Prior Year Corporation Business Tax Returns NJ Gov Form

What is the New Jersey CBT-100 Form?

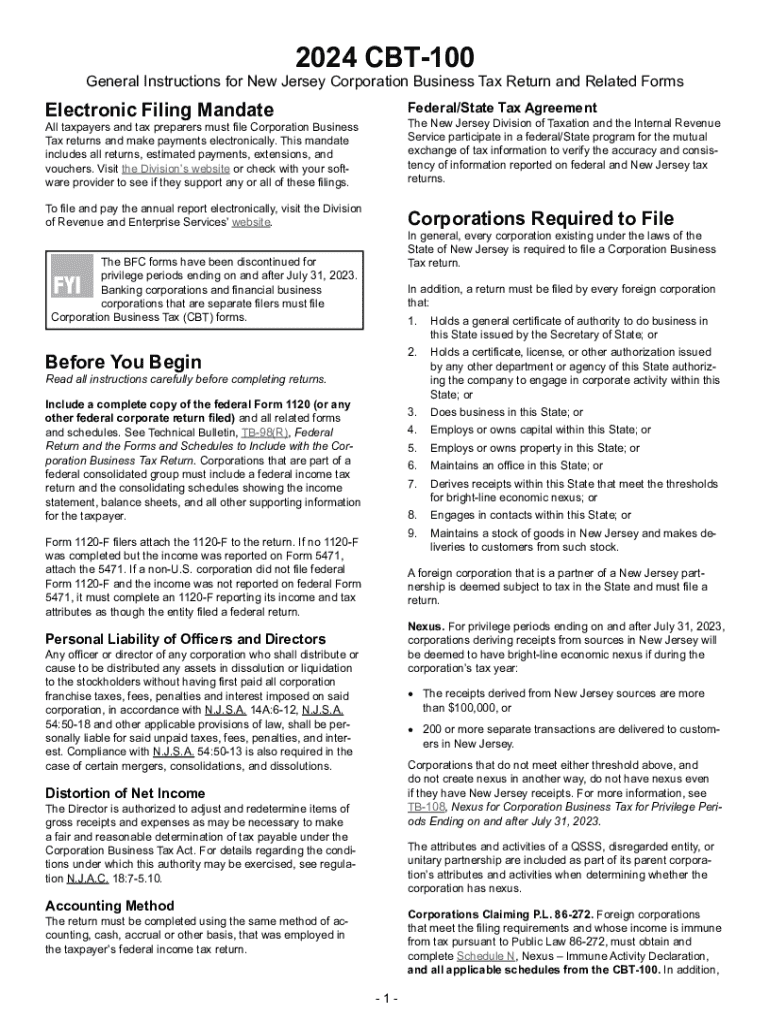

The New Jersey CBT-100 form, officially known as the Corporation Business Tax Return, is a tax document that corporations operating in New Jersey must file annually. This form is essential for reporting income, calculating tax liability, and ensuring compliance with state tax laws. The CBT-100 is specifically designed for C corporations, and it captures various financial details, including gross income, deductions, and credits. Understanding this form is crucial for businesses to accurately fulfill their tax obligations and avoid penalties.

Key Elements of the New Jersey CBT-100 Form

Several key elements must be included when completing the New Jersey CBT-100 form. These elements encompass:

- Gross Income: Total revenue generated by the corporation during the tax year.

- Deductions: Allowable expenses that can be subtracted from gross income to reduce taxable income.

- Tax Credits: Available credits that can offset tax liability, such as credits for research and development.

- Tax Rate: The applicable tax rate based on the corporation's income level.

- Signature: An authorized individual must sign the form to validate the submission.

Steps to Complete the New Jersey CBT-100 Form

Completing the New Jersey CBT-100 form involves several important steps:

- Gather necessary financial documents, including income statements and expense reports.

- Calculate gross income by summing all revenue streams.

- Identify and list all allowable deductions to reduce taxable income.

- Determine applicable tax credits that may be claimed.

- Complete the form accurately, ensuring all sections are filled out correctly.

- Review the form for accuracy and completeness before submission.

- Submit the form either online, by mail, or in person, depending on the preferred submission method.

Filing Deadlines for the New Jersey CBT-100 Form

Filing deadlines for the New Jersey CBT-100 form are crucial for compliance. Generally, corporations must file their tax returns by the fifteenth day of the fourth month following the end of their fiscal year. For corporations operating on a calendar year, this means the deadline is April 15. It is important to adhere to these deadlines to avoid penalties and interest on unpaid taxes.

Form Submission Methods for the New Jersey CBT-100

Corporations have several options for submitting the New Jersey CBT-100 form. These methods include:

- Online Submission: Corporations can file electronically through the New Jersey Division of Taxation's online portal.

- Mail: The completed form can be printed and mailed to the appropriate tax office.

- In-Person: Corporations may also choose to deliver the form directly to a tax office location.

Penalties for Non-Compliance with the New Jersey CBT-100

Failure to file the New Jersey CBT-100 form on time can result in significant penalties. These penalties may include:

- Late Filing Penalty: A percentage of the unpaid tax amount for each month the return is late.

- Interest Charges: Accrued interest on any unpaid taxes from the due date until payment is made.

- Potential Legal Consequences: Continued non-compliance may lead to legal action by the state.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the prior year corporation business tax returns nj gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the new jersey cbt 100 instructions?

The new jersey cbt 100 instructions provide detailed guidelines for completing the CBT-100 form, which is essential for businesses operating in New Jersey. These instructions cover everything from eligibility requirements to submission procedures, ensuring compliance with state regulations.

-

How can airSlate SignNow assist with new jersey cbt 100 instructions?

airSlate SignNow simplifies the process of completing and submitting the new jersey cbt 100 instructions by allowing users to eSign documents securely. Our platform streamlines document management, making it easier to gather necessary signatures and ensure timely submissions.

-

What features does airSlate SignNow offer for handling new jersey cbt 100 instructions?

airSlate SignNow offers features such as customizable templates, automated workflows, and real-time tracking, which are particularly beneficial for managing new jersey cbt 100 instructions. These tools enhance efficiency and reduce the likelihood of errors during the submission process.

-

Is there a cost associated with using airSlate SignNow for new jersey cbt 100 instructions?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including options for handling new jersey cbt 100 instructions. Our cost-effective solutions ensure that you can manage your document signing processes without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for new jersey cbt 100 instructions?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to enhance your workflow when dealing with new jersey cbt 100 instructions. This integration capability ensures that you can connect with your existing tools for a more streamlined experience.

-

What are the benefits of using airSlate SignNow for new jersey cbt 100 instructions?

Using airSlate SignNow for new jersey cbt 100 instructions offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform helps you manage your documents digitally, saving time and ensuring compliance with state requirements.

-

How secure is airSlate SignNow when handling new jersey cbt 100 instructions?

Security is a top priority at airSlate SignNow. When handling new jersey cbt 100 instructions, our platform employs advanced encryption and secure storage solutions to protect your sensitive information, ensuring that your documents remain confidential and secure.

Get more for Prior Year Corporation Business Tax Returns NJ gov

- Ubl bank challan form download

- Bzu degree verification fee 522636562 form

- Itr v acknowledgement ay 2020 21 pdf form

- Indane gas bond paper download form

- Computershare walmart form

- Dtc bus pass form

- Su07 sponsor form fill out ampamp sign online

- 15 motion to set aside final judgment of forfeiture 903 27 form

Find out other Prior Year Corporation Business Tax Returns NJ gov

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy