Form or LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001 2023

What is the Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001

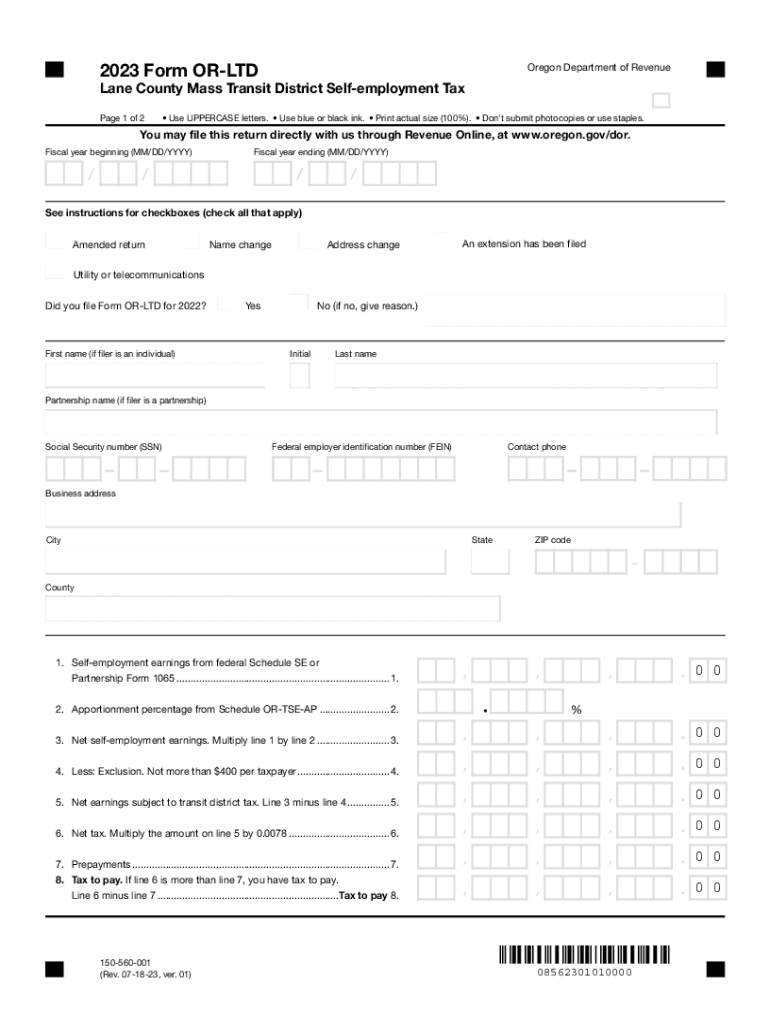

The Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001, is a tax form used by self-employed individuals in Lane County, Oregon. This form is specifically designed to assess the self-employment tax for those who earn income through self-employment within the jurisdiction of the Lane County Mass Transit District. It ensures that self-employed individuals contribute to local transit services, which are essential for community mobility and infrastructure.

How to use the Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001

To use the Form OR LTD, individuals must first determine their eligibility as self-employed persons within Lane County. After confirming eligibility, they should complete the form by providing accurate income details and any deductions applicable to their self-employment income. Once filled out, the form needs to be submitted to the appropriate local tax authority, ensuring compliance with local regulations.

Steps to complete the Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001

Completing the Form OR LTD involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Fill in personal identification information, including your name, address, and Social Security number.

- Report total self-employment income and any applicable deductions.

- Calculate the self-employment tax based on the provided income.

- Review the completed form for accuracy before submission.

Key elements of the Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001

Key elements of the Form OR LTD include the following:

- Personal identification details of the taxpayer.

- Total self-employment income reported for the tax year.

- Applicable deductions that can reduce taxable income.

- Calculation of the self-employment tax owed to the Lane County Mass Transit District.

Legal use of the Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001

The legal use of the Form OR LTD is mandated for self-employed individuals operating within Lane County. By filing this form, taxpayers fulfill their legal obligation to contribute to local transit funding. Failure to comply with this requirement may result in penalties or fines, emphasizing the importance of timely and accurate submission.

Filing Deadlines / Important Dates

Filing deadlines for the Form OR LTD typically align with the standard tax filing deadlines in the United States. It is crucial for self-employed individuals to submit their forms by the designated date to avoid late fees or penalties. Mark your calendar for the annual tax deadline, usually falling on April fifteenth, unless it falls on a weekend or holiday.

Create this form in 5 minutes or less

Find and fill out the correct form or ltd lane county mass transit district self employment tax 150 560 001

Create this form in 5 minutes!

How to create an eSignature for the form or ltd lane county mass transit district self employment tax 150 560 001

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001?

The Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001 is a tax form used by self-employed individuals in Lane County to report their income and calculate their self-employment tax obligations. This form ensures compliance with local tax regulations and helps in accurately determining the amount owed.

-

How can airSlate SignNow assist with the Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001?

airSlate SignNow provides a streamlined platform for completing and eSigning the Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001. Our solution simplifies the document management process, allowing users to fill out, sign, and send their tax forms securely and efficiently.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of individuals and businesses. Users can choose from various subscription options that provide access to features necessary for managing documents like the Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001, at a cost-effective rate.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like the Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001. These features enhance efficiency and ensure that all necessary steps are completed accurately.

-

Are there any integrations available with airSlate SignNow for tax preparation?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax preparation software, making it easier to manage documents like the Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001. These integrations help streamline workflows and ensure that all financial data is synchronized.

-

What are the benefits of using airSlate SignNow for self-employed individuals?

Using airSlate SignNow offers numerous benefits for self-employed individuals, including time savings, enhanced security, and improved organization. By utilizing our platform for the Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001, users can focus more on their business while ensuring compliance with tax regulations.

-

Is airSlate SignNow user-friendly for those unfamiliar with digital forms?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible for individuals who may not be familiar with digital forms. Our intuitive interface allows users to easily navigate and complete the Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001 without any hassle.

Get more for Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001

Find out other Form OR LTD, Lane County Mass Transit District Self Employment Tax, 150 560 001

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement