Kansas 1099 State Reporting RulesE File KS 1099 Forms

Understanding the Kansas 1099 State Reporting Rules

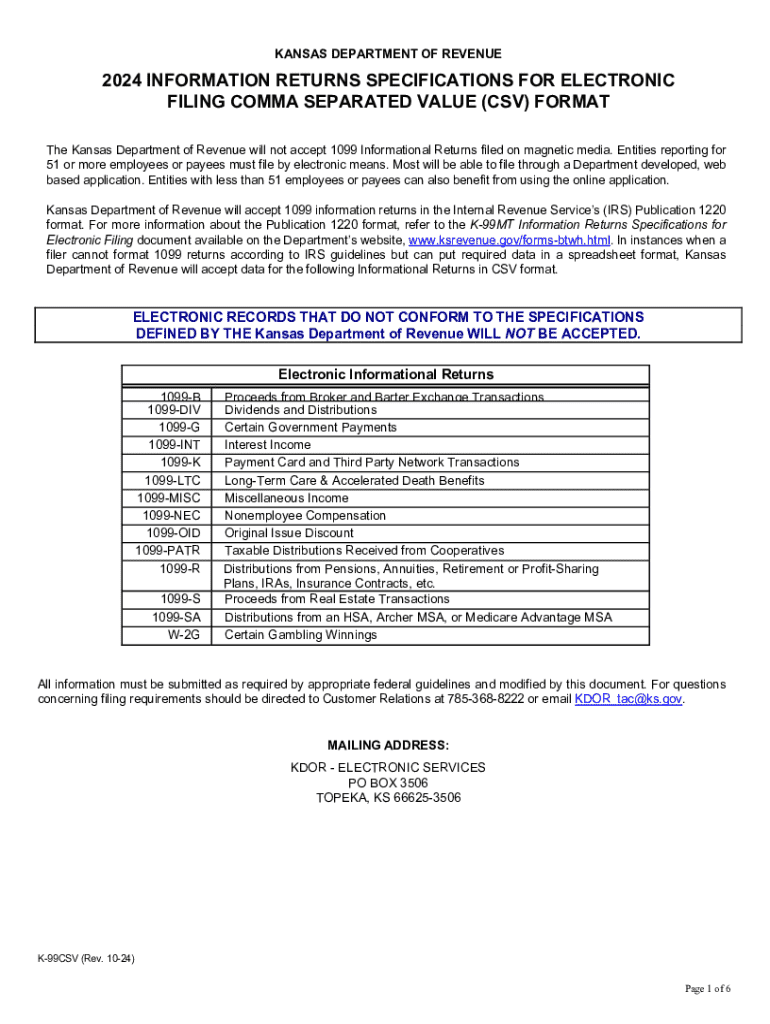

The Kansas 1099 State Reporting Rules outline the requirements for reporting income paid to independent contractors and other non-employees in Kansas. These rules are essential for ensuring compliance with state tax regulations. The Kansas Department of Revenue mandates the filing of 1099 forms for various types of payments, including but not limited to rents, royalties, and services. Businesses must accurately report these payments to avoid penalties and ensure proper tax processing.

Steps to Complete the Kansas 1099 Forms

Completing the Kansas 1099 forms involves several key steps:

- Gather necessary information about the payee, including their name, address, and taxpayer identification number (TIN).

- Determine the type of payment made to the contractor or vendor, as this will dictate which 1099 form to use.

- Fill out the relevant sections of the form, ensuring accuracy in reporting amounts and payment types.

- Review the completed form for any errors before submission.

Filing Deadlines and Important Dates

Filing deadlines for the Kansas 1099 forms are crucial for compliance. Typically, the forms must be submitted to the Kansas Department of Revenue by January thirty-first of the year following the tax year in which payments were made. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is important for businesses to keep track of these dates to avoid late penalties.

Form Submission Methods

Businesses can submit the Kansas 1099 forms through various methods:

- Online: Filing electronically is encouraged and can be done through the Kansas Department of Revenue’s online portal.

- Mail: Paper forms can be mailed to the appropriate address provided by the Kansas Department of Revenue.

- In-Person: Businesses may also choose to deliver forms in person at designated state offices.

Penalties for Non-Compliance

Failure to comply with Kansas 1099 reporting requirements can result in significant penalties. These may include fines for late submissions, inaccuracies, or failure to file altogether. The penalties can vary based on the severity and frequency of the violations. To mitigate risks, businesses should maintain accurate records and ensure timely submissions of all required forms.

Key Elements of the Kansas 1099 Forms

When completing the Kansas 1099 forms, several key elements must be included:

- Payee Information: Accurate name, address, and TIN of the individual or business receiving payment.

- Payment Amount: Total amount paid during the tax year, categorized by type of payment.

- Filer Information: Name, address, and TIN of the business or individual making the payment.

- Form Type: Correct identification of the specific 1099 form being filed, such as 1099-MISC or 1099-NEC.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kansas 1099 state reporting rulese file ks 1099 forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Kansas 1099 State Reporting Rules?

The Kansas 1099 State Reporting Rules outline the requirements for reporting income paid to independent contractors and other non-employees in Kansas. Understanding these rules is essential for compliance and to avoid penalties. Utilizing airSlate SignNow can simplify the process of preparing and filing KS 1099 Forms.

-

How can I eFile KS 1099 Forms using airSlate SignNow?

To eFile KS 1099 Forms with airSlate SignNow, simply upload your completed forms and follow the prompts to submit them electronically. Our platform ensures that your filings meet the Kansas 1099 State Reporting Rules, making the process efficient and hassle-free. Plus, you can track the status of your submissions in real-time.

-

What features does airSlate SignNow offer for 1099 form management?

airSlate SignNow provides a range of features for 1099 form management, including document templates, electronic signatures, and secure storage. These features help streamline the process of preparing and filing KS 1099 Forms while ensuring compliance with Kansas 1099 State Reporting Rules. Our user-friendly interface makes it easy for businesses of all sizes.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses looking to manage their 1099 forms. With competitive pricing plans, you can access all the necessary tools to comply with Kansas 1099 State Reporting Rules without breaking the bank. This affordability allows you to focus on your business while we handle your document needs.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software, making it easy to manage your financial documents and eFile KS 1099 Forms. This integration ensures that your data is consistent and up-to-date, helping you stay compliant with Kansas 1099 State Reporting Rules effortlessly.

-

What are the benefits of using airSlate SignNow for 1099 filing?

Using airSlate SignNow for 1099 filing offers numerous benefits, including increased efficiency, reduced errors, and enhanced security. Our platform simplifies the process of preparing and eFiling KS 1099 Forms, ensuring compliance with Kansas 1099 State Reporting Rules. Additionally, you can save time and resources by automating your document workflows.

-

How does airSlate SignNow ensure the security of my documents?

airSlate SignNow prioritizes the security of your documents with advanced encryption and secure cloud storage. We comply with industry standards to protect your sensitive information while you prepare and eFile KS 1099 Forms. Trust our platform to keep your data safe as you navigate the Kansas 1099 State Reporting Rules.

Get more for Kansas 1099 State Reporting RulesE File KS 1099 Forms

Find out other Kansas 1099 State Reporting RulesE File KS 1099 Forms

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself