implementing dr 6596 within airSlate SignNow can signNowly benefit your business by simplifying the eSigning process. It reduces the time spent on document management and enhances collaboration among team members. Additionally, the ease of use associated with dr 6596 can lead to higher adoption rates among employees.

-

Can I integrate dr 6596 with other software applications?

Yes, dr 6596 is designed to integrate seamlessly with various software applications, enhancing its functionality. Whether you use CRM systems, project management tools, or cloud storage services, airSlate SignNow can connect with them to streamline your workflows. This integration capability ensures that your document signing process is cohesive and efficient.

-

Is there a mobile app for airSlate SignNow that includes dr 6596?

Absolutely! airSlate SignNow offers a mobile app that incorporates the dr 6596 feature, allowing users to manage their documents on the go. This mobile accessibility ensures that you can send and eSign documents anytime, anywhere, making it a convenient solution for busy professionals. The app maintains the same user-friendly interface as the desktop version.

-

What security measures are in place for dr 6596?

Security is a top priority for airSlate SignNow, and the dr 6596 feature is no exception. The platform employs advanced encryption protocols to protect your documents and sensitive information. Additionally, airSlate SignNow complies with industry standards and regulations to ensure that your data remains secure throughout the signing process.

Get more for DR 6596 Statement Of Economic Hardship Colorado Tax

Find out other DR 6596 Statement Of Economic Hardship Colorado Tax

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form