Connecticut Income Tax Payment Options Online by Check Form

Connecticut income tax payment options online by check

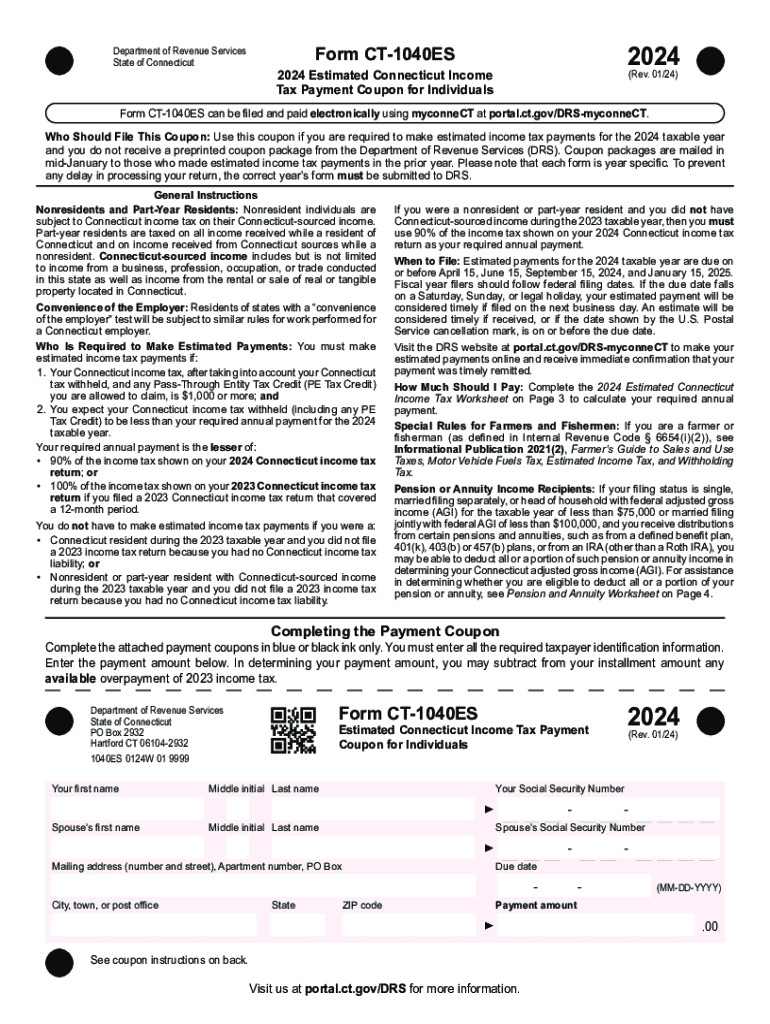

Connecticut offers various options for taxpayers to make their tax payments online, including the ability to pay by check. This method provides a convenient way to fulfill your tax obligations without the need for physical paperwork. Taxpayers can access the state's online payment portal to initiate their payments securely. It is essential to have your personal information and tax details ready to ensure a smooth transaction.

Steps to complete the Connecticut income tax payment online by check

To complete your tax payment online by check, follow these steps:

- Visit the Connecticut Department of Revenue Services website.

- Navigate to the online payment section.

- Select the option for payment by check.

- Enter your taxpayer information, including your Social Security number and tax year.

- Provide the check information, including the check number and amount.

- Review your information for accuracy and submit your payment.

After submission, you will receive a confirmation of your payment, which you should keep for your records.

Required documents for Connecticut tax payment

When making your Connecticut tax payment online, you will need to have certain documents at hand:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN).

- Details of your tax return for the relevant year.

- Information about any previous payments made, if applicable.

Having these documents ready will help streamline the payment process and reduce the likelihood of errors.

Filing deadlines and important dates

It is crucial to be aware of the filing deadlines for Connecticut taxes to avoid penalties. Generally, the state tax returns are due on April 15 for individual taxpayers. If you are making estimated tax payments, these are typically due quarterly. Check the Connecticut Department of Revenue Services for specific dates related to your tax situation.

Penalties for non-compliance

Failure to make timely payments or to file your tax returns can result in penalties. Connecticut imposes interest on unpaid taxes and may also charge a late payment penalty. It is advisable to stay informed about your tax obligations to avoid these additional costs.

Eligibility criteria for Connecticut tax payments

Most residents and businesses in Connecticut are required to pay state income tax. Eligibility for specific tax credits or deductions may vary based on income levels, filing status, and other factors. It is important to review the eligibility criteria set forth by the Connecticut Department of Revenue Services to ensure compliance and maximize potential benefits.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the connecticut income tax payment options online by check

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to Connecticut tax payment?

airSlate SignNow is a digital solution that allows businesses to send and eSign documents efficiently. When it comes to Connecticut tax payment, our platform simplifies the process by enabling users to securely sign and submit tax-related documents online, ensuring compliance and timely submissions.

-

How can airSlate SignNow help with filing Connecticut tax payment documents?

With airSlate SignNow, you can easily prepare, sign, and send your Connecticut tax payment documents electronically. This streamlines the filing process, reduces paperwork, and helps ensure that your submissions are accurate and on time, minimizing the risk of penalties.

-

What are the pricing options for using airSlate SignNow for Connecticut tax payment?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while ensuring you have the necessary tools for managing Connecticut tax payment documents efficiently.

-

Are there any features specifically designed for Connecticut tax payment?

Yes, airSlate SignNow includes features that cater specifically to Connecticut tax payment needs, such as customizable templates for tax forms and automated reminders for payment deadlines. These features help ensure that you stay organized and compliant with state tax regulations.

-

Can I integrate airSlate SignNow with other software for Connecticut tax payment?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and financial software, making it easier to manage your Connecticut tax payment processes. This integration allows for a more streamlined workflow, reducing the time spent on administrative tasks.

-

What benefits does airSlate SignNow provide for managing Connecticut tax payment?

Using airSlate SignNow for Connecticut tax payment offers numerous benefits, including enhanced security for sensitive documents, faster processing times, and improved accuracy. Our platform helps you avoid common pitfalls associated with manual submissions, ensuring a smoother tax payment experience.

-

Is airSlate SignNow user-friendly for those unfamiliar with digital tax payment processes?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those who are not tech-savvy. Our intuitive interface guides users through the Connecticut tax payment process, ensuring that everyone can easily navigate and complete their tasks.

Get more for Connecticut Income Tax Payment Options Online By Check

Find out other Connecticut Income Tax Payment Options Online By Check

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple