Form 1099 B Proceeds from Broker and Barter Exchange Transactions

What is the Form 1099 B Proceeds From Broker And Barter Exchange Transactions

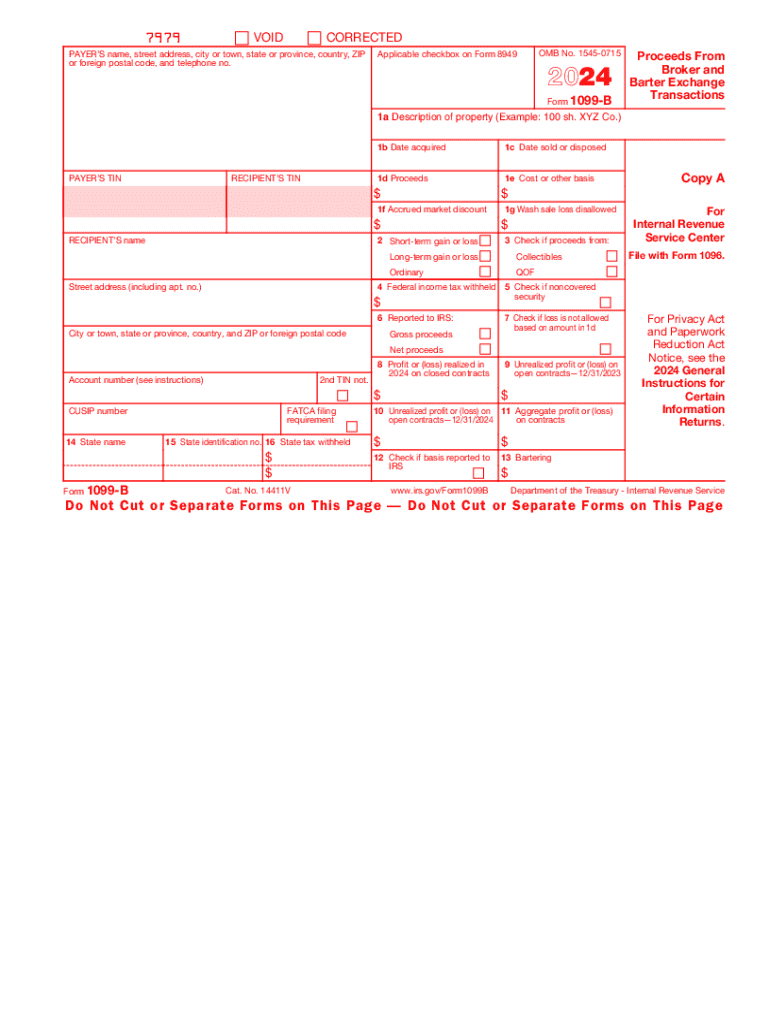

The Form 1099 B is a crucial document for reporting proceeds from broker and barter exchange transactions. This form is issued by brokers or barter exchanges to report gains or losses from transactions involving stocks, bonds, commodities, and other securities. It provides detailed information about the sale of securities, including the date of the transaction, the amount realized, and any applicable costs or adjustments. Understanding this form is essential for taxpayers who need to accurately report their income and comply with IRS regulations.

Key elements of the Form 1099 B Proceeds From Broker And Barter Exchange Transactions

The Form 1099 B includes several key elements that are important for taxpayers. These elements typically consist of:

- Transaction Date: The date when the transaction occurred.

- Proceeds: The total amount received from the sale of securities.

- Cost Basis: The original value of the asset sold, which is used to calculate gains or losses.

- Type of Gain or Loss: Whether the gain or loss is short-term or long-term, impacting tax rates.

- Adjustment Codes: Any necessary adjustments that may affect the reported amounts.

These elements help ensure accurate reporting on tax returns and provide clarity on the taxpayer's financial activities throughout the year.

Steps to complete the Form 1099 B Proceeds From Broker And Barter Exchange Transactions

Completing the Form 1099 B involves several steps to ensure accurate reporting. Here are the essential steps:

- Gather all relevant transaction data from your broker or barter exchange.

- Identify the transaction dates and amounts for each sale or exchange.

- Calculate the cost basis for each security sold to determine gains or losses.

- Fill out the form with the gathered information, ensuring accuracy in all fields.

- Review the completed form for any errors before submission.

Following these steps can help minimize mistakes and ensure compliance with IRS requirements.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of Form 1099 B. Taxpayers should be aware of the following:

- The form must be filed by the broker or barter exchange by the deadline set by the IRS.

- Taxpayers should receive a copy of the form by January 31 of the following tax year.

- Accurate reporting is essential to avoid penalties for incorrect information.

- Taxpayers must report the information from Form 1099 B on their tax returns, particularly on Schedule D for capital gains and losses.

Staying informed about these guidelines can help ensure compliance and avoid potential issues with the IRS.

Who Issues the Form 1099 B Proceeds From Broker And Barter Exchange Transactions

The Form 1099 B is typically issued by brokers, which may include financial institutions, investment firms, or other entities that facilitate the buying and selling of securities. Barter exchanges also issue this form for transactions involving the exchange of goods or services. It is important for taxpayers to understand who is responsible for issuing the form, as this entity is required to provide accurate information regarding the transactions conducted during the tax year.

Penalties for Non-Compliance

Failure to comply with the reporting requirements associated with Form 1099 B can result in significant penalties. The IRS may impose fines for late filing, incorrect information, or failure to provide the form altogether. Penalties can vary based on the severity of the non-compliance, including:

- Late Filing Penalties: Fees for failing to file the form by the deadline.

- Incorrect Information Penalties: Fines for providing inaccurate data on the form.

- Failure to Provide: Penalties for not issuing the form to the taxpayer.

Understanding these penalties can encourage timely and accurate reporting, reducing the risk of financial repercussions.

Handy tips for filling out Form 1099 B Proceeds From Broker And Barter Exchange Transactions online

Quick steps to complete and e-sign Form 1099 B Proceeds From Broker And Barter Exchange Transactions online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Gain access to a GDPR and HIPAA compliant platform for maximum straightforwardness. Use signNow to e-sign and send out Form 1099 B Proceeds From Broker And Barter Exchange Transactions for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1099 b proceeds from broker and barter exchange transactions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 1099 B explained?

Form 1099 B is a tax form used to report proceeds from broker and barter exchange transactions. It provides essential information about the sale of securities, including stocks and bonds, which is crucial for tax reporting. Understanding form 1099 B explained helps taxpayers accurately report their capital gains and losses.

-

How does airSlate SignNow help with form 1099 B?

airSlate SignNow simplifies the process of sending and signing documents related to form 1099 B. With our platform, you can easily create, send, and eSign tax documents securely and efficiently. This ensures that your form 1099 B is handled promptly and accurately.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like form 1099 B. These features streamline the workflow, making it easier to prepare and send necessary forms. Understanding these features can enhance your document management process.

-

Is airSlate SignNow cost-effective for small businesses handling form 1099 B?

Yes, airSlate SignNow is a cost-effective solution for small businesses needing to manage form 1099 B. Our pricing plans are designed to accommodate various business sizes, ensuring that you get the best value for your document management needs. This affordability allows small businesses to efficiently handle their tax documentation without breaking the bank.

-

Can I integrate airSlate SignNow with other accounting software for form 1099 B?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage form 1099 B alongside your financial records. This integration helps streamline your workflow, ensuring that all necessary tax documents are readily accessible and organized. Understanding these integrations can enhance your overall efficiency.

-

What are the benefits of using airSlate SignNow for form 1099 B?

Using airSlate SignNow for form 1099 B offers numerous benefits, including increased efficiency, enhanced security, and improved compliance. Our platform allows for quick document turnaround and reduces the risk of errors in tax reporting. By leveraging these benefits, businesses can focus more on their core operations.

-

How secure is airSlate SignNow when handling sensitive tax documents like form 1099 B?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax documents like form 1099 B. Our platform ensures that your data is secure during transmission and storage, giving you peace of mind. Understanding our security protocols is crucial for businesses handling sensitive information.

Get more for Form 1099 B Proceeds From Broker And Barter Exchange Transactions

- Trinity muscatine hospital form

- Notice of application filed seeking release or other relief form

- Parentage and child support branchdistrict of columbia form

- Official transcript new logo form

- Form 11 30 day notice to vacate for illegal act performed

- Instructions for florida supreme court approved fa form

- City of york accommodations tax reporting form tax

- R1029i 722sales tax return general instructions form

Find out other Form 1099 B Proceeds From Broker And Barter Exchange Transactions

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure