B 200 25 Withholding Tax on Owners of a Pass through Entity Form

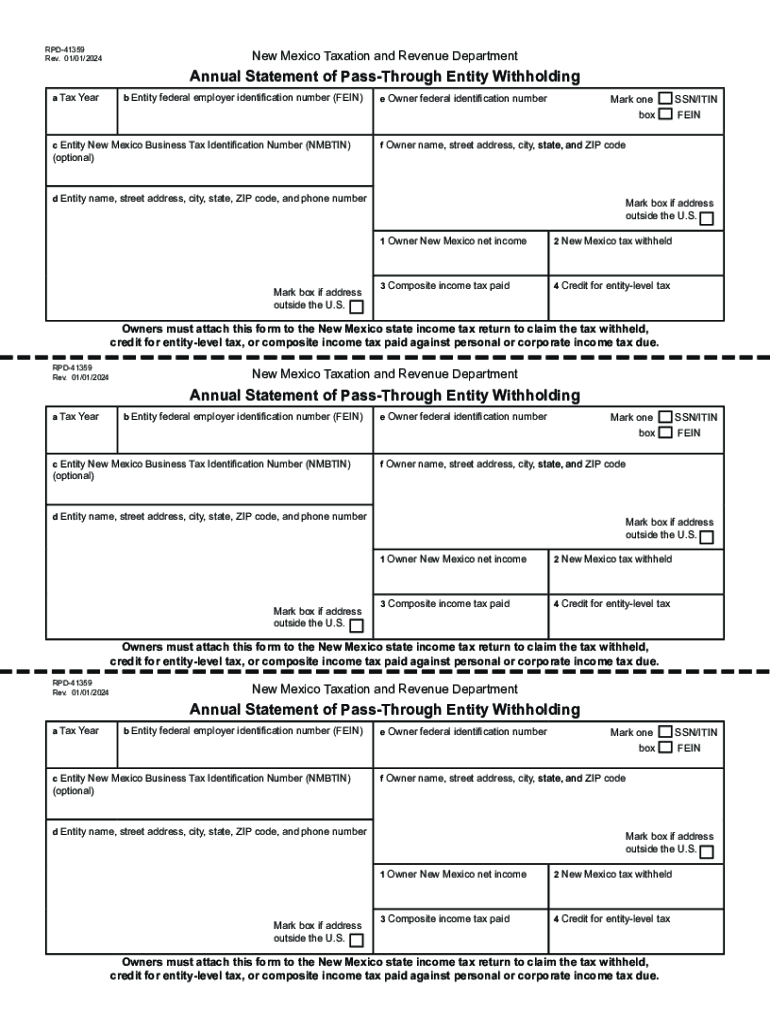

Understanding the RPD 41359 Form

The RPD 41359 form is utilized in New Mexico for reporting the withholding tax on owners of a pass-through entity. This form is essential for ensuring compliance with state tax laws, particularly for businesses that operate as partnerships, LLCs, or S corporations. By filing this form, entities can report the income distributed to their owners, ensuring that the appropriate taxes are withheld and remitted to the state.

Steps to Complete the RPD 41359 Form

Completing the RPD 41359 form involves several key steps:

- Gather necessary information about the entity and its owners, including names, addresses, and taxpayer identification numbers.

- Determine the total income distributed to each owner during the tax year.

- Calculate the withholding tax amount based on the applicable state tax rates.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors before submission.

Required Documents for Filing RPD 41359

When preparing to file the RPD 41359 form, certain documents are necessary:

- Tax identification numbers for the entity and each owner.

- Financial statements detailing income distributions.

- Any prior year tax documents that may be relevant.

Filing Deadlines for RPD 41359

It is crucial to adhere to the filing deadlines for the RPD 41359 form to avoid penalties. Typically, the form must be submitted by the due date of the entity's tax return. If the entity operates on a calendar year basis, this deadline is generally April 15 of the following year.

Penalties for Non-Compliance

Failure to file the RPD 41359 form or to remit the appropriate withholding tax can result in penalties. These may include fines based on the amount of tax due and interest on unpaid taxes. It is important for entities to stay compliant to avoid these financial repercussions.

Who Issues the RPD 41359 Form

The New Mexico Taxation and Revenue Department is responsible for issuing the RPD 41359 form. This department provides guidelines and resources to assist businesses in understanding their tax obligations related to pass-through entities.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the b 200 25 withholding tax on owners of a pass through entity

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is rpd 41359 and how does it relate to airSlate SignNow?

RPD 41359 refers to a specific regulatory document that can be efficiently managed using airSlate SignNow. This platform allows users to send, sign, and store documents securely, making it ideal for handling important paperwork like rpd 41359.

-

How much does airSlate SignNow cost for managing documents like rpd 41359?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including those requiring management of documents like rpd 41359. You can choose from monthly or annual subscriptions, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for rpd 41359 document management?

airSlate SignNow provides features such as eSignature capabilities, document templates, and real-time tracking for documents like rpd 41359. These tools streamline the signing process and enhance overall efficiency.

-

Can airSlate SignNow integrate with other software for handling rpd 41359?

Yes, airSlate SignNow seamlessly integrates with various software applications, allowing for efficient management of documents like rpd 41359. This integration capability enhances workflow and ensures that all your tools work together smoothly.

-

What are the benefits of using airSlate SignNow for rpd 41359?

Using airSlate SignNow for rpd 41359 offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security for your documents. This solution empowers businesses to manage their paperwork with ease.

-

Is airSlate SignNow user-friendly for managing rpd 41359?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to manage documents like rpd 41359. The intuitive interface ensures that users can navigate the platform without any technical expertise.

-

How does airSlate SignNow ensure the security of rpd 41359 documents?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect documents like rpd 41359. This commitment to security ensures that your sensitive information remains safe and confidential.

Get more for B 200 25 Withholding Tax On Owners Of A Pass Through Entity

Find out other B 200 25 Withholding Tax On Owners Of A Pass Through Entity

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament