Efile Rhode Island State Tax Returns Form

Understanding the Efile Rhode Island State Tax Returns

The Efile Rhode Island State Tax Returns is a digital method for submitting state tax forms electronically. This process simplifies the filing of state taxes, allowing taxpayers to complete their returns from the comfort of their homes. By using e-filing, individuals can ensure quicker processing times and receive confirmation of their submissions almost immediately. This method is particularly beneficial for those who may find traditional paper filing cumbersome or time-consuming.

Steps to Complete the Efile Rhode Island State Tax Returns

Completing the Efile Rhode Island State Tax Returns involves several key steps:

- Gather necessary documents, including W-2 forms, 1099 forms, and any other relevant financial records.

- Choose an e-filing software that is compatible with Rhode Island state tax forms.

- Input your personal information, including your Social Security number, address, and filing status.

- Enter your income details and any deductions or credits you qualify for.

- Review your information for accuracy before submission.

- Submit your return electronically and save the confirmation for your records.

Required Documents for Efile Rhode Island State Tax Returns

To successfully e-file your Rhode Island state tax returns, you will need to gather specific documents:

- W-2 forms from your employer(s).

- 1099 forms for any freelance or contract work.

- Records of any other income, such as rental income or investment earnings.

- Documentation for deductions, such as mortgage interest statements or medical expenses.

- Any prior year tax returns, if applicable.

Filing Deadlines for Efile Rhode Island State Tax Returns

It is essential to be aware of the filing deadlines for Rhode Island state tax returns to avoid penalties. Typically, the deadline for filing individual income tax returns is April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extension options available, which may allow for additional time to file, but not to pay any taxes owed.

Legal Use of the Efile Rhode Island State Tax Returns

The Efile Rhode Island State Tax Returns is legally recognized by the state of Rhode Island as a valid method for submitting tax returns. Taxpayers must ensure that they are using approved e-filing software and that their submissions comply with all state regulations. This legal framework helps protect taxpayers and ensures that their information is processed securely and efficiently.

Who Issues the Form for Efile Rhode Island State Tax Returns

The Rhode Island Division of Taxation is responsible for issuing the forms used in the e-filing process. This division oversees the administration of state tax laws and provides resources for taxpayers, including guidelines on how to complete and submit their returns electronically. Understanding the role of the Division of Taxation can help taxpayers navigate the e-filing process with confidence.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the efile rhode island state tax returns

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

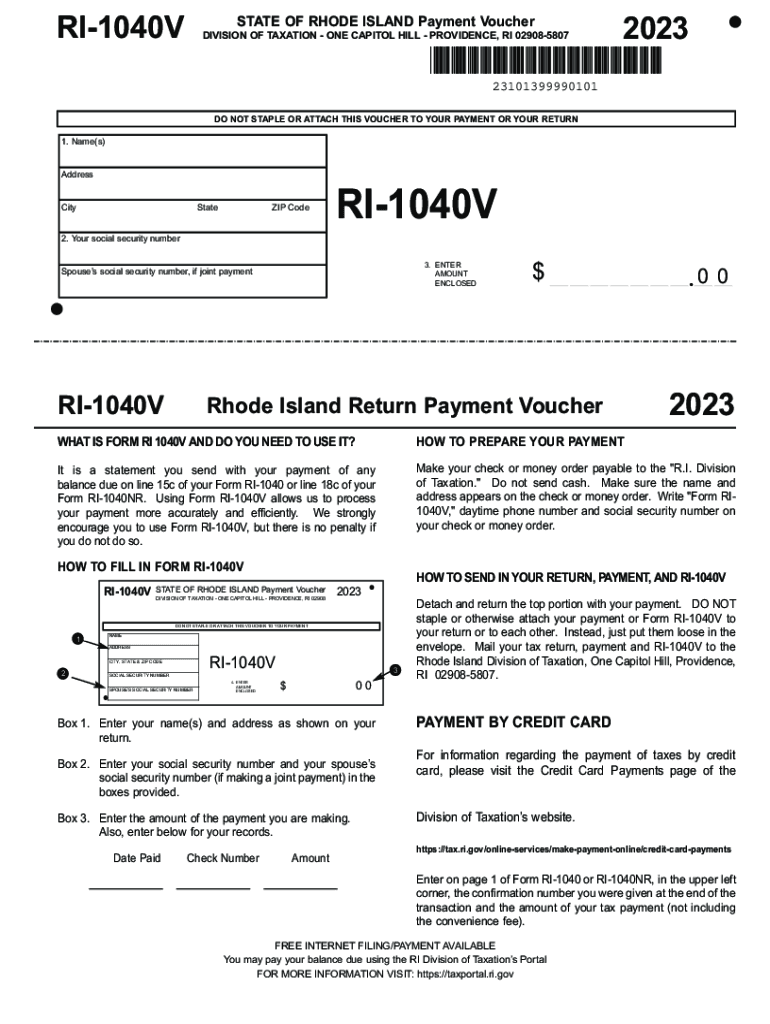

What is the RI 1040 V form and why is it important?

The RI 1040 V form is a payment voucher used for Rhode Island personal income tax returns. It is important because it ensures that your tax payments are properly credited to your account, helping you avoid penalties and interest on unpaid taxes.

-

How can airSlate SignNow help with the RI 1040 V form?

airSlate SignNow simplifies the process of signing and sending the RI 1040 V form electronically. With our platform, you can easily eSign the form and send it directly to the Rhode Island Division of Taxation, saving you time and ensuring compliance.

-

What are the pricing options for using airSlate SignNow for RI 1040 V?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you are a small business or a large enterprise, you can find a plan that fits your budget while allowing you to manage documents like the RI 1040 V efficiently.

-

Are there any features specifically designed for tax forms like the RI 1040 V?

Yes, airSlate SignNow includes features tailored for tax forms, including templates for the RI 1040 V. These templates streamline the process, allowing you to fill out, sign, and send your tax documents quickly and securely.

-

Can I integrate airSlate SignNow with other accounting software for RI 1040 V?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easy to manage your RI 1040 V form alongside your financial records. This integration enhances efficiency and reduces the risk of errors in your tax submissions.

-

What are the benefits of using airSlate SignNow for the RI 1040 V form?

Using airSlate SignNow for the RI 1040 V form offers numerous benefits, including faster processing times, enhanced security, and reduced paper usage. Our platform ensures that your documents are signed and sent securely, giving you peace of mind during tax season.

-

Is airSlate SignNow compliant with Rhode Island tax regulations for the RI 1040 V?

Yes, airSlate SignNow is fully compliant with Rhode Island tax regulations, including those pertaining to the RI 1040 V form. Our platform adheres to the highest security standards, ensuring that your tax documents are handled in accordance with state laws.

Get more for Efile Rhode Island State Tax Returns

- Parkland referral form

- Diagnostic assessment template form

- Blue badge renewal application form

- Draw flowchart that reads in three numbers and writes them all in sorted order form

- Scorad pdf form

- Moves in the field judging form usfsa

- The university of akron internal departmental tran form

- Application for permit driver license ny dmv form

Find out other Efile Rhode Island State Tax Returns

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form