Home Equity Application Form 2014-2026

What is the Home Equity Application Form

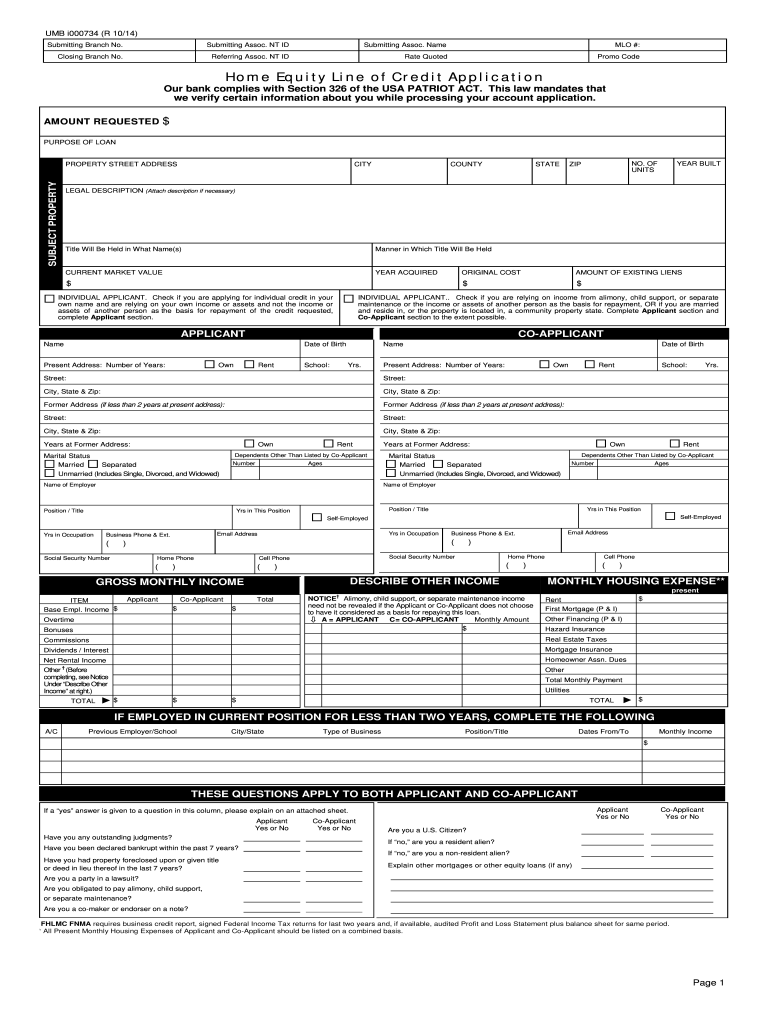

The home equity application form is a crucial document used by homeowners seeking to leverage the equity in their property for financial purposes. This form allows borrowers to request a home equity loan or a home equity line of credit (HELOC). By filling out this form, individuals provide essential information about their financial status, property value, and the amount of equity they wish to access. Understanding the purpose and components of this form is vital for a smooth application process.

Steps to Complete the Home Equity Application Form

Completing the home equity application form involves several key steps that ensure accuracy and compliance with lender requirements. The process typically includes:

- Gathering necessary financial documents, such as income statements, tax returns, and information about existing debts.

- Providing details about the property, including its current market value and any outstanding mortgages.

- Filling out personal information, such as Social Security number, employment details, and contact information.

- Reviewing the application for completeness and accuracy before submission.

Taking the time to follow these steps can significantly enhance the chances of approval and expedite the processing of the application.

Key Elements of the Home Equity Application Form

The home equity application form typically includes several key elements that lenders evaluate during the approval process. These elements include:

- Personal Information: Name, address, Social Security number, and contact details.

- Property Information: Address of the property, estimated value, and current mortgage details.

- Income Details: Monthly income, employment status, and other sources of income.

- Debt Obligations: Information about existing debts, including credit cards, loans, and other financial obligations.

Providing accurate and comprehensive information in these sections is essential for a successful application.

Legal Use of the Home Equity Application Form

The home equity application form must be completed in compliance with applicable laws and regulations to ensure its legal validity. In the United States, lenders are required to adhere to federal and state regulations regarding lending practices, including the Truth in Lending Act (TILA) and the Equal Credit Opportunity Act (ECOA). These laws protect consumers by ensuring transparency in lending terms and preventing discrimination. Proper completion and submission of the form help safeguard the rights of both the borrower and the lender.

Eligibility Criteria

Eligibility for obtaining a home equity loan or line of credit typically depends on several factors assessed through the application form. Common criteria include:

- Home Equity: Borrowers generally need to have sufficient equity in their home, often at least twenty percent.

- Credit Score: A good credit score is usually required to qualify for favorable loan terms.

- Income Stability: Lenders assess the borrower's income to ensure they can repay the loan.

- Debt-to-Income Ratio: A low debt-to-income ratio is often necessary to demonstrate financial responsibility.

Understanding these criteria can help applicants prepare their information accurately and increase their chances of approval.

Form Submission Methods

Submitting the home equity application form can be done through various methods, depending on the lender's preferences. Common submission methods include:

- Online Submission: Many lenders offer digital platforms for applicants to fill out and submit the form electronically.

- Mail Submission: Applicants can print the completed form and send it via postal mail to the lender's address.

- In-Person Submission: Some borrowers may choose to deliver the form directly to a local branch or office of the lender.

Choosing the most convenient submission method can help streamline the application process.

Quick guide on how to complete home equity application form

Effortlessly prepare Home Equity Application Form on any device

The management of online documents has gained traction among businesses and individuals. It offers a wonderful eco-friendly substitute for conventional printed and signed documents, allowing you to access the proper form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Handle Home Equity Application Form on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

Steps to modify and eSign Home Equity Application Form easily

- Obtain Home Equity Application Form and click Get Form to start.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure confidential information using tools designed specifically for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of misplaced or lost documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Home Equity Application Form and ensure smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the home equity application form

The best way to create an electronic signature for a PDF file online

The best way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to generate an eSignature right from your mobile device

The way to create an eSignature for a PDF file on iOS

How to generate an eSignature for a PDF on Android devices

People also ask

-

What is a home equity loan form?

A home equity loan form is a document that allows homeowners to access the equity in their property for borrowing purposes. It typically includes details about the home, the amount being borrowed, and the borrower's financial information. Using a home equity loan form can help streamline the application process.

-

How can airSlate SignNow help with my home equity loan form?

airSlate SignNow provides a user-friendly platform to create, send, and eSign your home equity loan form quickly and securely. With our intuitive tools, you can ensure that your documents are completed and returned without the hassle of printing or mailing. This speeds up the approval process for your home equity loan.

-

What are the pricing options for using airSlate SignNow for my home equity loan form?

airSlate SignNow offers flexible pricing plans to suit various needs, including individual users and businesses. Our cost-effective solutions allow you to manage documents like the home equity loan form without incurring hefty costs. Check our website for detailed pricing plans tailored for your requirements.

-

Can I customize my home equity loan form using airSlate SignNow?

Yes, airSlate SignNow allows you to customize your home equity loan form to fit your specific needs. You can add fields, logos, and other branding elements to ensure your document reflects your identity. This customization is beneficial for both personal use and professional services.

-

What features does airSlate SignNow offer for managing home equity loan forms?

airSlate SignNow includes several features to manage your home equity loan forms effectively. These features include instant eSignature, document tracking, templates for quick setup, and API integrations. With these, managing your loans becomes efficient and organized.

-

Are there any integrations available for the home equity loan form with airSlate SignNow?

Absolutely! airSlate SignNow offers numerous integrations with popular software tools, making it easy to link your home equity loan form to your existing systems. This can enhance workflow automation and ensure that all pertinent information is seamlessly transferred between applications.

-

What benefits should I expect when using airSlate SignNow for my home equity loan form?

By using airSlate SignNow for your home equity loan form, you enjoy numerous benefits like enhanced security, faster processing, and easy document tracking. The eSigning feature eliminates the need for physical documents, thus reducing time and resource expenditures. These advantages streamline the entire loan application process.

Get more for Home Equity Application Form

- To two individuals form

- Sample builders book form

- California renunciation and disclaimer of joint tenant or form

- Enhanced life estates form

- Florida enhanced life estate or lady bird deed two form

- Carve outs california department of industrial relations form

- Control number ca 040 77 form

- Trust and one individual to trust form

Find out other Home Equity Application Form

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF