Government of the District of Columbia Tatement Form

What is the FR 147 Statement?

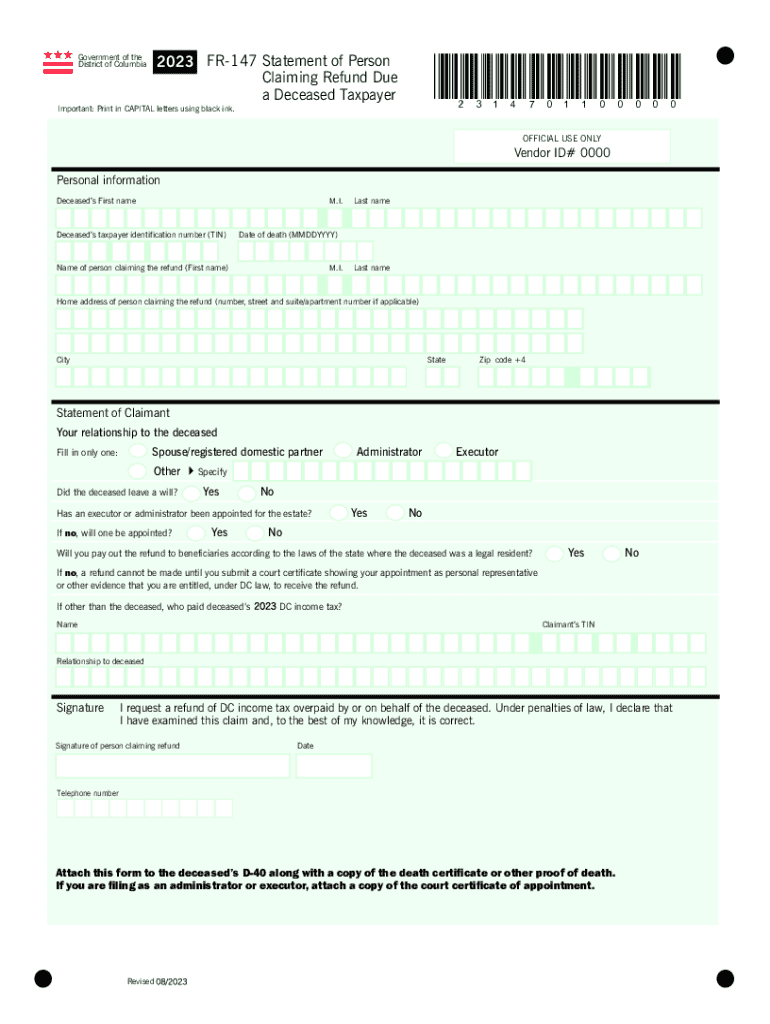

The FR 147 Statement, also known as the Statement of Claim for Refund, is a form utilized by taxpayers in the District of Columbia to claim a refund for overpaid taxes. This document is essential for individuals seeking to recover amounts that were mistakenly paid or assessed. It serves as an official request to the government, detailing the taxpayer's information and the specific reasons for the refund claim. Understanding the purpose of this form is crucial for ensuring that the process is completed correctly and efficiently.

Key Elements of the FR 147 Statement

The FR 147 Statement includes several important components that must be accurately filled out to ensure a successful refund claim. Key elements include:

- Taxpayer Information: This section requires the taxpayer's name, address, and identification number.

- Claim Amount: Taxpayers must specify the amount they believe was overpaid.

- Reason for Claim: A clear explanation of why the refund is being requested is necessary, such as an error in tax calculation.

- Signature: The form must be signed by the taxpayer or their authorized representative to validate the claim.

Steps to Complete the FR 147 Statement

Completing the FR 147 Statement requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather necessary documents, including previous tax returns and any relevant correspondence from the tax authority.

- Fill out the taxpayer information section with accurate details.

- Clearly state the claim amount and provide a concise explanation for the refund request.

- Review the completed form for any errors or omissions.

- Sign and date the form before submission.

Legal Use of the FR 147 Statement

The FR 147 Statement is legally recognized as a formal request for a tax refund within the District of Columbia. It is important for taxpayers to understand that submitting this form does not guarantee a refund; the claim will be reviewed by the tax authority, which may require additional documentation or information. Adhering to legal guidelines when completing and submitting the form is essential to avoid potential penalties or delays in processing.

Filing Deadlines for the FR 147 Statement

Taxpayers should be aware of the filing deadlines associated with the FR 147 Statement to ensure their claims are considered. Generally, the deadline to submit this form is three years from the date the tax return was filed or two years from the date the tax was paid, whichever is later. Keeping track of these deadlines is crucial for maintaining eligibility for a refund.

Form Submission Methods for the FR 147 Statement

The FR 147 Statement can be submitted through various methods. Taxpayers have the option to file the form online, by mail, or in person. Each method has its own advantages. Online submissions may offer quicker processing times, while mailing the form allows for physical documentation. In-person submissions can provide immediate confirmation of receipt, which can be beneficial for tracking the claim's progress.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the government of the district of columbia tatement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the fr 147 statement person blank?

The fr 147 statement person blank is a specific document used for various administrative purposes. It allows individuals to provide necessary information in a structured format. Understanding how to fill out this form correctly can streamline your processes.

-

How can airSlate SignNow help with the fr 147 statement person blank?

airSlate SignNow simplifies the process of completing the fr 147 statement person blank by providing an intuitive platform for eSigning and document management. Users can easily fill out and send this form electronically, ensuring a faster turnaround time. This efficiency can signNowly enhance your workflow.

-

Is there a cost associated with using airSlate SignNow for the fr 147 statement person blank?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost is competitive and reflects the value of features provided, including the ability to manage the fr 147 statement person blank efficiently. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the fr 147 statement person blank?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing the fr 147 statement person blank. These tools help ensure that your documents are completed accurately and securely. Additionally, the platform allows for easy collaboration among team members.

-

Can I integrate airSlate SignNow with other applications for the fr 147 statement person blank?

Absolutely! airSlate SignNow offers integrations with various applications, enhancing your ability to manage the fr 147 statement person blank. Whether you use CRM systems or cloud storage solutions, these integrations can streamline your document workflow and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for the fr 147 statement person blank?

Using airSlate SignNow for the fr 147 statement person blank provides numerous benefits, including time savings and improved accuracy. The platform's user-friendly interface makes it easy to complete and send documents. Additionally, the security features ensure that your sensitive information remains protected.

-

Is airSlate SignNow suitable for small businesses needing the fr 147 statement person blank?

Yes, airSlate SignNow is an excellent choice for small businesses that need to manage the fr 147 statement person blank. The platform is designed to be cost-effective and user-friendly, making it accessible for businesses of all sizes. Small businesses can benefit from the efficiency and reliability that airSlate SignNow offers.

Get more for Government Of The District Of Columbia Tatement

- Peabody picture vocabulary test pdf form

- Travel elite proposal form

- Go math grade 2 answer key pdf form

- Physician assistant contract template form

- Catering authority request type 222 deliver or form

- Notification of change of vehicle ownership vehicle dealers only form mr9b

- Application for facility rental mesa community college mesacc form

- Caregiver self assessment worksheet va form

Find out other Government Of The District Of Columbia Tatement

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document