Tax Information Authorization Tax Disclosure

What is the Tax Information Authorization Tax Disclosure

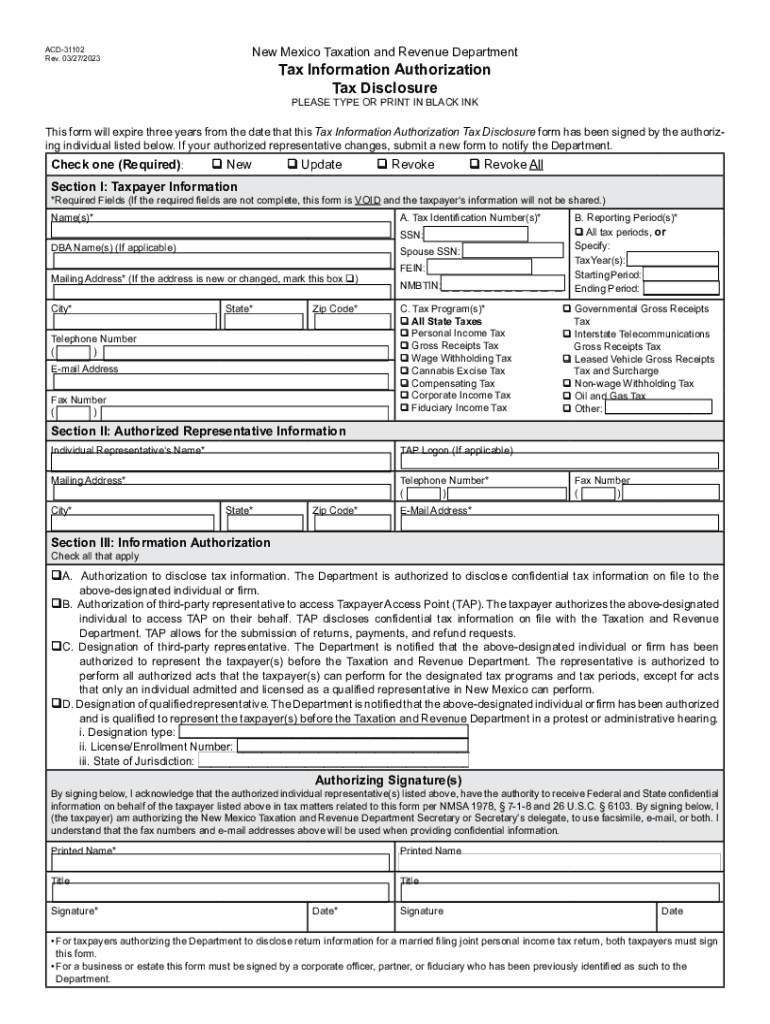

The Tax Information Authorization Tax Disclosure, commonly referred to as nm acd 31102, is a form used by taxpayers to authorize the disclosure of their tax information to a third party. This form is essential for individuals or businesses that need to allow another entity, such as a tax professional or financial institution, to access their tax records. The disclosure ensures that the authorized party can obtain necessary information directly from the IRS or other relevant tax authorities, facilitating smoother communication and processing.

How to use the Tax Information Authorization Tax Disclosure

Using the Tax Information Authorization Tax Disclosure involves a few straightforward steps. First, the taxpayer must fill out the form with accurate personal information, including name, address, and Social Security number. Next, the taxpayer should specify the third party authorized to receive the tax information. It is crucial to include the purpose of the disclosure and the duration for which the authorization is valid. After completing the form, the taxpayer must sign and date it to validate the authorization. Once signed, the form can be submitted to the relevant tax authority, ensuring that the designated third party can access the necessary tax information.

Steps to complete the Tax Information Authorization Tax Disclosure

Completing the Tax Information Authorization Tax Disclosure requires careful attention to detail. Here are the steps to follow:

- Obtain the nm acd 31102 form from the appropriate source.

- Fill in your personal information accurately.

- Identify the third party you are authorizing, including their contact details.

- Clearly state the purpose of the disclosure.

- Specify the effective date and duration of the authorization.

- Sign and date the form to confirm your consent.

- Submit the completed form to the relevant tax authority.

Legal use of the Tax Information Authorization Tax Disclosure

The legal use of the Tax Information Authorization Tax Disclosure is governed by IRS regulations. This form is designed to comply with federal laws regarding the privacy and confidentiality of taxpayer information. When properly executed, it grants permission for the designated third party to receive specific tax information, ensuring that the taxpayer's rights are upheld. It is important for taxpayers to understand that the disclosure should only be made to trusted entities, as unauthorized access to tax information can lead to potential misuse.

Key elements of the Tax Information Authorization Tax Disclosure

Several key elements are essential when filling out the Tax Information Authorization Tax Disclosure. These include:

- Taxpayer Information: Full name, address, and Social Security number.

- Authorized Party: Name and contact details of the individual or organization receiving the information.

- Purpose of Disclosure: A clear explanation of why the information is being shared.

- Duration: The time frame for which the authorization is valid.

- Signature: The taxpayer's signature and date, confirming consent.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Information Authorization Tax Disclosure can vary based on the specific circumstances of the taxpayer. Generally, it is advisable to submit the form well in advance of any deadlines related to tax filings or audits. Keeping track of important dates, such as the tax filing deadline and any extensions, is crucial for ensuring that the authorized party has access to the necessary information in a timely manner. Taxpayers should also be aware of any changes in regulations that may affect submission timelines.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax information authorization tax disclosure

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is nm acd 31102 and how does it relate to airSlate SignNow?

nm acd 31102 refers to a specific code that may be relevant for businesses using airSlate SignNow. This code can help streamline document management processes, ensuring compliance and efficiency in eSigning and document workflows.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs. The plans are designed to be cost-effective, ensuring that users can leverage the benefits of nm acd 31102 without breaking the bank.

-

What features does airSlate SignNow provide?

airSlate SignNow includes a range of features such as document templates, eSignature capabilities, and real-time tracking. These features enhance the user experience and are particularly beneficial for those utilizing nm acd 31102.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, businesses can improve their document workflow efficiency and reduce turnaround times. The integration of nm acd 31102 can further enhance these benefits by ensuring compliance and streamlining processes.

-

Does airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers integrations with various software applications, making it easy to incorporate into your existing workflows. This flexibility is crucial for businesses looking to utilize nm acd 31102 effectively.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely, airSlate SignNow prioritizes security and compliance, ensuring that all documents are handled safely. This is particularly important for businesses dealing with nm acd 31102, as they often require stringent security measures.

-

Can I customize my documents with airSlate SignNow?

Yes, airSlate SignNow allows users to customize documents to fit their specific needs. This feature is especially useful for businesses that need to align their documents with nm acd 31102 requirements.

Get more for Tax Information Authorization Tax Disclosure

- West virginia file form

- Request to continue hearing west virginia form

- Wv workers compensation form

- Correction statement and agreement west virginia form

- West virginia closing 497431828 form

- Flood zone statement and authorization west virginia form

- Name affidavit of buyer west virginia form

- Name affidavit of seller west virginia form

Find out other Tax Information Authorization Tax Disclosure

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS

- Send Sign Document iPad

- How To Send Sign Document

- Fax Sign PDF Online

- How To Fax Sign PDF