480 6D Rev 06 24 480 6D Rev 06 24 Form

What is the 480 6D Rev 06 24?

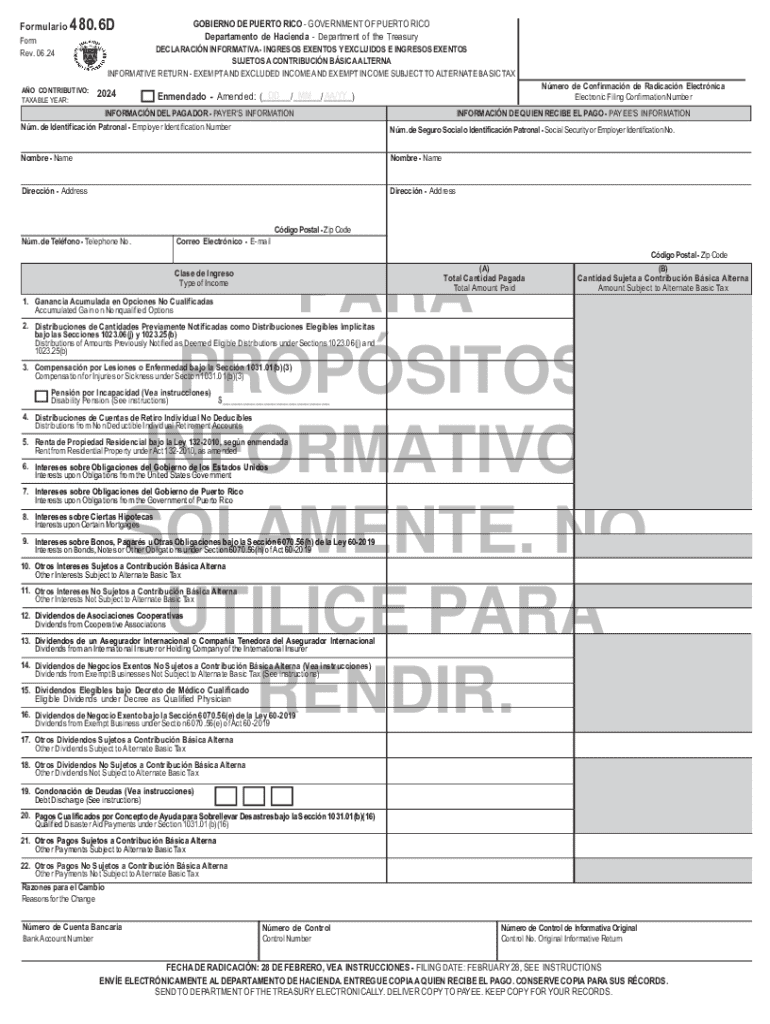

The 480 6D Rev 06 24 is a specific form used primarily for reporting certain types of income and transactions to the Internal Revenue Service (IRS). This form is essential for businesses and individuals who need to disclose specific financial information, ensuring compliance with U.S. tax laws. It is particularly relevant for those involved in transactions that require detailed reporting, such as payments made to independent contractors or specific types of business expenses.

How to use the 480 6D Rev 06 24

Using the 480 6D Rev 06 24 involves several steps to ensure accurate reporting. First, gather all necessary financial documents related to the transactions you need to report. This includes invoices, receipts, and any other relevant records. Next, fill out the form with precise details about the income or payments made, ensuring that all information matches your supporting documents. After completing the form, review it for accuracy before submission.

Steps to complete the 480 6D Rev 06 24

Completing the 480 6D Rev 06 24 requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents.

- Fill in your personal or business information at the top of the form.

- Report the income or payments in the designated sections of the form.

- Double-check all entries for accuracy and completeness.

- Sign and date the form where required.

- Submit the form to the IRS as per the guidelines provided.

Legal use of the 480 6D Rev 06 24

The legal use of the 480 6D Rev 06 24 is crucial for compliance with U.S. tax regulations. This form must be filed accurately to avoid penalties or legal issues. It is used to report income that may not be captured on other tax forms, ensuring that all income is properly documented. Failure to use this form correctly can result in audits or fines, emphasizing the importance of adhering to IRS guidelines.

Required Documents

To complete the 480 6D Rev 06 24, specific documents are necessary. These include:

- Invoices related to the reported transactions.

- Receipts for any expenses claimed.

- Previous tax returns for reference.

- Any correspondence from the IRS regarding previous filings.

Having these documents ready will facilitate a smoother completion process.

Filing Deadlines / Important Dates

Filing the 480 6D Rev 06 24 must be done by specific deadlines to avoid penalties. Typically, the form is due on the same date as your annual tax return. It is essential to stay informed about any changes to these dates, as they can vary from year to year. Mark your calendar with important dates to ensure timely submission.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 480 6d rev 06 24 480 6d rev 06 24

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 480 6D Rev 06 24?

The 480 6D Rev 06 24 is a specific version of our document signing solution that enhances the eSigning process. It provides users with advanced features designed to streamline document management and improve workflow efficiency. By utilizing the 480 6D Rev 06 24, businesses can ensure secure and compliant electronic signatures.

-

How does the 480 6D Rev 06 24 improve document signing?

The 480 6D Rev 06 24 offers a user-friendly interface that simplifies the eSigning process. It includes features such as customizable templates, automated reminders, and real-time tracking of document status. These enhancements help businesses save time and reduce errors in their signing processes.

-

What are the pricing options for the 480 6D Rev 06 24?

Pricing for the 480 6D Rev 06 24 varies based on the number of users and features required. We offer flexible subscription plans that cater to businesses of all sizes. For detailed pricing information, please visit our pricing page or contact our sales team.

-

Can the 480 6D Rev 06 24 integrate with other software?

Yes, the 480 6D Rev 06 24 seamlessly integrates with various third-party applications, including CRM and document management systems. This integration allows for a more cohesive workflow, enabling users to manage documents and signatures from a single platform. Check our integration page for a full list of compatible software.

-

What are the key benefits of using the 480 6D Rev 06 24?

Using the 480 6D Rev 06 24 provides numerous benefits, including increased efficiency, enhanced security, and improved compliance with legal standards. It allows businesses to reduce turnaround times for document signing and minimizes the need for physical paperwork. Overall, it helps streamline operations and improve customer satisfaction.

-

Is the 480 6D Rev 06 24 suitable for small businesses?

Absolutely! The 480 6D Rev 06 24 is designed to be cost-effective and user-friendly, making it ideal for small businesses. It provides essential eSigning features without overwhelming users with unnecessary complexity, allowing small teams to manage their document signing needs efficiently.

-

What security measures are in place for the 480 6D Rev 06 24?

The 480 6D Rev 06 24 employs robust security measures, including encryption and secure access controls, to protect sensitive documents. We comply with industry standards to ensure that all electronic signatures are legally binding and secure. Your data privacy is our top priority.

Get more for 480 6D Rev 06 24 480 6D Rev 06 24

Find out other 480 6D Rev 06 24 480 6D Rev 06 24

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure