NJ Division of Taxation Updated Versions of Forms GITREP

Understanding the NJ Division of Taxation's Updated GITREP Forms

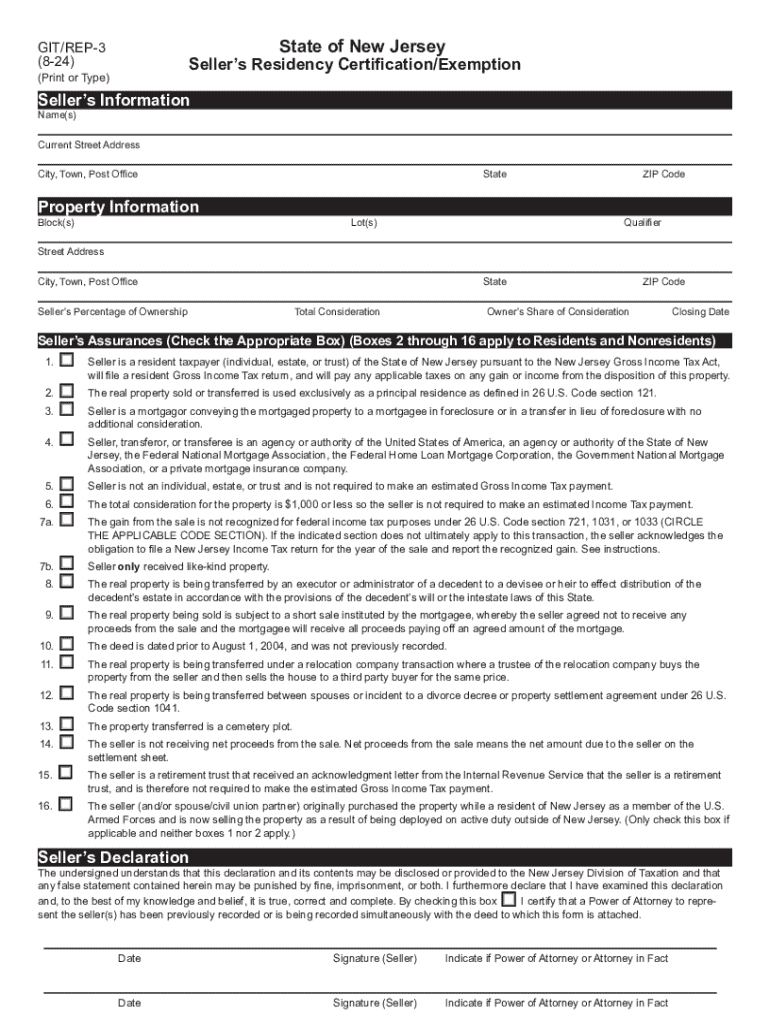

The New Jersey Division of Taxation provides updated versions of the GITREP forms, which are essential for sellers to certify their residency status when selling property. These forms are crucial for determining tax obligations and ensuring compliance with state regulations. The GITREP forms help clarify whether a seller qualifies for residency exemptions, which can significantly impact the tax liabilities associated with real estate transactions.

Steps to Complete the NJ Division of Taxation's GITREP Forms

Completing the GITREP forms involves several key steps. First, gather all necessary information, including your personal details and property information. Next, accurately fill out the form, ensuring that all sections are completed to avoid delays. After filling out the form, review it carefully for any errors or omissions. Finally, submit the form as required, either electronically or via mail, depending on your preference and the specific instructions provided by the New Jersey Division of Taxation.

Eligibility Criteria for Using the GITREP Forms

To utilize the GITREP forms, sellers must meet specific eligibility criteria. Generally, these forms are intended for individuals selling residential property in New Jersey. Sellers must provide proof of residency, which may include documents such as a driver's license or utility bills. Additionally, sellers who are not residents of New Jersey may need to complete different forms to comply with state tax laws.

Required Documents for GITREP Form Submission

When submitting the GITREP forms, certain documents are typically required to support your residency claim. These may include a copy of your New Jersey driver's license, proof of property ownership, and any relevant tax documents. Having these documents ready can facilitate a smoother submission process and help ensure that your residency status is accurately assessed.

Form Submission Methods for GITREP

The GITREP forms can be submitted through various methods, providing flexibility for sellers. Options typically include online submission through the New Jersey Division of Taxation's website, mailing a hard copy of the form, or delivering it in person to a designated office. Each method has its own set of instructions, so it is important to follow the guidelines provided for the chosen submission method.

Legal Use of the GITREP Forms

The legal use of the GITREP forms is vital for compliance with New Jersey tax laws. These forms serve as a declaration of residency status and are used to determine any applicable tax exemptions for property sales. Failing to use the forms correctly can lead to penalties or additional tax liabilities, making it essential for sellers to understand their legal obligations when completing and submitting the GITREP forms.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nj division of taxation updated versions of forms gitrep

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the git form new jersey and how does it work?

The git form new jersey is a digital document that allows users to manage and sign forms electronically. With airSlate SignNow, you can easily create, send, and eSign the git form new jersey, streamlining your workflow and reducing paperwork.

-

How much does it cost to use the git form new jersey with airSlate SignNow?

Pricing for using the git form new jersey with airSlate SignNow varies based on the plan you choose. We offer flexible pricing options that cater to businesses of all sizes, ensuring you get the best value for your needs.

-

What features are included with the git form new jersey?

The git form new jersey includes features such as customizable templates, secure eSigning, and real-time tracking. These features enhance your document management process, making it efficient and user-friendly.

-

Can I integrate the git form new jersey with other applications?

Yes, airSlate SignNow allows seamless integration of the git form new jersey with various applications like Google Drive, Salesforce, and more. This integration helps you streamline your processes and improve productivity.

-

What are the benefits of using the git form new jersey?

Using the git form new jersey offers numerous benefits, including reduced turnaround time for document signing and enhanced security. It also helps in minimizing paper usage, contributing to a more sustainable business practice.

-

Is the git form new jersey compliant with legal standards?

Absolutely! The git form new jersey created with airSlate SignNow complies with all legal standards for electronic signatures. This ensures that your signed documents are legally binding and recognized in New Jersey and beyond.

-

How can I get started with the git form new jersey?

Getting started with the git form new jersey is easy. Simply sign up for an airSlate SignNow account, create your git form new jersey, and start sending it for eSignature. Our user-friendly interface makes the process straightforward.

Get more for NJ Division Of Taxation Updated Versions Of Forms GITREP

- Printable temporary license plate california form

- Insecure housing eligibility confirmation form

- 64 8 form pdf

- Central bank of india kyc update online form

- Lic specimen signature form

- Clark county fire department records request form

- Ribbon requestapproval form

- Printable medical forms colostomy output log

Find out other NJ Division Of Taxation Updated Versions Of Forms GITREP

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer