IRS Form 1040 Schedule 2 Additional Tax Reporting for

What is the IRS Form 1040 Schedule 2 Additional Tax Reporting For

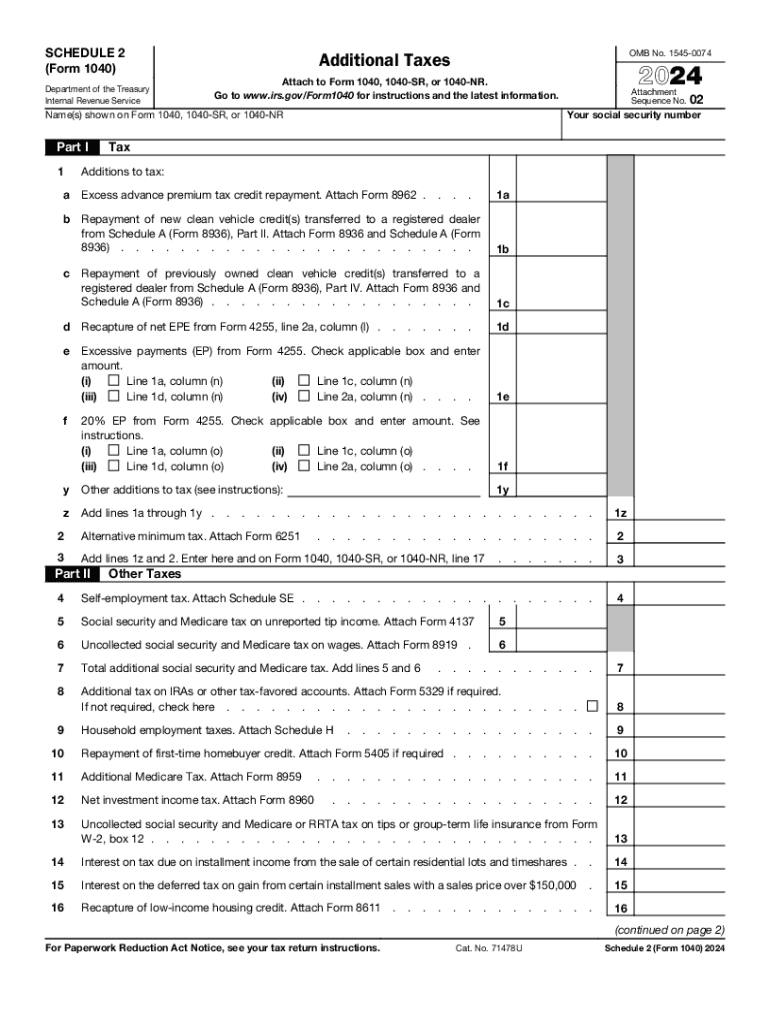

The IRS Form 1040 Schedule 2 is used to report additional taxes that are not included on the main Form 1040. This form is essential for taxpayers who have specific tax liabilities, such as self-employment tax, alternative minimum tax, or additional taxes on qualified plans. By accurately completing Schedule 2, taxpayers ensure compliance with IRS regulations and avoid potential penalties.

How to use the IRS Form 1040 Schedule 2 Additional Tax Reporting For

To utilize the IRS Form 1040 Schedule 2, taxpayers must first determine if they have any additional taxes to report. This involves reviewing their financial situation, including self-employment income, distributions from retirement accounts, or any other applicable tax scenarios. Once identified, taxpayers can fill out Schedule 2 and attach it to their Form 1040 when filing their taxes.

Steps to complete the IRS Form 1040 Schedule 2 Additional Tax Reporting For

Completing the IRS Form 1040 Schedule 2 involves several key steps:

- Gather necessary financial documents, including income statements and records of any additional taxes owed.

- Identify any applicable additional taxes, such as self-employment tax or alternative minimum tax.

- Fill out the relevant sections of Schedule 2, ensuring all figures are accurate and complete.

- Double-check calculations and ensure that all required information is included.

- Attach Schedule 2 to your completed Form 1040 before submission.

Key elements of the IRS Form 1040 Schedule 2 Additional Tax Reporting For

The key elements of the IRS Form 1040 Schedule 2 include sections for reporting various additional taxes. These typically encompass:

- Self-employment tax, which applies to individuals earning income from self-employment.

- Alternative minimum tax, which ensures that taxpayers pay at least a minimum amount of tax.

- Additional taxes on IRAs or other qualified retirement plans if early distributions were taken.

- Other specific taxes as mandated by IRS regulations.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the IRS Form 1040 Schedule 2. Generally, the deadline for filing individual tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is crucial for taxpayers to file their returns, including Schedule 2, by the due date to avoid penalties and interest on any taxes owed.

Penalties for Non-Compliance

Failure to accurately report additional taxes using the IRS Form 1040 Schedule 2 can result in significant penalties. The IRS may impose fines for underreporting income or failing to pay the correct amount of tax owed. Additionally, interest may accrue on any unpaid taxes, further increasing the total amount due. It is essential for taxpayers to ensure that all information on Schedule 2 is complete and accurate to avoid these consequences.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 1040 schedule 2 additional tax reporting for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Schedule 2 and how does it relate to airSlate SignNow?

IRS Schedule 2 is a form used to report additional taxes owed, such as self-employment tax or alternative minimum tax. With airSlate SignNow, you can easily eSign and send your IRS Schedule 2 documents securely, ensuring compliance and accuracy in your tax filings.

-

How can airSlate SignNow help me with my IRS Schedule 2 submissions?

airSlate SignNow streamlines the process of preparing and submitting your IRS Schedule 2 by allowing you to fill out, eSign, and send your documents electronically. This not only saves time but also reduces the risk of errors, making your tax submission process more efficient.

-

Is there a cost associated with using airSlate SignNow for IRS Schedule 2?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. The cost is competitive and provides great value, especially considering the ease of use and the ability to manage IRS Schedule 2 documents seamlessly.

-

What features does airSlate SignNow offer for managing IRS Schedule 2 documents?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, which are essential for managing IRS Schedule 2 documents. These features ensure that your tax documents are handled efficiently and securely.

-

Can I integrate airSlate SignNow with other software for IRS Schedule 2 management?

Absolutely! airSlate SignNow integrates with various software applications, allowing you to manage your IRS Schedule 2 documents alongside your existing tools. This integration enhances your workflow and ensures that all your tax-related documents are in one place.

-

What are the benefits of using airSlate SignNow for IRS Schedule 2 eSigning?

Using airSlate SignNow for IRS Schedule 2 eSigning offers numerous benefits, including faster turnaround times, enhanced security, and reduced paper usage. This not only helps you stay organized but also contributes to a more sustainable business practice.

-

Is airSlate SignNow user-friendly for filing IRS Schedule 2?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to file their IRS Schedule 2. The intuitive interface guides you through the process, ensuring that you can complete your tax documents without any hassle.

Get more for IRS Form 1040 Schedule 2 Additional Tax Reporting For

- Soccer lineup sheet form

- Soapst form

- Date of birth certificate download pdf form

- Air powered car seminar report form

- Eft mandate duly certified by bank form

- Failure to return this form to the alabama law enforcement agency will result in the cancellation of

- Eu pet certificate form

- Republique et canton de geneve dpartement de la sc 778819966 form

Find out other IRS Form 1040 Schedule 2 Additional Tax Reporting For

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile