Tax Account Information ChangeCorrection Form REV 1705 R FormsPublications

Understanding the Tax Account Information Change Correction Form REV 1705R

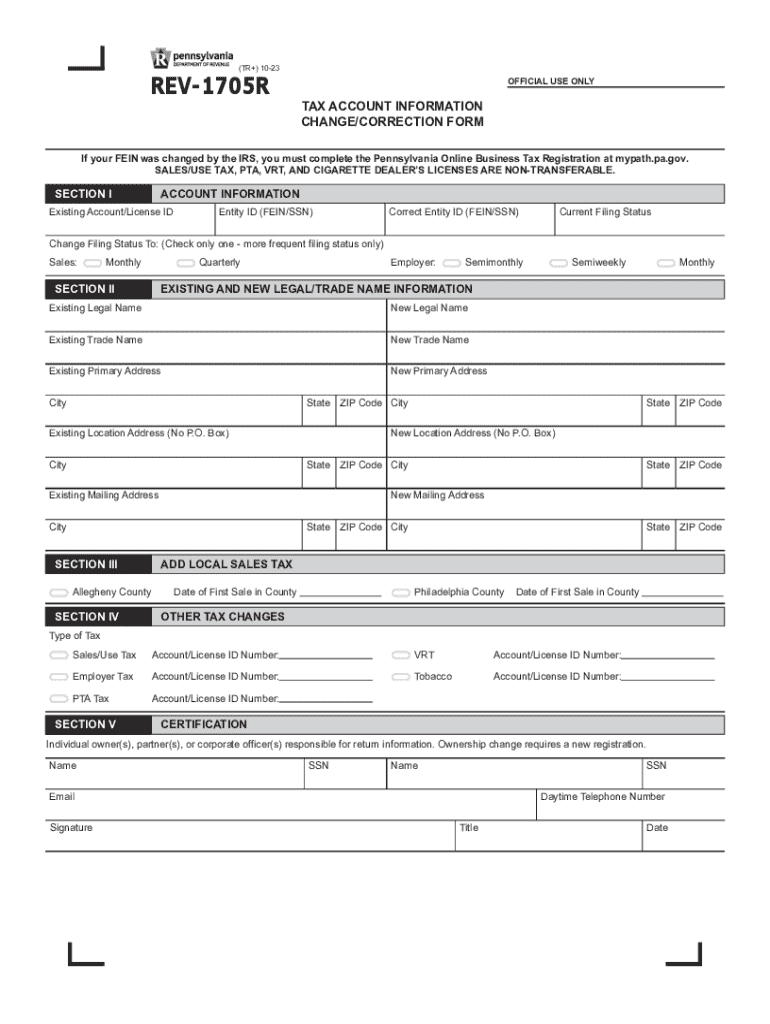

The Tax Account Information Change Correction Form REV 1705R is an essential document used in Pennsylvania for updating or correcting information related to a taxpayer's account. This form is particularly important for individuals and businesses that need to ensure their tax records are accurate and up-to-date. It allows taxpayers to report changes such as name, address, or other relevant information that affects their tax account. Proper completion of this form helps maintain compliance with state tax regulations and ensures that all correspondence from the Pennsylvania Department of Revenue is directed to the correct address.

Steps to Complete the Tax Account Information Change Correction Form REV 1705R

Completing the REV 1705R form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your current account details and the new information you wish to report. Next, fill out the form carefully, ensuring that all sections are completed. It is crucial to double-check the information for any errors or omissions. Once the form is filled out, sign and date it to validate your submission. Finally, submit the form according to the instructions provided, whether online, by mail, or in person, to the appropriate Pennsylvania Department of Revenue office.

Required Documents for the Tax Account Information Change Correction Form REV 1705R

When submitting the REV 1705R form, certain documents may be required to support your request for changes. These documents can include proof of identity, such as a driver's license or state ID, and any legal documents that justify the changes, such as marriage certificates for name changes or utility bills for address verification. Having these documents ready can expedite the processing of your form and help avoid potential delays.

Form Submission Methods for the Tax Account Information Change Correction Form REV 1705R

The REV 1705R form can be submitted through various methods, providing flexibility for taxpayers. You can file the form online through the Pennsylvania Department of Revenue's e-services portal, which offers a convenient and efficient way to manage your tax account. Alternatively, you can print the completed form and mail it to the designated office. For those who prefer in-person interactions, visiting a local Department of Revenue office is also an option. Each submission method may have different processing times, so it's advisable to choose the one that best fits your needs.

Legal Use of the Tax Account Information Change Correction Form REV 1705R

The REV 1705R form is legally recognized for making official changes to your tax account in Pennsylvania. It is important to use this form when you need to report changes to ensure compliance with state tax laws. Failing to update your information can lead to complications, such as misdirected correspondence or issues with tax assessments. By using the REV 1705R, you fulfill your legal obligation to keep your tax records accurate, which can help prevent penalties or legal repercussions.

Key Elements of the Tax Account Information Change Correction Form REV 1705R

Understanding the key elements of the REV 1705R form is crucial for successful completion. The form typically includes sections for personal information, such as your name, address, and taxpayer identification number. It also contains areas for specifying the changes being made, including the type of correction and the reason for the change. Additionally, there may be a section for signatures to confirm that the information provided is accurate and truthful. Familiarizing yourself with these elements can facilitate a smoother filing process.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax account information changecorrection form rev 1705 r formspublications

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rev 1705r and how does it work?

The rev 1705r is a powerful tool within the airSlate SignNow platform that allows users to easily send and eSign documents. It streamlines the signing process, making it efficient and user-friendly. With rev 1705r, businesses can manage their documents electronically, reducing the need for paper and enhancing productivity.

-

What are the key features of the rev 1705r?

The rev 1705r offers a variety of features including customizable templates, real-time tracking of document status, and secure cloud storage. These features ensure that users can manage their documents effectively while maintaining compliance and security. Additionally, the rev 1705r integrates seamlessly with other tools to enhance workflow.

-

How much does the rev 1705r cost?

Pricing for the rev 1705r varies based on the plan selected, with options suitable for businesses of all sizes. airSlate SignNow offers competitive pricing that reflects the value and efficiency provided by the rev 1705r. For detailed pricing information, it's best to visit the airSlate SignNow website or contact their sales team.

-

What are the benefits of using the rev 1705r for my business?

Using the rev 1705r can signNowly enhance your business operations by reducing turnaround times for document signing. It also minimizes errors associated with manual processes and improves overall efficiency. By adopting the rev 1705r, businesses can focus more on their core activities while ensuring that document management is streamlined.

-

Can the rev 1705r integrate with other software?

Yes, the rev 1705r is designed to integrate seamlessly with various software applications, including CRM systems and project management tools. This integration capability allows businesses to enhance their workflows and improve collaboration across teams. By utilizing the rev 1705r, users can ensure that their document processes align with their existing systems.

-

Is the rev 1705r secure for sensitive documents?

Absolutely, the rev 1705r prioritizes security and compliance, ensuring that sensitive documents are protected. It employs advanced encryption methods and secure access controls to safeguard your data. With the rev 1705r, businesses can confidently manage their documents without compromising on security.

-

How can I get started with the rev 1705r?

Getting started with the rev 1705r is simple. You can sign up for a free trial on the airSlate SignNow website to explore its features. Once you're ready, you can choose a plan that fits your business needs and start leveraging the benefits of the rev 1705r immediately.

Get more for Tax Account Information ChangeCorrection Form REV 1705 R FormsPublications

- Limkokwing entry requirements form

- Form 34

- 6 week challenge meal plan pdf form

- General information pdf

- Rouses catering form

- Lead based paint disclosure ohio form

- Authorization letter to withdraw money from bdo form

- Ab 130 out of province power engineer certificate transfer application d0040804 14 doc wdnostamp form

Find out other Tax Account Information ChangeCorrection Form REV 1705 R FormsPublications

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now