Sales Tax Exemption Certificate for Health Care Providers Form

What is the Sales Tax Exemption Certificate For Health Care Providers

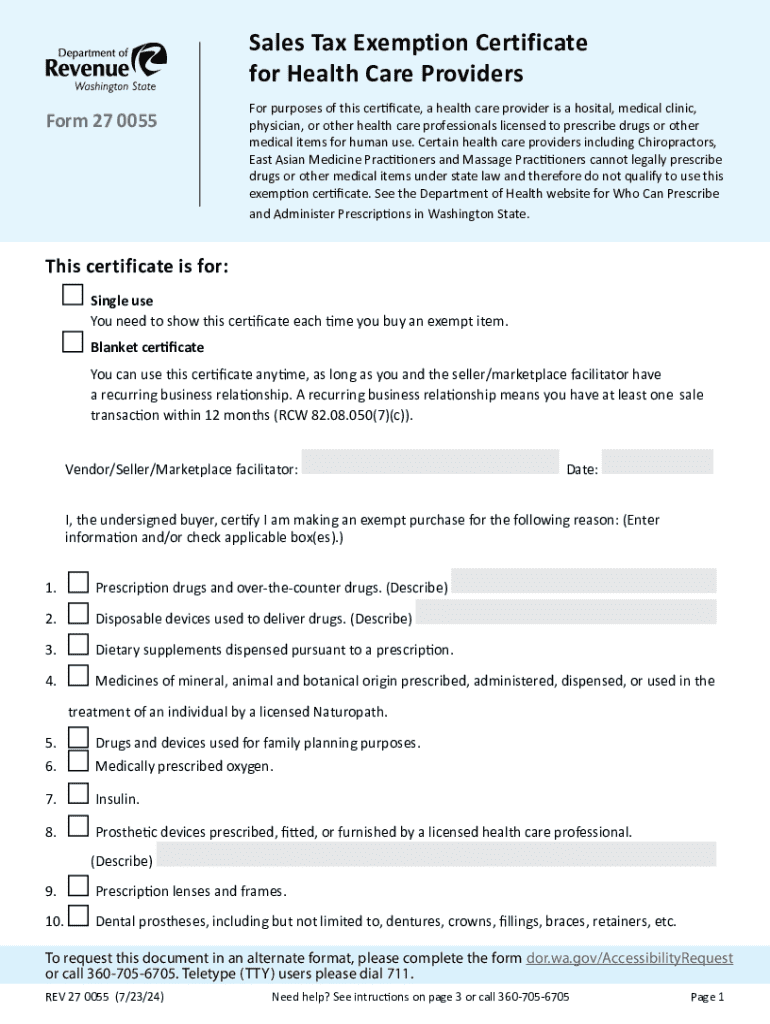

The Sales Tax Exemption Certificate for Health Care Providers serves as a crucial document that allows eligible health care entities to purchase goods and services without incurring sales tax. This certificate is specifically designed for health care providers, including hospitals, clinics, and individual practitioners, who use the purchased items directly in their medical services. By utilizing this certificate, health care providers can reduce operational costs, ultimately benefiting their patients and the broader health care system.

How to Use the Sales Tax Exemption Certificate For Health Care Providers

To use the Sales Tax Exemption Certificate, health care providers must present the certificate to vendors at the time of purchase. It is essential to ensure that the goods or services acquired are directly related to health care services. Vendors are required to retain a copy of the certificate for their records, confirming that the transaction is exempt from sales tax. This process helps maintain compliance with state tax regulations while allowing providers to manage their finances effectively.

Steps to Complete the Sales Tax Exemption Certificate For Health Care Providers

Completing the Sales Tax Exemption Certificate involves several straightforward steps:

- Obtain the appropriate form from your state’s tax authority or relevant agency.

- Fill in the required information, including the name and address of the health care provider, as well as the type of services offered.

- Provide the vendor's information, ensuring it matches the entity from which you are purchasing.

- Sign and date the certificate, affirming that the information provided is accurate and that the purchases are for exempt purposes.

Eligibility Criteria

Eligibility for the Sales Tax Exemption Certificate typically includes health care providers who are registered and licensed to operate in their respective states. This may encompass hospitals, nursing homes, outpatient care centers, and individual practitioners. Each state may have specific criteria regarding the types of services and goods eligible for exemption, so it is important to review local regulations to ensure compliance.

Legal Use of the Sales Tax Exemption Certificate For Health Care Providers

The legal use of the Sales Tax Exemption Certificate is governed by state tax laws. Health care providers must ensure that the certificate is used solely for purchases that are directly related to their medical services. Misuse of the certificate, such as using it for personal or non-medical purchases, can result in penalties, including fines or loss of exemption privileges. Providers should maintain accurate records of all transactions made under the exemption to support compliance during audits.

State-Specific Rules for the Sales Tax Exemption Certificate For Health Care Providers

Each state in the U.S. has unique rules and regulations regarding the Sales Tax Exemption Certificate for Health Care Providers. Some states may require additional documentation or have specific forms that must be completed. It is crucial for providers to familiarize themselves with their state's requirements to ensure they are compliant and to avoid any potential issues. Consulting with a tax professional or legal advisor can provide valuable guidance tailored to individual circumstances.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales tax exemption certificate for health care providers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Sales Tax Exemption Certificate For Health Care Providers?

A Sales Tax Exemption Certificate For Health Care Providers is a document that allows eligible health care organizations to purchase goods and services without paying sales tax. This certificate is essential for managing costs and ensuring compliance with tax regulations. By utilizing this certificate, health care providers can focus more on patient care rather than tax liabilities.

-

How can airSlate SignNow help with the Sales Tax Exemption Certificate For Health Care Providers?

airSlate SignNow simplifies the process of obtaining and managing the Sales Tax Exemption Certificate For Health Care Providers. Our platform allows you to easily create, send, and eSign the necessary documents, ensuring a smooth workflow. This efficiency helps health care providers save time and reduce administrative burdens.

-

What are the benefits of using airSlate SignNow for managing Sales Tax Exemption Certificates?

Using airSlate SignNow for managing Sales Tax Exemption Certificates offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our user-friendly interface allows health care providers to quickly access and manage their certificates. Additionally, the secure eSigning feature ensures that all documents are legally binding and easily retrievable.

-

Is there a cost associated with using airSlate SignNow for Sales Tax Exemption Certificates?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for health care providers. Our pricing plans are flexible and cater to various organizational needs, ensuring that you only pay for what you use. Investing in our solution can lead to signNow savings in time and resources when managing Sales Tax Exemption Certificates.

-

Can airSlate SignNow integrate with other software for managing Sales Tax Exemption Certificates?

Absolutely! airSlate SignNow offers seamless integrations with various software applications that health care providers may already be using. This capability allows for a streamlined process when managing Sales Tax Exemption Certificates, ensuring that all your systems work together efficiently. Integrations help maintain accurate records and improve overall productivity.

-

How secure is the information related to Sales Tax Exemption Certificates on airSlate SignNow?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect all information related to Sales Tax Exemption Certificates. Our platform is designed to ensure that sensitive data remains confidential and secure, giving health care providers peace of mind when managing their documents.

-

What features does airSlate SignNow offer for handling Sales Tax Exemption Certificates?

airSlate SignNow offers a variety of features tailored for handling Sales Tax Exemption Certificates, including customizable templates, automated workflows, and real-time tracking. These features enhance the efficiency of document management and ensure that health care providers can easily navigate the process. Our platform is designed to simplify the complexities associated with tax exemption documentation.

Get more for Sales Tax Exemption Certificate For Health Care Providers

Find out other Sales Tax Exemption Certificate For Health Care Providers

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed