Untitled Form

What is the form E-536R?

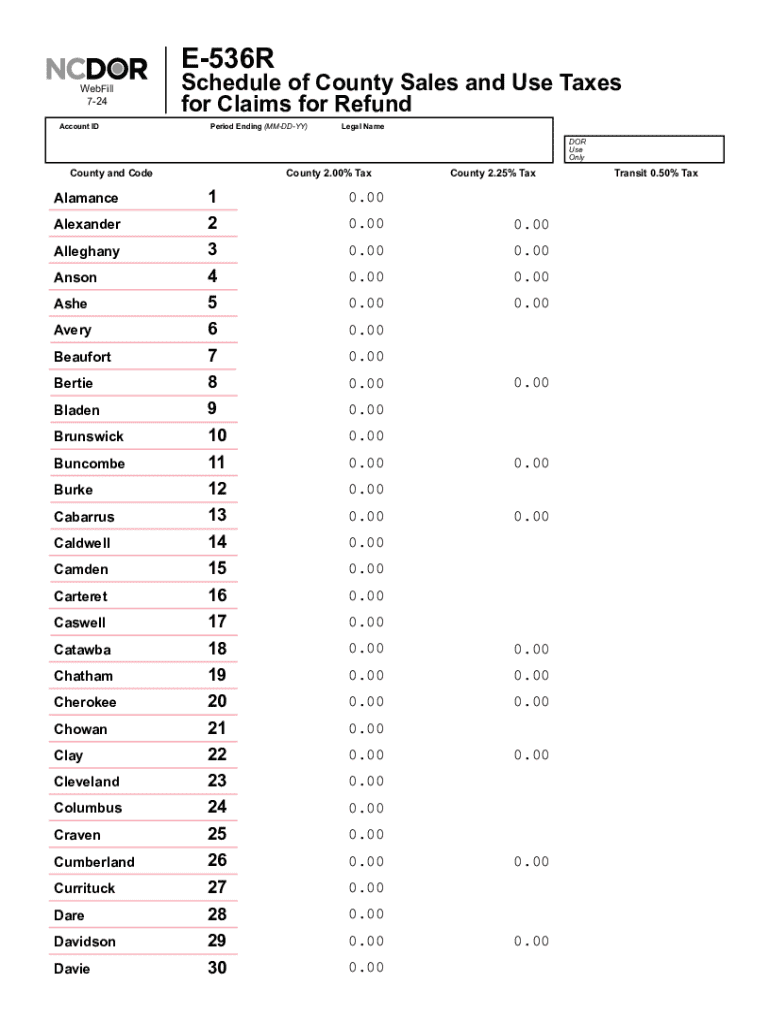

The form E-536R, also known as the NC E-536R taxes claims refund form, is a document used in North Carolina for claiming refunds on sales and use taxes. It is primarily utilized by businesses and individuals who have overpaid taxes or are eligible for refunds due to various reasons such as exempt sales or incorrect tax calculations. This form is essential for ensuring that taxpayers receive the appropriate refunds they are entitled to under state tax laws.

How to use the form E-536R

To use the form E-536R, you need to complete it accurately by providing all required information. This includes details about the taxpayer, the nature of the claim, and the amount being requested for refund. It is important to follow the specific instructions provided on the form to ensure that your claim is processed smoothly. After completing the form, you can submit it either online or via mail, depending on your preference and the guidelines set by the North Carolina Department of Revenue.

Steps to complete the form E-536R

Completing the form E-536R involves several key steps:

- Gather necessary documentation, including receipts and proof of tax payments.

- Fill out the taxpayer information section with accurate details.

- Provide a detailed explanation of the reason for the refund claim.

- Calculate the total amount of refund being requested.

- Review the form for accuracy and completeness before submission.

Following these steps carefully can help expedite the processing of your refund claim.

Required documents for the form E-536R

When submitting the form E-536R, it is essential to include supporting documents to substantiate your claim. Required documents may include:

- Receipts or invoices showing the original tax payments.

- Exemption certificates if applicable.

- Any correspondence with the North Carolina Department of Revenue regarding the tax payments.

Providing these documents will help ensure that your claim is processed without delays.

Form submission methods

The form E-536R can be submitted through various methods, allowing flexibility for taxpayers. You can choose to:

- Submit the form online through the North Carolina Department of Revenue's website.

- Mail the completed form to the appropriate address as indicated on the form.

- Deliver the form in person at a local Department of Revenue office.

Selecting the method that best suits your needs can help facilitate a quicker response to your claim.

Eligibility criteria for the form E-536R

To be eligible to file the form E-536R, taxpayers must meet specific criteria. Generally, eligibility includes:

- Having overpaid sales and use taxes in North Carolina.

- Being a registered taxpayer with the North Carolina Department of Revenue.

- Providing valid reasons for the refund claim, such as exempt sales or errors in tax calculation.

Meeting these criteria is crucial for ensuring that your claim is accepted and processed efficiently.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the untitled 769979174

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form e 536r and how does it work with airSlate SignNow?

Form e 536r is a specific document used for various business processes. With airSlate SignNow, you can easily create, send, and eSign this form, streamlining your workflow. The platform ensures that your form e 536r is securely managed and accessible from anywhere.

-

How can I integrate form e 536r into my existing workflows?

Integrating form e 536r into your workflows is simple with airSlate SignNow. The platform allows you to connect with various applications and automate processes, ensuring that your form e 536r is seamlessly incorporated into your daily operations. This integration enhances efficiency and reduces manual errors.

-

What are the pricing options for using airSlate SignNow with form e 536r?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you are a small business or a large enterprise, you can choose a plan that allows you to manage form e 536r effectively. Each plan provides access to essential features for eSigning and document management.

-

What features does airSlate SignNow offer for managing form e 536r?

airSlate SignNow provides a range of features for managing form e 536r, including customizable templates, secure eSigning, and real-time tracking. These features help you streamline the document process and ensure compliance. Additionally, you can collaborate with team members directly within the platform.

-

What are the benefits of using airSlate SignNow for form e 536r?

Using airSlate SignNow for form e 536r offers numerous benefits, such as increased efficiency, reduced turnaround time, and enhanced security. The platform simplifies the signing process, allowing you to focus on your core business activities. Moreover, it helps in maintaining a digital record of all transactions.

-

Is airSlate SignNow compliant with regulations for form e 536r?

Yes, airSlate SignNow is compliant with various regulations, ensuring that your form e 536r is handled according to legal standards. The platform adheres to industry best practices for security and data protection, giving you peace of mind when managing sensitive documents. Compliance is a priority for us.

-

Can I customize form e 536r templates in airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize form e 536r templates to fit your specific needs. You can add fields, adjust layouts, and incorporate branding elements to ensure that your documents reflect your business identity. Customization enhances the user experience and improves engagement.

Get more for Untitled

- Grammar crossword present perfect form

- Polmed chronic application form 2022

- Mv1415 form

- Anna and the french kiss pdf form

- Flextangle template pdf form

- Patient safety plan template form

- Tp 524c pdf form

- Required minimum distributions for non vested inactive members and individuals who have lost trs membership rights brochure form

Find out other Untitled

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document