Form 4506 T Rev 9 Request for Transcript of Tax Return

What is the Form 4506-T Request for Transcript of Tax Return

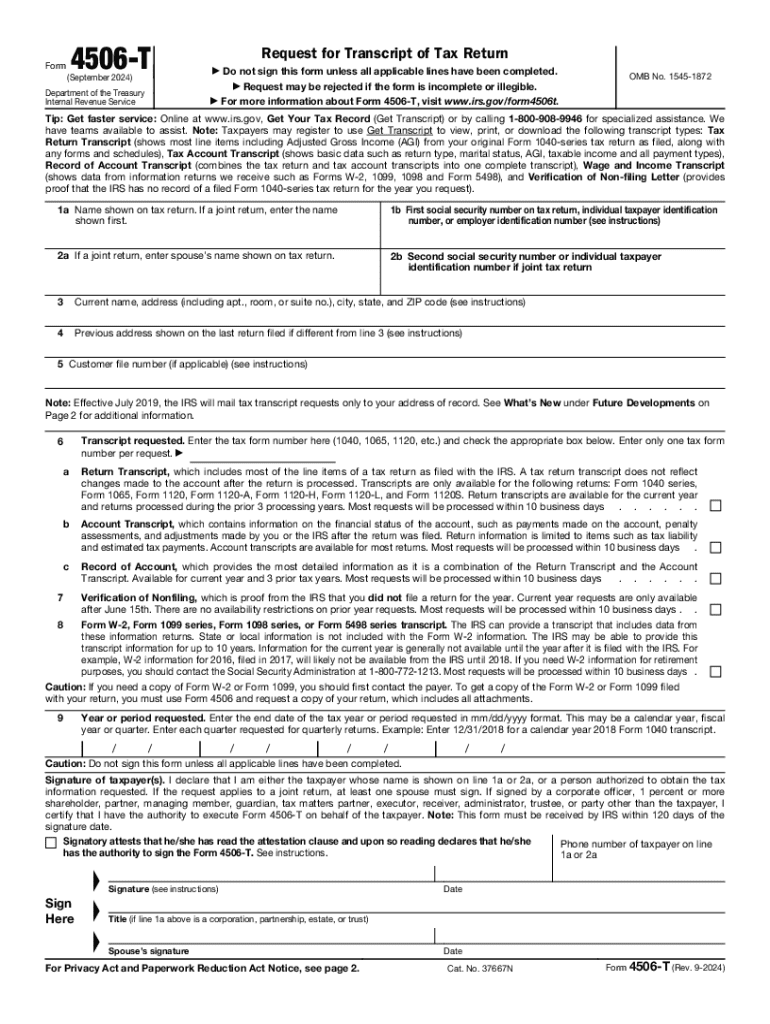

The Form 4506-T is an official document issued by the IRS that allows taxpayers to request a transcript of their tax return. This form is essential for individuals or businesses needing to verify income, especially when applying for loans, mortgages, or financial aid. The transcript provides a summary of the tax return information and is generally available for the current tax year and the past three years. Understanding the specifics of this form can help ensure that you receive the correct information in a timely manner.

How to Use the Form 4506-T Request for Transcript of Tax Return

Using Form 4506-T is straightforward. First, download the form from the IRS website or obtain a physical copy. Fill in your personal information, including your name, Social Security number, and address. Specify the type of transcript you need, such as a tax return transcript or an account transcript. You will also need to indicate the tax years for which you are requesting transcripts. Once completed, you can submit the form via mail or fax, depending on your preference and the instructions provided on the form.

Steps to Complete the Form 4506-T Request for Transcript of Tax Return

Completing Form 4506-T involves several key steps:

- Download the form from the IRS website or obtain a physical copy.

- Provide your name, Social Security number, and address in the designated fields.

- Select the type of transcript you wish to receive.

- Specify the tax years for which you are requesting transcripts.

- Sign and date the form to certify the information is accurate.

- Submit the form via mail or fax to the appropriate IRS address or number listed on the form.

Legal Use of the Form 4506-T Request for Transcript of Tax Return

The Form 4506-T serves a legal purpose, allowing individuals and businesses to obtain necessary documentation for various financial transactions. This form is often required by lenders when applying for loans, as it verifies income and tax filing status. Additionally, educational institutions may request transcripts for financial aid applications. It is crucial to ensure that the form is filled out accurately and submitted correctly to avoid delays in receiving your transcripts.

IRS Guidelines for Using Form 4506-T

The IRS provides specific guidelines for using Form 4506-T. It is important to follow these guidelines to ensure your request is processed efficiently. The form must be signed by the taxpayer, and if you are requesting a transcript on behalf of someone else, you must have the appropriate authorization. The IRS typically processes requests within five to ten business days, but this can vary based on the volume of requests. Always check the IRS website for the most current guidelines and processing times.

Form Submission Methods

Form 4506-T can be submitted in several ways, depending on your preference. You can mail the completed form to the address specified for your state on the IRS instructions. Alternatively, you can fax the form to the IRS if you prefer a quicker response. Ensure that you have the correct fax number for your state, as this can vary. For those who prefer digital options, some tax software programs may allow you to submit the request electronically, streamlining the process.

Handy tips for filling out Form 4506 T Rev 9 Request For Transcript Of Tax Return online

Quick steps to complete and e-sign Form 4506 T Rev 9 Request For Transcript Of Tax Return online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Gain access to a GDPR and HIPAA compliant service for optimum efficiency. Use signNow to electronically sign and send out Form 4506 T Rev 9 Request For Transcript Of Tax Return for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4506 t rev 9 request for transcript of tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IRS transcript and why do I need it?

An IRS transcript is a summary of your tax return information provided by the Internal Revenue Service. You may need an IRS transcript for various reasons, including applying for loans, verifying income, or resolving tax issues. Understanding how to obtain and use your IRS transcript can simplify these processes.

-

How can airSlate SignNow help me with my IRS transcript?

airSlate SignNow allows you to easily send and eSign documents related to your IRS transcript. With our user-friendly platform, you can securely manage your tax documents and ensure that they are signed and submitted on time. This streamlines the process of handling your IRS transcript and other important paperwork.

-

Is there a cost associated with obtaining an IRS transcript through airSlate SignNow?

While obtaining an IRS transcript from the IRS is free, using airSlate SignNow to manage and eSign your documents may involve a subscription fee. Our pricing plans are designed to be cost-effective, providing you with a valuable solution for handling your IRS transcript and other documents efficiently.

-

What features does airSlate SignNow offer for managing IRS transcripts?

airSlate SignNow offers features such as document templates, secure eSigning, and real-time tracking for your IRS transcript and other documents. These tools enhance your workflow, making it easier to manage your tax-related paperwork. Additionally, our platform ensures compliance with legal standards for electronic signatures.

-

Can I integrate airSlate SignNow with other applications for IRS transcript management?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing you to manage your IRS transcript alongside other business tools. This integration helps streamline your workflow and ensures that all your documents are easily accessible. You can connect with popular platforms like Google Drive, Dropbox, and more.

-

What are the benefits of using airSlate SignNow for IRS transcript-related documents?

Using airSlate SignNow for your IRS transcript-related documents offers numerous benefits, including enhanced security, ease of use, and time savings. Our platform simplifies the process of sending and signing documents, ensuring that you can focus on what matters most. Additionally, our customer support is available to assist you with any questions.

-

How secure is my information when using airSlate SignNow for IRS transcripts?

Security is a top priority at airSlate SignNow. We use advanced encryption and security protocols to protect your information, including your IRS transcript. You can trust that your sensitive data is safe while using our platform to manage your documents.

Get more for Form 4506 T Rev 9 Request For Transcript Of Tax Return

Find out other Form 4506 T Rev 9 Request For Transcript Of Tax Return

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer