New York State Department of State Division of Cor 2014

Understanding the New York State Department of State Division of Corporations

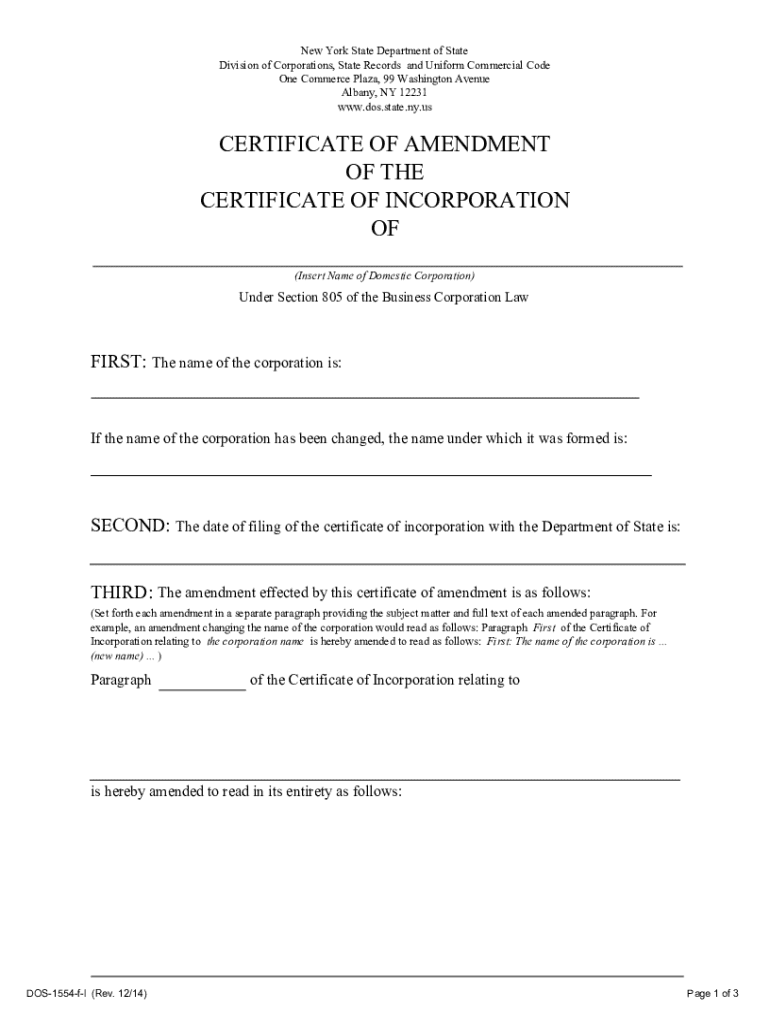

The New York State Department of State Division of Corporations is responsible for overseeing the registration and regulation of business entities within the state. This division manages the filing of various documents, including articles of incorporation, amendments, and dissolution forms. It plays a vital role in ensuring compliance with state laws and maintaining public records related to business entities.

Businesses, including corporations, limited liability companies (LLCs), and partnerships, must register with this division to operate legally in New York. The division also provides essential information regarding the status of registered entities, which is crucial for both business owners and potential investors.

Steps to Complete the New York State Department of State Division of Corporations Form

Completing the necessary forms for the New York State Department of State Division of Corporations involves several key steps:

- Determine the appropriate form required for your business entity type, such as articles of incorporation for corporations or articles of organization for LLCs.

- Gather all necessary information, including the business name, address, and details about the owners or directors.

- Fill out the form accurately, ensuring all required fields are completed to avoid delays.

- Review the form for any errors or omissions before submission.

- Submit the form through the designated method, which may include online submission, mailing, or in-person delivery.

Required Documents for the New York State Department of State Division of Corporations

When filing with the New York State Department of State Division of Corporations, specific documents are typically required:

- Articles of Incorporation or Organization: This foundational document outlines the structure and purpose of the business.

- Operating Agreement: Particularly for LLCs, this document details the management structure and operational procedures.

- Filing Fee: A payment is required at the time of submission, the amount of which varies by entity type.

- Certificate of Good Standing: If applicable, this certificate verifies that the business is compliant with state regulations.

Form Submission Methods for the New York State Department of State Division of Corporations

There are several methods available for submitting forms to the New York State Department of State Division of Corporations:

- Online Submission: Many forms can be completed and submitted electronically through the department's website, providing a quicker processing time.

- Mail: Forms can be printed, filled out, and mailed to the appropriate address. Ensure that you include any necessary fees.

- In-Person Submission: Businesses may also choose to deliver forms directly to the department's office, which can be beneficial for urgent filings.

Legal Use of the New York State Department of State Division of Corporations Forms

Utilizing the forms provided by the New York State Department of State Division of Corporations is essential for legal compliance. These forms ensure that businesses are registered correctly, which protects the owners from personal liability and allows for legal recognition of the entity. Failure to file the necessary documents can result in penalties, including fines and the inability to conduct business legally within the state.

Eligibility Criteria for Filing with the New York State Department of State Division of Corporations

Eligibility to file with the New York State Department of State Division of Corporations varies based on the type of business entity:

- Corporations: Must have at least one director and meet specific naming requirements.

- LLCs: Must have at least one member and adhere to naming conventions that include "LLC" or "Limited Liability Company."

- Partnerships: Generally require at least two partners and must comply with state partnership laws.

Create this form in 5 minutes or less

Find and fill out the correct new york state department of state division of cor

Create this form in 5 minutes!

How to create an eSignature for the new york state department of state division of cor

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New York State Department Of State Division Of Cor?

The New York State Department Of State Division Of Cor is a governmental body that oversees various regulatory functions, including the management of corporate filings and business registrations. Understanding its role is crucial for businesses operating in New York, especially when it comes to compliance and documentation.

-

How can airSlate SignNow help with New York State Department Of State Division Of Cor filings?

airSlate SignNow simplifies the process of preparing and submitting documents required by the New York State Department Of State Division Of Cor. With our eSigning capabilities, you can ensure that your documents are signed quickly and securely, helping you meet compliance deadlines efficiently.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans provide access to essential features that facilitate document management and eSigning, making it a cost-effective solution for those dealing with the New York State Department Of State Division Of Cor.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes a range of features such as customizable templates, automated workflows, and secure cloud storage. These features are designed to streamline your document management processes, particularly for those interacting with the New York State Department Of State Division Of Cor.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow efficiency. This is particularly beneficial for businesses that need to manage documents related to the New York State Department Of State Division Of Cor alongside other operational tools.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning offers numerous benefits, including increased speed, enhanced security, and improved compliance. These advantages are especially important for businesses that frequently interact with the New York State Department Of State Division Of Cor, ensuring that all documents are handled professionally.

-

Is airSlate SignNow suitable for small businesses dealing with the New York State Department Of State Division Of Cor?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it an ideal choice for small businesses. It provides the necessary tools to manage documents efficiently, which is essential for compliance with the New York State Department Of State Division Of Cor.

Get more for New York State Department Of State Division Of Cor

Find out other New York State Department Of State Division Of Cor

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy