Oregon Income Tax Form or 40 N and 2024-2026

Understanding the Oregon Income Tax Form OR-40 N

The Oregon Income Tax Form OR-40 N is designed for non-residents who earn income in Oregon. This form is essential for reporting income and calculating the tax owed to the state. Non-residents must ensure they accurately report all income sourced from Oregon to comply with state tax laws. The form captures various types of income, including wages, dividends, and business income, ensuring that all taxable income is accounted for.

Steps to Complete the Oregon Income Tax Form OR-40 N

Completing the Oregon Income Tax Form OR-40 N involves several key steps:

- Gather all relevant financial documents, including W-2s and 1099s, that detail your income earned in Oregon.

- Fill out your personal information, including your name, address, and Social Security number.

- Report your total income earned in Oregon, ensuring you include all sources of income.

- Calculate your tax liability based on the income reported, applying any applicable deductions or credits.

- Review the completed form for accuracy before submission.

Required Documents for Filing the Oregon Income Tax Form OR-40 N

When filing the Oregon Income Tax Form OR-40 N, it is important to have the following documents ready:

- W-2 forms from all employers in Oregon.

- 1099 forms for any freelance or contract work completed in the state.

- Records of any other income received while working in Oregon.

- Documentation for any deductions or credits you plan to claim.

Filing Deadlines for the Oregon Income Tax Form OR-40 N

The filing deadline for the Oregon Income Tax Form OR-40 N typically aligns with the federal tax deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to file on time to avoid penalties and interest on any taxes owed.

Form Submission Methods for Oregon Income Tax Form OR-40 N

There are several methods for submitting the Oregon Income Tax Form OR-40 N:

- Online: Many taxpayers choose to file electronically through approved tax software.

- By Mail: You can print the completed form and send it to the appropriate address provided by the Oregon Department of Revenue.

- In-Person: Some taxpayers may opt to deliver their forms directly to local tax offices.

Penalties for Non-Compliance with Oregon Tax Regulations

Failure to comply with Oregon tax regulations can result in significant penalties. Taxpayers who do not file the Oregon Income Tax Form OR-40 N by the deadline may face late fees and interest on unpaid taxes. Additionally, the Oregon Department of Revenue may impose further penalties for underreporting income or failing to pay taxes owed. It is essential to understand these consequences to maintain compliance and avoid financial repercussions.

Create this form in 5 minutes or less

Find and fill out the correct oregon income tax form or 40 n and

Create this form in 5 minutes!

How to create an eSignature for the oregon income tax form or 40 n and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

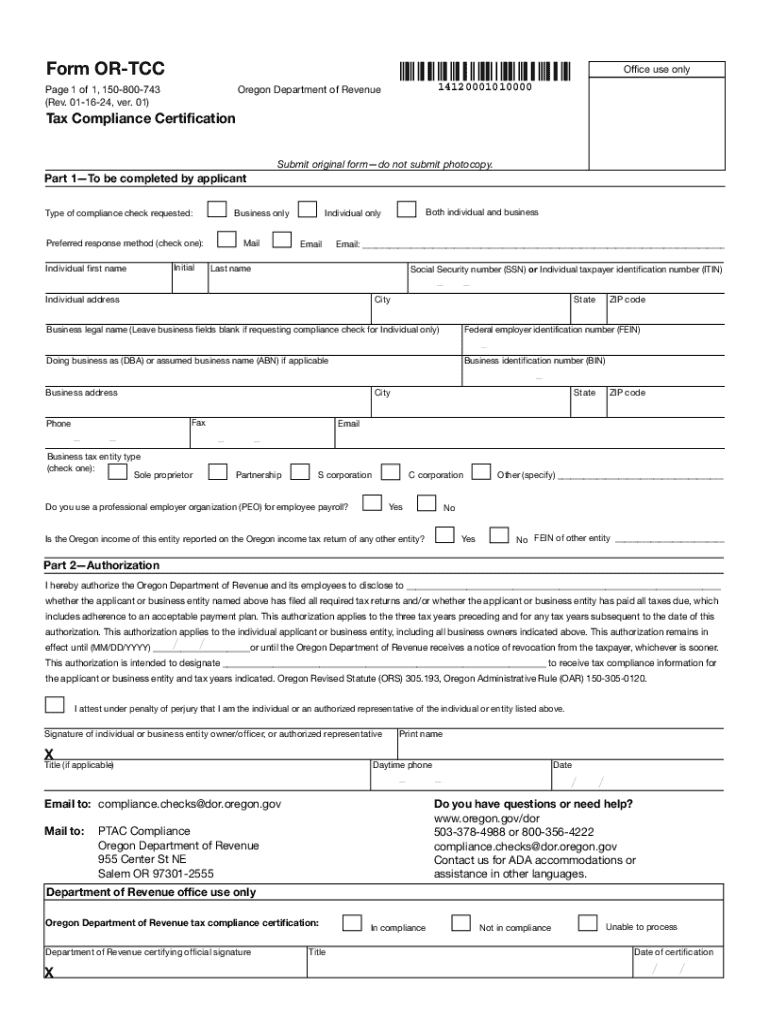

What is the Oregon Department of Revenue tax compliance certification?

The Oregon Department of Revenue tax compliance certification is a verification process that ensures businesses are compliant with state tax regulations. Obtaining this certification can help businesses demonstrate their commitment to adhering to tax laws, which is essential for maintaining good standing with the state.

-

How can airSlate SignNow assist with obtaining the Oregon Department of Revenue tax compliance certification?

airSlate SignNow streamlines the document signing process, making it easier for businesses to gather necessary signatures and submit required forms for the Oregon Department of Revenue tax compliance certification. Our platform ensures that all documents are securely signed and stored, simplifying compliance efforts.

-

What are the pricing options for airSlate SignNow when pursuing tax compliance certification?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our cost-effective solution allows you to choose a plan that fits your budget while providing the necessary tools to facilitate the Oregon Department of Revenue tax compliance certification process.

-

What features does airSlate SignNow offer to support tax compliance?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are essential for managing the Oregon Department of Revenue tax compliance certification process. These features help ensure that your documents are completed accurately and efficiently.

-

What are the benefits of using airSlate SignNow for tax compliance certification?

Using airSlate SignNow for the Oregon Department of Revenue tax compliance certification offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform helps businesses save time and resources while ensuring compliance with state tax regulations.

-

Can airSlate SignNow integrate with other software for tax compliance?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your ability to manage the Oregon Department of Revenue tax compliance certification process. These integrations allow for a more streamlined workflow, reducing the chances of errors and improving overall efficiency.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that all documents related to the Oregon Department of Revenue tax compliance certification are protected. Our platform uses advanced encryption and security protocols to safeguard sensitive information.

Get more for Oregon Income Tax Form OR 40 N And

Find out other Oregon Income Tax Form OR 40 N And

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document