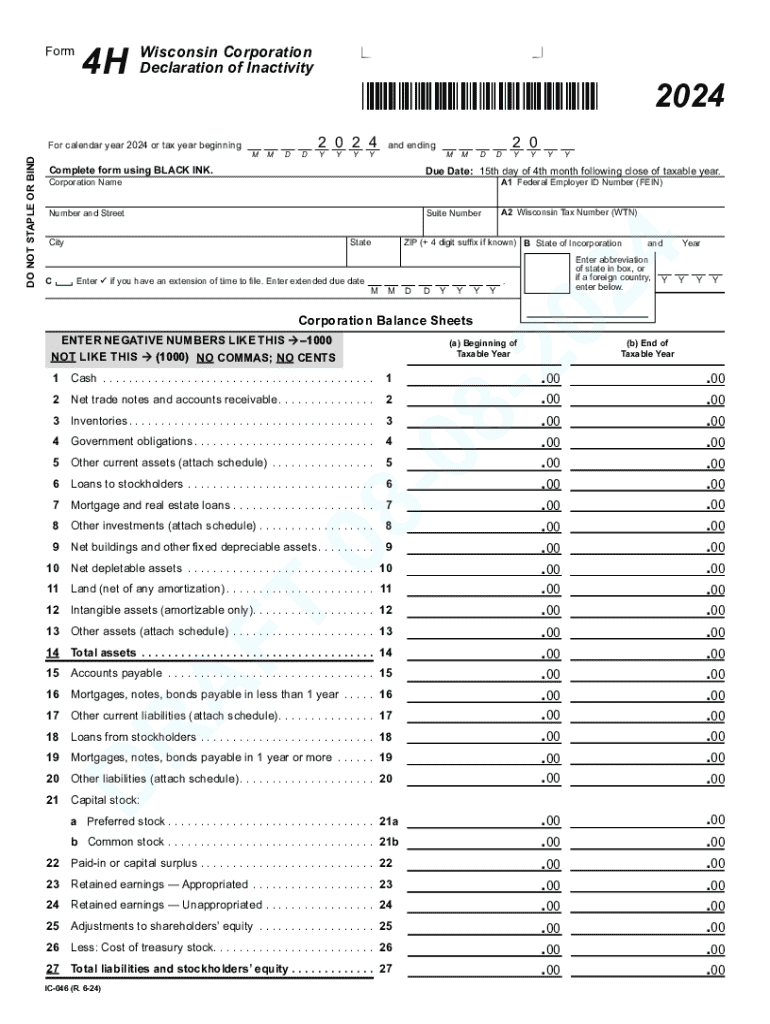

IC 046 Form 4H Wisconsin Corporation Declaration of Inactivity

Understanding the IC 046 Form 4H Wisconsin Corporation Declaration Of Inactivity

The IC 046 Form 4H is a declaration used by corporations in Wisconsin to formally state their inactivity. This form is essential for businesses that have not conducted any operations during a specific period. By filing this form, corporations can maintain their good standing with the state while avoiding unnecessary fees or penalties associated with inactive status.

This declaration is particularly relevant for corporations that may not be generating revenue but still wish to keep their business entity registered. It ensures compliance with state regulations and helps prevent the automatic dissolution of the corporation due to inactivity.

Steps to Complete the IC 046 Form 4H Wisconsin Corporation Declaration Of Inactivity

Completing the IC 046 Form 4H involves several straightforward steps:

- Gather necessary information about the corporation, including its name, address, and identification number.

- Indicate the period of inactivity clearly on the form.

- Provide any required signatures from authorized individuals within the corporation.

- Review the completed form for accuracy to ensure all information is correct.

- Submit the form through the appropriate channels, either online or via mail.

Following these steps carefully will help ensure that the form is processed without issues.

How to Obtain the IC 046 Form 4H Wisconsin Corporation Declaration Of Inactivity

The IC 046 Form 4H can be obtained directly from the Wisconsin Department of Financial Institutions (DFI) website. It is available as a downloadable PDF, which can be printed and filled out manually. Additionally, businesses can often request a copy through their registered agent or local DFI office. Ensuring you have the most current version of the form is crucial for compliance.

Legal Use of the IC 046 Form 4H Wisconsin Corporation Declaration Of Inactivity

The IC 046 Form 4H serves a legal purpose by allowing corporations to officially declare their inactivity. This declaration is recognized by the state as a formal notification, which helps protect the corporation's status. Filing this form can prevent penalties related to non-compliance and helps maintain the corporation's good standing with state authorities.

It is important for corporations to understand that failure to file this declaration may lead to administrative dissolution, which can complicate future business operations.

Filing Deadlines and Important Dates for the IC 046 Form 4H

Corporations must be aware of specific deadlines when it comes to filing the IC 046 Form 4H. Generally, the form should be submitted annually to reflect the corporation's inactivity for the previous year. It is advisable to check with the Wisconsin Department of Financial Institutions for the exact filing dates, as these may vary based on the corporation's registration date and other factors.

Examples of Using the IC 046 Form 4H Wisconsin Corporation Declaration Of Inactivity

There are various scenarios in which a corporation might need to file the IC 046 Form 4H. For instance:

- A corporation that has ceased operations due to market conditions but intends to remain registered for future opportunities.

- A startup that has not yet launched its services or products but wants to keep its business entity active.

- A corporation undergoing restructuring that temporarily halts all operations.

In each of these cases, filing the IC 046 helps maintain compliance and protects the corporation's legal status.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ic 046 form 4h wisconsin corporation declaration of inactivity

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 Wisconsin IC046 and how does it work?

The 2024 Wisconsin IC046 is a specific form used for electronic signatures in Wisconsin. It streamlines the signing process, allowing users to complete documents quickly and securely. With airSlate SignNow, you can easily manage and eSign the 2024 Wisconsin IC046 from any device.

-

How much does airSlate SignNow cost for the 2024 Wisconsin IC046?

Pricing for airSlate SignNow varies based on the plan you choose, but it remains a cost-effective solution for managing the 2024 Wisconsin IC046. We offer flexible pricing tiers that cater to different business needs, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for the 2024 Wisconsin IC046?

airSlate SignNow provides a range of features for the 2024 Wisconsin IC046, including customizable templates, secure cloud storage, and real-time tracking of document status. These features enhance efficiency and ensure compliance with state regulations.

-

Can I integrate airSlate SignNow with other software for the 2024 Wisconsin IC046?

Yes, airSlate SignNow offers seamless integrations with various software applications, making it easy to incorporate the 2024 Wisconsin IC046 into your existing workflows. This flexibility allows you to enhance productivity and streamline document management.

-

What are the benefits of using airSlate SignNow for the 2024 Wisconsin IC046?

Using airSlate SignNow for the 2024 Wisconsin IC046 provides numerous benefits, including faster turnaround times, reduced paper usage, and enhanced security. These advantages help businesses operate more efficiently while maintaining compliance with legal standards.

-

Is airSlate SignNow compliant with Wisconsin regulations for the 2024 Wisconsin IC046?

Absolutely! airSlate SignNow is designed to comply with all relevant Wisconsin regulations for the 2024 Wisconsin IC046. Our platform ensures that your electronic signatures are legally binding and secure, giving you peace of mind.

-

How can I get started with airSlate SignNow for the 2024 Wisconsin IC046?

Getting started with airSlate SignNow for the 2024 Wisconsin IC046 is simple. You can sign up for a free trial on our website, explore the features, and begin creating and eSigning your documents in no time.

Get more for IC 046 Form 4H Wisconsin Corporation Declaration Of Inactivity

Find out other IC 046 Form 4H Wisconsin Corporation Declaration Of Inactivity

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure