New Hampshire Seller's Disclosure of Financing Terms for Residential Property in Connection with Contract or Agreement for Deed Form

What is the New Hampshire Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract

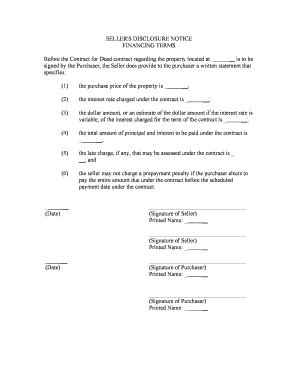

The New Hampshire Seller's Disclosure of Financing Terms for Residential Property in Connection with Contract or Agreement for Deed, commonly referred to as a land contract, is a legal document that outlines the financing terms agreed upon by the buyer and seller in a real estate transaction. This form is essential for ensuring transparency regarding the financial obligations of both parties. It includes details such as the purchase price, down payment, interest rate, payment schedule, and any other relevant financing terms. Understanding this document is crucial for both buyers and sellers to protect their interests and ensure compliance with state regulations.

How to use the New Hampshire Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract

Using the New Hampshire Seller's Disclosure of Financing Terms involves several steps. First, the seller must accurately fill out the form with all necessary details regarding the financing terms. This includes specifying the total purchase price, the amount of the down payment, and the interest rate. Once completed, the seller should provide this document to the buyer for review. The buyer should carefully examine the terms and may seek legal advice if needed. After both parties agree on the terms, they can sign the document, making it legally binding. Utilizing digital tools can streamline this process, allowing for easy sharing and signing of the document.

Steps to complete the New Hampshire Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract

Completing the New Hampshire Seller's Disclosure of Financing Terms involves a systematic approach:

- Gather necessary information, including property details and financing terms.

- Fill out the form with accurate data regarding the purchase price, down payment, interest rate, and payment schedule.

- Review the completed form for accuracy and completeness.

- Provide the form to the buyer for their review and input.

- Make any necessary adjustments based on the buyer's feedback.

- Both parties sign the document to finalize the agreement.

Key elements of the New Hampshire Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract

Key elements of this disclosure form include:

- Purchase Price: The total amount for which the property is being sold.

- Down Payment: The initial payment made by the buyer, which is subtracted from the purchase price.

- Interest Rate: The rate at which interest will accrue on the remaining balance.

- Payment Schedule: The timeline for payments, including frequency and due dates.

- Default Terms: Conditions under which the seller may take action if the buyer fails to meet payment obligations.

Legal use of the New Hampshire Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract

The legal use of the New Hampshire Seller's Disclosure of Financing Terms is governed by state laws that require transparency in real estate transactions. This document must be completed accurately to ensure that both parties are aware of their financial obligations. It serves as a binding agreement once signed, meaning that any failure to adhere to the terms outlined can result in legal consequences. It is advisable for both parties to retain copies of the signed document for their records and to consult legal professionals if there are any uncertainties regarding the terms.

State-specific rules for the New Hampshire Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract

New Hampshire has specific rules regarding the Seller's Disclosure of Financing Terms. These rules mandate that sellers provide clear and complete information about the financing terms to potential buyers. The state requires that all disclosures be made in writing and that both parties acknowledge the terms. Additionally, New Hampshire law may impose penalties for failing to disclose important information or for providing misleading terms. Understanding these regulations is crucial for compliance and to avoid potential disputes.

Quick guide on how to complete new hampshire sellers disclosure of financing terms for residential property in connection with contract or agreement for deed

Manage New Hampshire Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed easily on any device

Digital document management has gained traction among businesses and individuals. It serves as a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without complications. Handle New Hampshire Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign New Hampshire Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed effortlessly

- Find New Hampshire Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of the documents or redact sensitive information with tools that airSlate SignNow offers for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal significance as a conventional ink signature.

- Review the details and then click on the Done button to finalize your changes.

- Decide how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and electronically sign New Hampshire Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed and maintain excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the New Hampshire Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract?

The New Hampshire Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract outlines the specific financial terms agreed upon between the buyer and seller. This document is crucial for transparency in real estate transactions, ensuring that both parties understand the financing details involved.

-

Why is it important to have a New Hampshire Seller's Disclosure Of Financing Terms?

Having a New Hampshire Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract is vital for protecting both the buyer and seller. It minimizes the risk of misunderstandings and disputes by clearly stating the financial terms and conditions governing the agreement.

-

How can airSlate SignNow help with creating the New Hampshire Seller's Disclosure Of Financing Terms?

airSlate SignNow provides an efficient platform for creating and managing the New Hampshire Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract. Our user-friendly interface allows you to easily customize templates, making it simple to fill out necessary information for your real estate transactions.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers competitive pricing plans designed to meet the needs of various users. You can choose from different subscription levels based on your business size and document management requirements, all while ensuring access to tools for handling the New Hampshire Seller's Disclosure Of Financing Terms.

-

Can I integrate airSlate SignNow with other software I use?

Yes, airSlate SignNow integrates seamlessly with various software applications, enabling you to streamline your document processes. This is especially helpful when managing the New Hampshire Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract alongside your existing workflows.

-

What features does airSlate SignNow offer that are beneficial for real estate transactions?

airSlate SignNow offers a range of features including e-signature capabilities, document templates, and secure storage which are essential for real estate transactions. These tools help you manage the New Hampshire Seller's Disclosure Of Financing Terms effectively, ensuring that all parties can easily review and sign important documents.

-

How does airSlate SignNow ensure the security of my documents?

Security is a top priority for airSlate SignNow. We utilize advanced encryption technologies and secure access controls to protect your documents, including the New Hampshire Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract, ensuring that sensitive information remains safe and confidential.

Get more for New Hampshire Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed

- Control number us ab9 pkg form

- Life and heath ins guaranty assoc model act legislative history form

- In re agent orange product liability litigation 597 f form

- Insurers rehabilitation and liquidation model act form

- Appendix h form 5birrevocable reversionary inter vivos medical trust for the

- Cobra sample letter form

- Cobra continuation waiver letter form

- Cobra faqs new mexico general services department form

Find out other New Hampshire Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself

- Electronic signature Maryland Landlord lease agreement Secure

- How To Electronic signature Utah Landlord lease agreement

- Electronic signature Wyoming Landlord lease agreement Safe