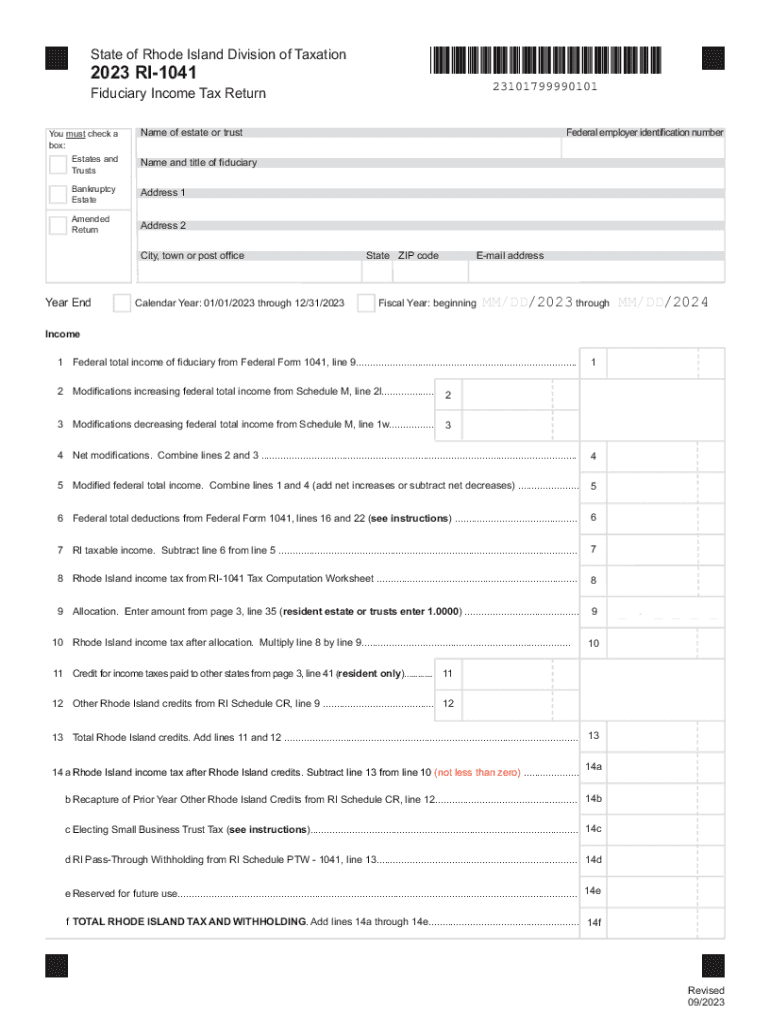

RI 1041 Fiduciary Income Tax Return Form

What is the RI 1041 Fiduciary Income Tax Return

The RI 1041 is the fiduciary income tax return form used in Rhode Island. It is specifically designed for estates and trusts to report their income, deductions, and tax liabilities. This form allows fiduciaries to calculate the taxes owed on income generated by the estate or trust assets. Completing the RI 1041 is essential for compliance with state tax regulations, ensuring that the fiduciary fulfills their legal obligations while managing the financial affairs of the estate or trust.

Steps to complete the RI 1041 Fiduciary Income Tax Return

Completing the RI 1041 involves several key steps:

- Gather necessary documentation, including income statements, expense records, and prior year tax returns.

- Fill out the form accurately, ensuring all income and deductions are reported correctly.

- Calculate the total income, allowable deductions, and the resulting taxable income.

- Determine the tax owed based on the applicable Rhode Island tax rates.

- Review the completed form for accuracy before submission.

Legal use of the RI 1041 Fiduciary Income Tax Return

The RI 1041 serves a critical legal function by ensuring that fiduciaries report and pay taxes on income generated by estates and trusts. It is a legal requirement for any fiduciary managing an estate or trust in Rhode Island. Failure to file this return can result in penalties and interest on unpaid taxes. Therefore, understanding its legal implications is crucial for fiduciaries to maintain compliance with state tax laws.

Required Documents

When preparing the RI 1041, several documents are necessary to ensure accurate reporting:

- Income statements from all sources, including dividends, interest, and rental income.

- Records of any deductions, such as administrative expenses, legal fees, and charitable contributions.

- Prior year tax returns for reference and to ensure consistency in reporting.

- Any supporting documentation for claims made on the return.

Filing Deadlines / Important Dates

Timely filing of the RI 1041 is essential to avoid penalties. The filing deadline for the RI 1041 typically aligns with the federal tax return due date, which is usually April fifteenth. However, if the fiduciary is filing for an estate or trust that has a different fiscal year, the deadline may vary. It is important to check for specific dates each tax year to ensure compliance.

Examples of using the RI 1041 Fiduciary Income Tax Return

There are various scenarios in which the RI 1041 is applicable:

- When an estate generates income from investments or property after the owner's death.

- When a trust earns income from its assets, such as dividends or interest.

- In cases where the fiduciary must distribute income to beneficiaries, necessitating the reporting of income and deductions.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ri 1041 fiduciary income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ri 1041 form and how does airSlate SignNow help with it?

The ri 1041 form is used for reporting income for estates and trusts in Rhode Island. airSlate SignNow simplifies the process by allowing users to easily eSign and send the ri 1041 form securely, ensuring compliance and efficiency in document handling.

-

How much does airSlate SignNow cost for handling the ri 1041?

airSlate SignNow offers competitive pricing plans that cater to various business needs. Whether you are a small business or a large enterprise, you can find a plan that fits your budget while efficiently managing documents like the ri 1041.

-

What features does airSlate SignNow offer for the ri 1041 form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for forms like the ri 1041. These features enhance the user experience and streamline the document management process.

-

Can I integrate airSlate SignNow with other software for managing the ri 1041?

Yes, airSlate SignNow integrates seamlessly with various software applications, allowing you to manage the ri 1041 form alongside your existing tools. This integration helps improve workflow efficiency and reduces the time spent on document processing.

-

What are the benefits of using airSlate SignNow for the ri 1041?

Using airSlate SignNow for the ri 1041 offers numerous benefits, including faster turnaround times, enhanced security, and reduced paper usage. These advantages not only save time but also contribute to a more sustainable business practice.

-

Is airSlate SignNow user-friendly for completing the ri 1041?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the ri 1041 form. The intuitive interface ensures that users can navigate the platform without any technical expertise.

-

How does airSlate SignNow ensure the security of the ri 1041 documents?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your ri 1041 documents. This commitment to security ensures that sensitive information remains confidential and secure.

Get more for RI 1041 Fiduciary Income Tax Return

Find out other RI 1041 Fiduciary Income Tax Return

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation