Form 150 800 743 2004

What is the Form 150 800 743

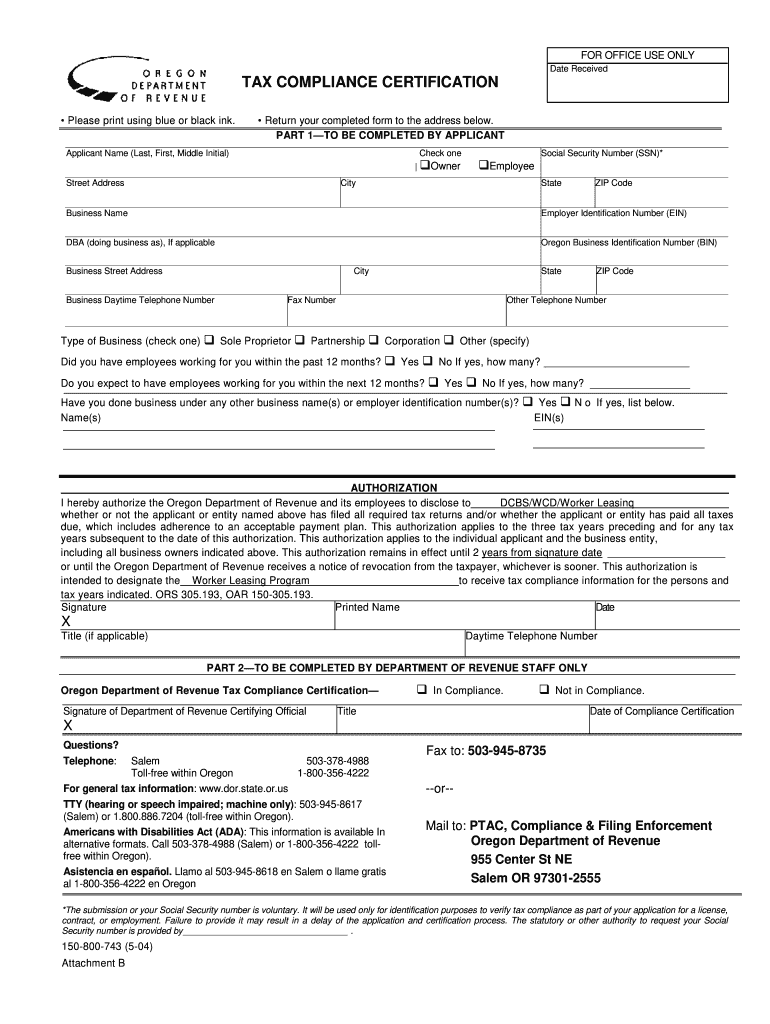

The Form 150 800 743, commonly referred to as the Oregon tax compliance certification form, is a document issued by the Oregon Department of Revenue. This form certifies that a business or individual is in compliance with state tax obligations. It is often required for various business transactions, such as applying for licenses, permits, or contracts with state agencies. Understanding the purpose and significance of this form is crucial for maintaining good standing with the state and avoiding potential penalties.

How to use the Form 150 800 743

To effectively use the Form 150 800 743, individuals or businesses must complete it accurately and submit it as required. This form serves as proof of tax compliance, so it is essential to ensure that all tax obligations are met before submission. Users should gather all necessary financial documents and tax records to verify compliance. The completed form can be presented to relevant authorities or organizations that require proof of tax compliance, facilitating smoother business operations.

Steps to complete the Form 150 800 743

Completing the Form 150 800 743 involves several key steps:

- Gather necessary documentation, including tax returns and payment records.

- Ensure all tax obligations are fulfilled to avoid discrepancies.

- Accurately fill out the form, providing all required information.

- Review the completed form for accuracy and completeness.

- Submit the form to the appropriate authority, either electronically or via mail.

Following these steps will help ensure that the tax compliance certification is processed without issues.

Legal use of the Form 150 800 743

The legal use of the Form 150 800 743 is grounded in its role as an official document certifying tax compliance. This certification is recognized by various state agencies and can be used in legal contexts, such as during audits or disputes regarding tax obligations. It is vital that the information provided on the form is truthful and accurate, as any misrepresentation can lead to legal consequences, including fines or penalties.

Required Documents

When completing the Form 150 800 743, certain documents are typically required to demonstrate tax compliance. These may include:

- Recent tax returns filed with the Oregon Department of Revenue.

- Payment records for any outstanding taxes.

- Documentation of any tax credits or deductions claimed.

- Proof of business registration or licensing, if applicable.

Having these documents ready will streamline the process of filling out the form and ensure that all necessary information is provided.

Form Submission Methods

The Form 150 800 743 can be submitted through various methods, depending on the preferences of the filer and the requirements of the receiving agency. Common submission methods include:

- Online submission through the Oregon Department of Revenue's website.

- Mailing the completed form to the designated address.

- In-person submission at local tax offices or designated agencies.

Choosing the appropriate submission method can help ensure timely processing of the tax compliance certification.

Quick guide on how to complete tax compliance certification oregon form

Complete Form 150 800 743 seamlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the features you need to create, modify, and eSign your documents promptly without delays. Manage Form 150 800 743 on any platform with airSlate SignNow Android or iOS applications and enhance any document-centered process today.

The easiest way to modify and eSign Form 150 800 743 effortlessly

- Locate Form 150 800 743 and click on Get Form to begin.

- Make use of the tools available to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Modify and eSign Form 150 800 743 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax compliance certification oregon form

Create this form in 5 minutes!

How to create an eSignature for the tax compliance certification oregon form

How to create an electronic signature for your Tax Compliance Certification Oregon Form in the online mode

How to make an eSignature for the Tax Compliance Certification Oregon Form in Google Chrome

How to generate an electronic signature for putting it on the Tax Compliance Certification Oregon Form in Gmail

How to generate an eSignature for the Tax Compliance Certification Oregon Form straight from your mobile device

How to generate an electronic signature for the Tax Compliance Certification Oregon Form on iOS devices

How to generate an eSignature for the Tax Compliance Certification Oregon Form on Android

People also ask

-

What is the Oregon Department of Revenue tax compliance certification?

The Oregon Department of Revenue tax compliance certification confirms that a business is compliant with state tax obligations. This certification is essential for businesses to ensure they meet all financial responsibilities and avoid penalties. Obtaining this certification can improve trust with clients and stakeholders.

-

How can airSlate SignNow help with obtaining the Oregon Department of Revenue tax compliance certification?

airSlate SignNow streamlines the document signing process, enabling businesses to quickly compile and send necessary paperwork for the Oregon Department of Revenue tax compliance certification. With its user-friendly interface, businesses can efficiently manage their tax documentation. This feature helps in reducing errors and accelerating compliance.

-

What are the benefits of having the Oregon Department of Revenue tax compliance certification?

Having the Oregon Department of Revenue tax compliance certification assures clients and partners that your business adheres to state tax laws. This certification can enhance your company's credibility and contribute to business growth. It also opens doors to additional opportunities when engaging with state contracts.

-

What is the pricing for airSlate SignNow services related to tax compliance?

airSlate SignNow offers flexible pricing plans tailored to fit various business sizes and needs. The service is designed to be cost-effective, ensuring you get great value, especially when dealing with critical documents like those for the Oregon Department of Revenue tax compliance certification. For specific pricing details, you can visit our pricing page.

-

Are there any integrations available with airSlate SignNow for tax compliance certification processes?

Yes, airSlate SignNow integrates seamlessly with popular software and platforms that assist in tax compliance certification processes. These integrations enhance workflow efficiency by allowing users to connect their existing tools directly with our eSignature solution for timely document management and signature collection. This makes obtaining the Oregon Department of Revenue tax compliance certification much simpler.

-

How does airSlate SignNow ensure document security when handling tax compliance certifications?

airSlate SignNow prioritizes document security with advanced encryption methods and secure cloud storage. This ensures that sensitive documents related to the Oregon Department of Revenue tax compliance certification remain protected against unauthorized access. Our platform also provides an audit trail for each transaction to maintain transparency.

-

Can airSlate SignNow assist in tracking the status of my certification process?

Absolutely! With airSlate SignNow's tracking features, you can easily monitor the status of documents related to the Oregon Department of Revenue tax compliance certification. This allows you to stay informed about where your paperwork stands in the approval process, ensuring no delays in compliance.

Get more for Form 150 800 743

- Delaware child protection request form

- Provider interest form umbh university of miami umbh med miami

- U miami transcript request form

- Mihalik group medical necessity form

- Take care communication in english nina ito pdf form

- Lifsonshapira scholarships application form

- Lifson scholarship application form university of minnesota policy umn

- School monitoring format

Find out other Form 150 800 743

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online

- How To Sign New York Notice to Stop Credit Charge

- How Do I Sign North Dakota Notice to Stop Credit Charge

- How To Sign Oklahoma Notice of Rescission

- How To Sign Maine Share Donation Agreement

- Sign Maine Share Donation Agreement Simple

- Sign New Jersey Share Donation Agreement Simple

- How To Sign Arkansas Collateral Debenture

- Sign Arizona Bill of Lading Simple

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure