CT 128 DOC Form

Understanding the CT Revenue OR131 Document

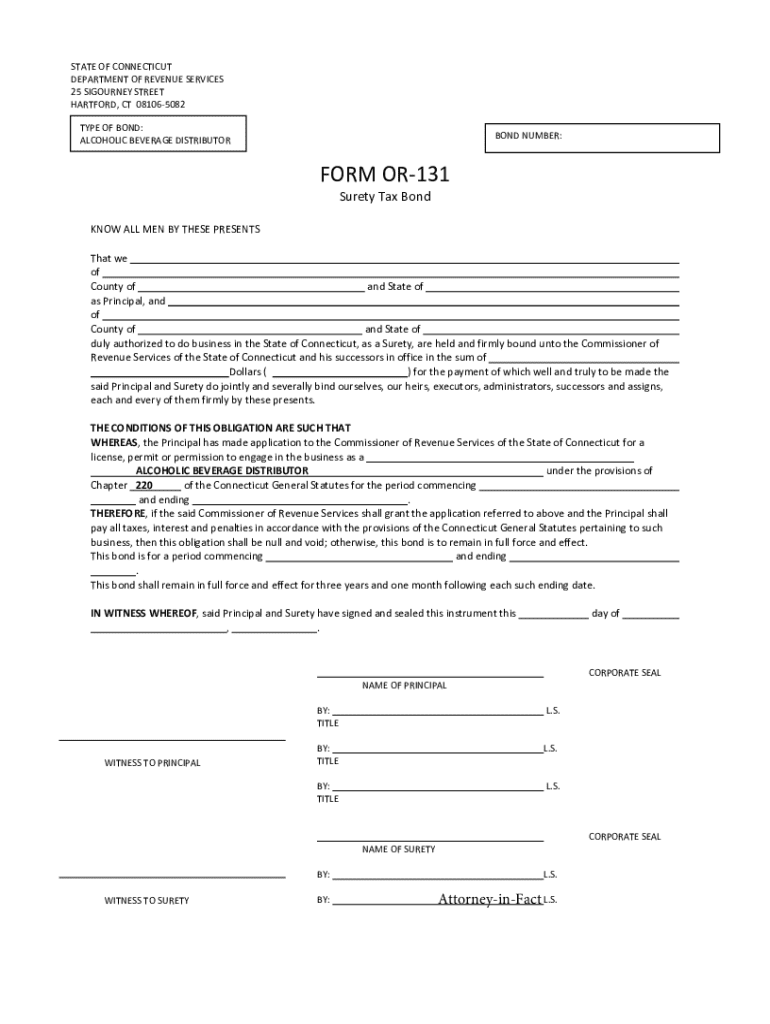

The CT Revenue OR131 is a crucial form used by businesses and individuals in Connecticut for reporting various tax-related information. This document is essential for ensuring compliance with state tax regulations. It serves as a means for taxpayers to communicate their tax obligations and financial details to the Connecticut Department of Revenue Services.

Steps to Complete the CT Revenue OR131 Document

Filling out the CT Revenue OR131 requires careful attention to detail. Here are the steps to ensure accurate completion:

- Gather necessary financial documents, such as previous tax returns and income statements.

- Provide accurate personal or business information, including name, address, and taxpayer identification number.

- Report all applicable income sources and deductions as outlined in the form.

- Review the form for accuracy before submission to avoid penalties.

Filing Deadlines and Important Dates

It is important to be aware of the filing deadlines associated with the CT Revenue OR131. Generally, the form must be submitted by the due date specified by the Connecticut Department of Revenue Services, which is typically aligned with the annual tax filing deadline. Late submissions may incur penalties, so timely filing is essential.

Form Submission Methods

The CT Revenue OR131 can be submitted through various methods, providing flexibility for taxpayers:

- Online: Many taxpayers prefer to file electronically through the Connecticut Department of Revenue Services website.

- Mail: The form can also be printed and mailed to the appropriate address provided in the instructions.

- In-Person: Some individuals may choose to deliver the form in person at their local revenue office.

Key Elements of the CT Revenue OR131 Document

Understanding the key elements of the CT Revenue OR131 is vital for accurate reporting. The form typically includes sections for:

- Taxpayer identification details.

- Income reporting, including wages, self-employment income, and other earnings.

- Deductions and credits that may apply to the taxpayer.

- Signature and date, confirming the accuracy of the information provided.

Legal Use of the CT Revenue OR131 Document

The CT Revenue OR131 is legally binding once submitted. Taxpayers must ensure that all information is truthful and complete to avoid legal repercussions. Misrepresentation or errors can lead to audits, penalties, or other legal actions by the Connecticut Department of Revenue Services.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 128 doc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct revenue or131 and how does it relate to airSlate SignNow?

ct revenue or131 refers to a specific revenue code that businesses may encounter when using airSlate SignNow for electronic signatures and document management. Understanding this code can help streamline your billing processes and ensure compliance with financial regulations.

-

How does airSlate SignNow support businesses in managing ct revenue or131?

airSlate SignNow provides tools that help businesses efficiently manage documents related to ct revenue or131. With features like customizable templates and automated workflows, you can ensure that all necessary documentation is completed accurately and on time.

-

What are the pricing options for airSlate SignNow when dealing with ct revenue or131?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, including those focused on ct revenue or131. You can choose from monthly or annual subscriptions, ensuring you find a plan that fits your budget while accessing essential features.

-

What features does airSlate SignNow offer for handling ct revenue or131 documentation?

airSlate SignNow includes features such as secure eSigning, document templates, and real-time tracking, all of which are beneficial for managing ct revenue or131 documentation. These tools help ensure that your documents are signed quickly and securely, enhancing overall efficiency.

-

Can airSlate SignNow integrate with other software for ct revenue or131 management?

Yes, airSlate SignNow offers integrations with various software solutions that can assist in managing ct revenue or131. This allows for seamless data transfer and improved workflow efficiency, making it easier to handle all aspects of your revenue management.

-

What are the benefits of using airSlate SignNow for ct revenue or131?

Using airSlate SignNow for ct revenue or131 provides numerous benefits, including reduced paperwork, faster processing times, and enhanced security. By digitizing your document management, you can focus more on your core business activities while ensuring compliance.

-

Is airSlate SignNow user-friendly for managing ct revenue or131?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to manage ct revenue or131 documents. The intuitive interface allows users to navigate the platform effortlessly, regardless of their technical expertise.

Get more for CT 128 doc

Find out other CT 128 doc

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free