Oregon Department of Revenue Tax Lien 2021

What is the Oregon Department Of Revenue Tax Lien

The Oregon Department of Revenue Tax Lien is a legal claim against a taxpayer's property due to unpaid state taxes. This lien serves as a public record that indicates the state has a right to the taxpayer's assets until the owed taxes are paid. Tax liens can affect credit ratings and may hinder the ability to sell or refinance property. Understanding the implications of a tax lien is crucial for taxpayers to manage their financial responsibilities effectively.

Steps to complete the Oregon Department Of Revenue Tax Lien

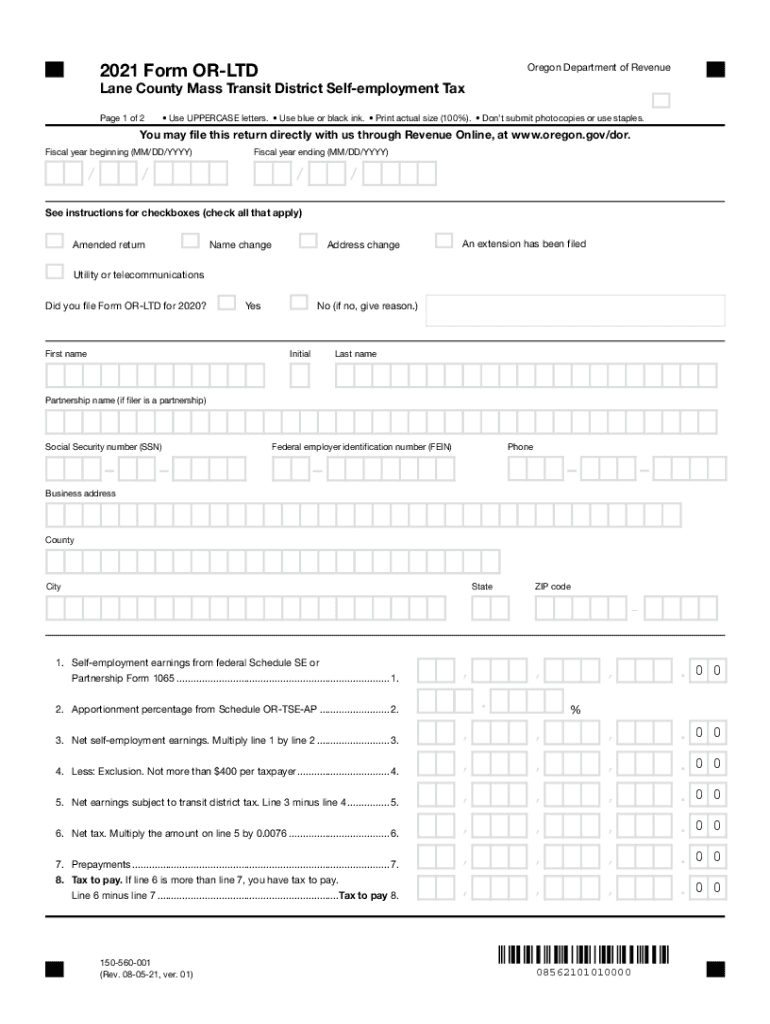

Completing the Oregon Department of Revenue Tax Lien involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including taxpayer identification details and the amount owed. Next, fill out the appropriate forms accurately, ensuring that all required fields are completed. Once the form is filled out, review it for any errors before submitting. Finally, submit the form either electronically or via mail, depending on the preferred method. Keeping a copy of the submitted form for personal records is also advisable.

Key elements of the Oregon Department Of Revenue Tax Lien

Understanding the key elements of the Oregon Department of Revenue Tax Lien is essential for taxpayers. These elements include the taxpayer's name, the amount of tax owed, the date the lien was filed, and the legal description of the property involved. Additionally, the lien may include information about any penalties or interest accrued on the unpaid taxes. Familiarity with these components can help taxpayers navigate the process more effectively and understand their obligations.

Legal use of the Oregon Department Of Revenue Tax Lien

The legal use of the Oregon Department of Revenue Tax Lien is primarily to secure the state’s interest in collecting unpaid taxes. When a lien is filed, it legally establishes the state’s right to the taxpayer's property until the debt is settled. This legal framework ensures that taxpayers are aware of their obligations and the potential consequences of non-payment. It is important for taxpayers to understand their rights and responsibilities regarding tax liens to avoid further legal complications.

How to obtain the Oregon Department Of Revenue Tax Lien

Obtaining the Oregon Department of Revenue Tax Lien requires a few straightforward steps. Taxpayers can request a copy of the lien from the Oregon Department of Revenue's website or by contacting their office directly. It is important to provide necessary identification and details regarding the tax account to facilitate the process. Additionally, taxpayers may need to pay a nominal fee for obtaining copies of the lien documents.

Filing Deadlines / Important Dates

Filing deadlines and important dates related to the Oregon Department of Revenue Tax Lien are crucial for compliance. Taxpayers should be aware of the due dates for tax payments to avoid liens being filed. Typically, the state sets specific deadlines for tax filings, and failing to meet these can result in immediate lien actions. Keeping track of these dates can help taxpayers manage their tax responsibilities and avoid unnecessary penalties.

Form Submission Methods (Online / Mail / In-Person)

There are several methods for submitting the Oregon Department of Revenue Tax Lien form. Taxpayers can choose to submit their forms online through the Oregon Department of Revenue’s secure portal, which is often the fastest option. Alternatively, forms can be mailed to the appropriate department, or submitted in person at designated locations. Each method has its own processing times, so taxpayers should select the option that best suits their needs and timelines.

Quick guide on how to complete oregon department of revenue tax lien

Accomplish Oregon Department Of Revenue Tax Lien effortlessly on any device

Web-based document management has become favored by organizations and individuals alike. It offers a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow supplies you with all the tools necessary to create, edit, and eSign your documents rapidly without delays. Manage Oregon Department Of Revenue Tax Lien on any device using airSlate SignNow's Android or iOS applications and simplify any document-driven task today.

The easiest method to modify and eSign Oregon Department Of Revenue Tax Lien without any hassle

- Locate Oregon Department Of Revenue Tax Lien and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign feature, which only takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Choose your preferred method to send your form, whether via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry about lost or misplaced documents, tedious form searches, or mistakes that require printing new document versions. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Oregon Department Of Revenue Tax Lien and ensure seamless communication throughout the entire form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oregon department of revenue tax lien

Create this form in 5 minutes!

People also ask

-

What is an Oregon Department Of Revenue Tax Lien?

An Oregon Department Of Revenue Tax Lien is a legal claim against your property due to unpaid taxes owed to the state. Once the lien is filed, it ensures that the state can collect what is owed before other creditors. Understanding this lien is crucial for managing your tax obligations and ensuring you stay compliant.

-

How can airSlate SignNow help with Oregon Department Of Revenue Tax Lien documentation?

airSlate SignNow streamlines the process of sending and eSigning tax-related documents, including those related to an Oregon Department Of Revenue Tax Lien. This can signNowly reduce the time spent on paperwork, allowing you to focus on resolving your tax issues efficiently.

-

What are the costs associated with handling an Oregon Department Of Revenue Tax Lien?

Costs related to an Oregon Department Of Revenue Tax Lien can include penalties, interest, and potential legal fees. Additionally, using services like airSlate SignNow to manage related documents can provide a cost-effective solution, helping to minimize these expenses by speeding up workflows.

-

Is airSlate SignNow secure for handling sensitive Oregon Department Of Revenue Tax Lien documents?

Yes, airSlate SignNow employs advanced security measures to ensure the confidentiality and integrity of your documents, including those related to an Oregon Department Of Revenue Tax Lien. With features like encryption and secure access controls, you can trust that your sensitive data is protected.

-

What features does airSlate SignNow offer for managing Oregon Department Of Revenue Tax Lien forms?

airSlate SignNow offers a variety of features that simplify managing Oregon Department Of Revenue Tax Lien documents, including customizable templates, eSigning, and document tracking. These tools make it easy to collect signatures and manage the submission process effectively.

-

Can airSlate SignNow integrate with other tools for tax management related to Oregon Department Of Revenue Tax Lien?

Yes, airSlate SignNow integrates seamlessly with various software solutions that can aid in managing tax information, including those requiring documentation for an Oregon Department Of Revenue Tax Lien. This interoperability enhances your workflow, providing a cohesive solution for all your tax management needs.

-

How quickly can I resolve an Oregon Department Of Revenue Tax Lien using airSlate SignNow?

Using airSlate SignNow can help expedite the resolution of an Oregon Department Of Revenue Tax Lien by simplifying the document signing and submission process. Typically, clients find that they can reduce the time spent on paperwork signNowly, allowing them to focus on resolving their tax situation faster.

Get more for Oregon Department Of Revenue Tax Lien

- Mississippi guardian 497315561 form

- Mississippi northern district bankruptcy guide and forms package for chapters 7 or 13 mississippi

- Mississippi southern district bankruptcy guide and forms package for chapters 7 or 13 mississippi

- Bill of sale with warranty by individual seller mississippi form

- Bill of sale with warranty for corporate seller mississippi form

- Bill of sale without warranty by individual seller mississippi form

- Bill of sale without warranty by corporate seller mississippi form

- Chapter 13 plan mississippi form

Find out other Oregon Department Of Revenue Tax Lien

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation