Fp 7c 2024-2026

What is the Fp 7c

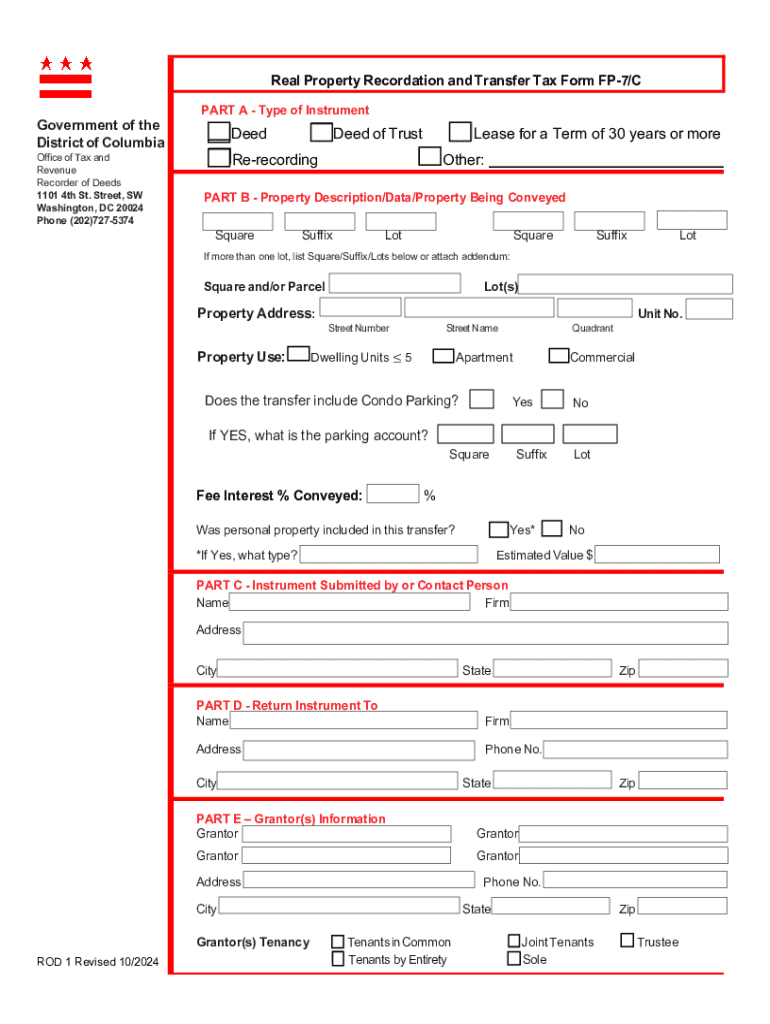

The Fp 7c is a specific form used for various administrative and compliance purposes within the United States. It is often utilized by individuals and businesses to report certain types of information to federal or state agencies. Understanding the purpose and function of the Fp 7c is essential for ensuring compliance with relevant regulations.

How to use the Fp 7c

Using the Fp 7c involves filling out the required sections accurately and completely. Users must provide necessary information, which may include personal details, financial data, or other relevant information depending on the form's purpose. It is important to review all entries for accuracy before submission to avoid delays or penalties.

Steps to complete the Fp 7c

Completing the Fp 7c involves several key steps:

- Gather all necessary documents and information required for the form.

- Fill out the form carefully, ensuring all sections are completed.

- Double-check the information for accuracy and completeness.

- Submit the form through the appropriate channels, whether online, by mail, or in person.

Legal use of the Fp 7c

The Fp 7c must be used in accordance with applicable laws and regulations. Incorrect or fraudulent use of the form can lead to legal repercussions, including fines or other penalties. It is crucial to understand the legal implications of submitting this form and to ensure that all information provided is truthful and accurate.

Filing Deadlines / Important Dates

Filing deadlines for the Fp 7c can vary based on the specific purpose of the form and the jurisdiction. It is important to be aware of these deadlines to avoid late submissions, which can result in penalties. Users should check the relevant guidelines to confirm the exact dates for filing the Fp 7c.

Required Documents

To complete the Fp 7c, certain documents may be required. These can include identification, financial statements, or other supporting materials that validate the information provided on the form. Having these documents ready can streamline the completion process and ensure compliance with submission requirements.

Form Submission Methods

The Fp 7c can typically be submitted through various methods, including:

- Online submission via designated government portals.

- Mailing the completed form to the appropriate agency.

- In-person submission at designated offices.

Choosing the right submission method can depend on personal preference and the specific requirements associated with the form.

Create this form in 5 minutes or less

Find and fill out the correct fp 7c

Create this form in 5 minutes!

How to create an eSignature for the fp 7c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Fp 7c and how does it relate to airSlate SignNow?

Fp 7c is a powerful feature within airSlate SignNow that enhances document management and eSigning capabilities. It allows users to streamline their workflows, making it easier to send, sign, and manage documents efficiently. By leveraging Fp 7c, businesses can improve their operational efficiency and reduce turnaround times.

-

How much does airSlate SignNow with Fp 7c cost?

The pricing for airSlate SignNow with Fp 7c is competitive and designed to fit various business needs. We offer flexible subscription plans that cater to different user requirements, ensuring that you get the best value for your investment. For detailed pricing information, please visit our pricing page.

-

What are the key features of Fp 7c in airSlate SignNow?

Fp 7c includes features such as customizable templates, automated workflows, and real-time tracking of document status. These features are designed to enhance user experience and ensure that documents are processed quickly and securely. With Fp 7c, you can also integrate with other tools to further streamline your processes.

-

What benefits does Fp 7c offer for businesses?

By utilizing Fp 7c, businesses can signNowly reduce the time spent on document management tasks. This feature promotes collaboration and ensures that all stakeholders can access and sign documents seamlessly. Additionally, Fp 7c enhances compliance and security, giving businesses peace of mind.

-

Can Fp 7c integrate with other software applications?

Yes, Fp 7c is designed to integrate seamlessly with various software applications, including CRM and project management tools. This integration capability allows businesses to create a cohesive workflow that enhances productivity. You can easily connect Fp 7c with your existing systems to maximize efficiency.

-

Is Fp 7c suitable for small businesses?

Absolutely! Fp 7c is tailored to meet the needs of businesses of all sizes, including small businesses. Its user-friendly interface and cost-effective pricing make it an ideal solution for small teams looking to improve their document management processes. With Fp 7c, small businesses can compete effectively in their markets.

-

How does Fp 7c ensure document security?

Fp 7c incorporates advanced security measures, including encryption and secure access controls, to protect your documents. This ensures that sensitive information remains confidential and is only accessible to authorized users. With Fp 7c, you can trust that your documents are safe throughout the signing process.

Get more for Fp 7c

- Us passport application blank form

- Ratio and proportion word problems worksheet with answers form

- Nck1 form

- Seasonal lawn care contract form

- Georgia death certificate pdf form

- Cct102 form

- Docslib orgdoc9174077state of south dakota in the circuit court ss county of form

- Marketing statement of work template form

Find out other Fp 7c

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online