Estates and Trusts Understanding Income Tax NJ Gov Form

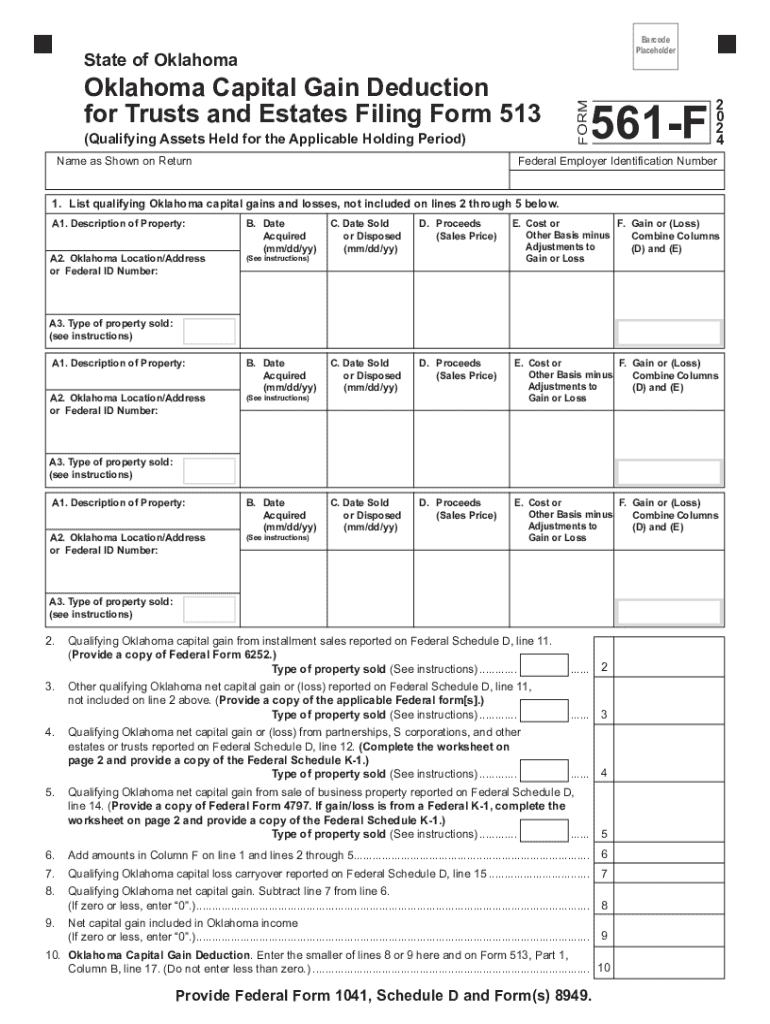

Overview of Oklahoma Form 561

Oklahoma Form 561 is a tax form used for reporting income from estates and trusts. This form is essential for fiduciaries who manage estates or trusts, ensuring compliance with state tax regulations. It provides a structured way to report income, deductions, and other pertinent financial information related to the estate or trust.

Steps to Complete Oklahoma Form 561

Completing Oklahoma Form 561 involves several key steps:

- Gather necessary financial documents, including income statements and expense reports related to the estate or trust.

- Fill in the identifying information at the top of the form, ensuring accuracy to avoid delays.

- Report all income received by the estate or trust, including dividends, interest, and rental income.

- Detail any deductions that the estate or trust is eligible for, such as administrative expenses and distributions to beneficiaries.

- Review all entries for accuracy before finalizing the form.

Required Documents for Oklahoma Form 561

To successfully complete Oklahoma Form 561, several documents are required:

- Financial statements from the estate or trust, including bank statements and investment records.

- Documentation of any income received during the tax year, such as 1099 forms.

- Records of expenses incurred by the estate or trust, including receipts for administrative costs.

- Any previous tax returns related to the estate or trust may also be helpful for reference.

Filing Deadlines for Oklahoma Form 561

It is crucial to be aware of the filing deadlines for Oklahoma Form 561 to avoid penalties. Typically, the form must be filed by the 15th day of the fourth month following the end of the tax year. For estates and trusts operating on a calendar year, this means the due date is April 15. Extensions may be available, but they must be filed timely to avoid late fees.

Form Submission Methods for Oklahoma Form 561

Oklahoma Form 561 can be submitted through several methods:

- Online: Many taxpayers prefer to file electronically through the Oklahoma Tax Commission's website, which streamlines the process.

- Mail: Completed forms can be mailed to the appropriate address as specified by the Oklahoma Tax Commission.

- In-Person: Taxpayers may also choose to submit the form in person at designated tax offices.

Penalties for Non-Compliance with Oklahoma Form 561

Failure to file Oklahoma Form 561 on time or inaccuracies in reporting can lead to penalties. These may include monetary fines and interest on any unpaid taxes. It is advisable to ensure all information is accurate and submitted by the deadline to avoid such consequences.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the estates and trusts understanding income tax nj gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the ok 561 instructions for using airSlate SignNow?

The ok 561 instructions for airSlate SignNow guide users through the process of sending and eSigning documents efficiently. These instructions cover everything from setting up your account to managing your documents. Following these steps ensures a smooth experience with our platform.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow varies based on the plan you choose. We offer flexible pricing options that cater to different business needs, ensuring you get the best value for your investment. For detailed ok 561 instructions on pricing, please visit our pricing page.

-

What features are included in the ok 561 instructions?

The ok 561 instructions encompass a range of features designed to enhance your document management experience. Key features include customizable templates, secure eSigning, and real-time tracking of document status. These tools help streamline your workflow and improve efficiency.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers seamless integrations with various applications to enhance your workflow. The ok 561 instructions provide guidance on how to connect with popular tools like Google Drive, Salesforce, and more. This integration capability allows for a more cohesive business process.

-

What are the benefits of using airSlate SignNow?

Using airSlate SignNow provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security for your documents. The ok 561 instructions highlight how these advantages can help your business save time and resources while ensuring compliance with legal standards.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses. The ok 561 instructions emphasize how our cost-effective solution can help small businesses streamline their document processes without breaking the bank.

-

How secure is airSlate SignNow for document signing?

Security is a top priority for airSlate SignNow. Our platform employs advanced encryption and authentication measures to protect your documents. The ok 561 instructions detail the security features in place to ensure that your sensitive information remains safe throughout the signing process.

Get more for Estates And Trusts Understanding Income Tax NJ gov

- Planned parenthood letterhead form

- Hand heart printable form

- Declaration of domicile indian river county form

- Jamaican passport application form sample

- Bpsc form download

- Haw code r 11 44 2 definitionsstate regulations form

- Purple book taxpayer advocate service form

- California hotel tax exempt form pdf 100067283

Find out other Estates And Trusts Understanding Income Tax NJ gov

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA