I 804 Form 804 Claim for Decedent's Wisconsin Income Tax Refund Fillable

Understanding the Wisconsin 804 Form for Decedent's Income Tax Refund

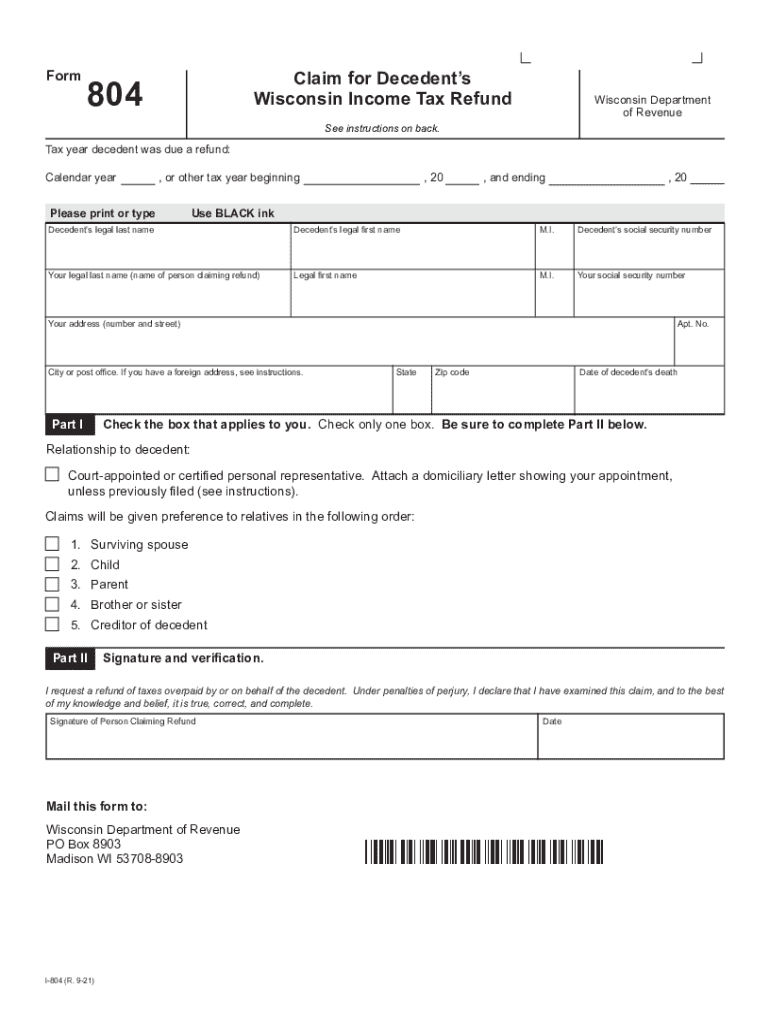

The Wisconsin 804 Form, officially known as the Claim for Decedent's Wisconsin Income Tax Refund, is designed for individuals seeking to claim a tax refund on behalf of a deceased taxpayer. This form is essential for the estate or personal representative of the deceased to recover any tax overpayments made during the decedent's lifetime. It is crucial to understand the specific requirements and procedures involved in filing this form to ensure compliance with Wisconsin tax regulations.

Steps to Complete the Wisconsin 804 Form

Completing the Wisconsin 804 Form involves several key steps:

- Gather necessary documentation, including the decedent's previous tax returns, death certificate, and any relevant financial records.

- Fill out the form accurately, providing all required information about the decedent, including their Social Security number and the tax year for which the refund is being claimed.

- Attach any supporting documents that may be required, such as proof of tax payments or additional forms as specified by the Wisconsin Department of Revenue.

- Review the completed form for accuracy before submission.

Required Documents for the Wisconsin 804 Form

When filing the Wisconsin 804 Form, certain documents are necessary to support the claim. These typically include:

- The decedent's death certificate to verify the date of death.

- Copies of prior tax returns filed by the decedent for the years in question.

- Any documentation that shows tax payments made by the decedent, such as W-2 forms or 1099 statements.

- Proof of your authority to act on behalf of the decedent, such as a will or court appointment as executor or administrator.

Filing Methods for the Wisconsin 804 Form

The Wisconsin 804 Form can be submitted through various methods, ensuring flexibility for those filing the claim. The available submission methods include:

- Online submission through the Wisconsin Department of Revenue's e-file system, if available.

- Mailing the completed form and all supporting documents to the appropriate address as specified by the Department of Revenue.

- In-person submission at local Department of Revenue offices, which may provide immediate assistance and confirmation of receipt.

Eligibility Criteria for the Wisconsin 804 Form

To qualify for filing the Wisconsin 804 Form, certain eligibility criteria must be met:

- The individual for whom the claim is being filed must be deceased.

- The claim must pertain to tax years in which the decedent was a resident of Wisconsin.

- The claimant must have legal authority to act on behalf of the decedent's estate, which may require documentation such as a will or court order.

Legal Use of the Wisconsin 804 Form

The Wisconsin 804 Form is legally recognized for the purpose of claiming tax refunds on behalf of deceased individuals. It is important to ensure that all information provided is truthful and accurate to avoid any potential legal issues. Misrepresentation or errors in the filing process can lead to delays or penalties, making it essential to follow the guidelines set forth by the Wisconsin Department of Revenue.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the i 804 form 804 claim for decedents wisconsin income tax refund fillable 770488142

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for obtaining a 2024 Wisconsin refund using airSlate SignNow?

To obtain your 2024 Wisconsin refund using airSlate SignNow, you can easily prepare and eSign your tax documents online. Our platform streamlines the process, allowing you to send documents for signatures and track their status in real-time. This ensures that your refund process is efficient and hassle-free.

-

Are there any fees associated with using airSlate SignNow for my 2024 Wisconsin refund?

airSlate SignNow offers a cost-effective solution with transparent pricing. While there may be subscription fees depending on the features you choose, there are no hidden costs when preparing documents for your 2024 Wisconsin refund. You can select a plan that best fits your needs and budget.

-

What features does airSlate SignNow offer to help with my 2024 Wisconsin refund?

airSlate SignNow provides a variety of features designed to simplify document management for your 2024 Wisconsin refund. These include customizable templates, secure eSigning, and automated workflows that help you manage your documents efficiently. Our user-friendly interface makes it easy for anyone to navigate the process.

-

Can I integrate airSlate SignNow with other software for my 2024 Wisconsin refund?

Yes, airSlate SignNow offers seamless integrations with various software applications that can assist in managing your 2024 Wisconsin refund. Whether you use accounting software or tax preparation tools, our platform can connect with them to streamline your workflow. This integration helps ensure that all your documents are in one place.

-

How secure is airSlate SignNow when handling my 2024 Wisconsin refund documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your sensitive information related to your 2024 Wisconsin refund. You can trust that your documents are safe and accessible only to authorized users.

-

What are the benefits of using airSlate SignNow for my 2024 Wisconsin refund?

Using airSlate SignNow for your 2024 Wisconsin refund offers numerous benefits, including time savings and increased efficiency. Our platform allows you to quickly prepare and eSign documents, reducing the time spent on paperwork. Additionally, you can track the status of your documents, ensuring you never miss a step in the refund process.

-

Is there customer support available for airSlate SignNow users regarding the 2024 Wisconsin refund?

Absolutely! airSlate SignNow provides dedicated customer support to assist users with any questions or issues related to their 2024 Wisconsin refund. Our support team is available via chat, email, or phone to ensure you have the help you need throughout the process.

Get more for I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable

Find out other I 804 Form 804 Claim For Decedent's Wisconsin Income Tax Refund fillable

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer