CIFT 620ES WEB Louisiana Department of Revenue 2024-2026

Understanding the CIFT 620ES for Louisiana Tax Declaration

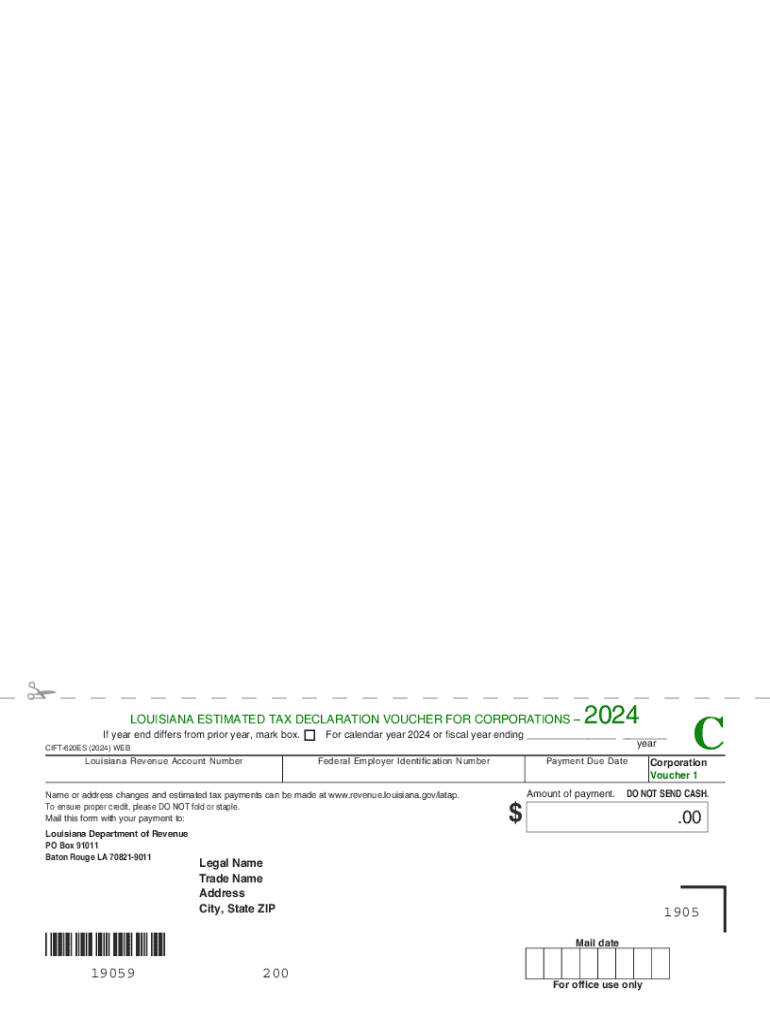

The CIFT 620ES is a tax declaration voucher specifically designed for businesses in Louisiana. It serves as a means for entities to report and pay estimated taxes to the Louisiana Department of Revenue. This form is essential for ensuring compliance with state tax obligations and is particularly relevant for corporations and partnerships. By utilizing the CIFT 620ES, businesses can effectively manage their tax liabilities throughout the year.

Steps to Complete the CIFT 620ES

Completing the CIFT 620ES involves several key steps:

- Gather necessary financial information, including previous year’s tax returns and estimated income for the current year.

- Fill out the form with accurate details, including the business name, address, and tax identification number.

- Calculate the estimated tax liability based on projected income and applicable tax rates.

- Sign and date the voucher to validate the submission.

- Choose a submission method: online, by mail, or in person.

Filing Deadlines for CIFT 620ES

It is crucial to adhere to the filing deadlines for the CIFT 620ES to avoid penalties. Generally, the estimated tax payments are due quarterly. The specific deadlines are:

- First quarter: April 15

- Second quarter: June 15

- Third quarter: September 15

- Fourth quarter: December 15

Ensure that payments are submitted on time to maintain compliance with state regulations.

Submission Methods for CIFT 620ES

The CIFT 620ES can be submitted through various methods, providing flexibility for businesses:

- Online: Businesses can file electronically through the Louisiana Department of Revenue’s website.

- Mail: Completed forms can be sent to the appropriate address specified by the Louisiana Department of Revenue.

- In-Person: Businesses may also deliver the form directly to local revenue offices.

Choosing the right submission method can streamline the process and ensure timely filing.

Legal Use of the CIFT 620ES

The CIFT 620ES is legally recognized by the Louisiana Department of Revenue as a valid means of reporting estimated taxes. Businesses must ensure that the information provided is accurate and complete to avoid legal repercussions. Failure to file or inaccuracies can lead to penalties, interest, and potential audits.

Key Elements of the CIFT 620ES

When completing the CIFT 620ES, several key elements must be included:

- Business identification information, including name and address.

- Tax identification number.

- Estimated income and tax calculations.

- Signature of the authorized representative.

Each element plays a crucial role in ensuring the form is processed correctly by the Louisiana Department of Revenue.

Create this form in 5 minutes or less

Find and fill out the correct cift 620es web louisiana department of revenue 735288027

Create this form in 5 minutes!

How to create an eSignature for the cift 620es web louisiana department of revenue 735288027

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Louisiana tax declaration voucher?

A Louisiana tax declaration voucher is a document used by taxpayers in Louisiana to report their property taxes. It provides essential information about the property and helps ensure accurate tax assessments. Using airSlate SignNow, you can easily create and eSign your Louisiana tax declaration voucher online.

-

How can airSlate SignNow help with my Louisiana tax declaration voucher?

airSlate SignNow streamlines the process of preparing and submitting your Louisiana tax declaration voucher. Our platform allows you to fill out, sign, and send your voucher electronically, saving you time and reducing paperwork. With our user-friendly interface, managing your tax documents has never been easier.

-

Is there a cost associated with using airSlate SignNow for my Louisiana tax declaration voucher?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including options for individuals and businesses. The cost is competitive and reflects the value of our easy-to-use platform for managing documents like the Louisiana tax declaration voucher. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for Louisiana tax declaration vouchers?

airSlate SignNow provides features such as customizable templates, electronic signatures, and secure document storage for your Louisiana tax declaration voucher. Additionally, our platform allows for real-time collaboration, making it easy to work with others on your tax documents. These features enhance efficiency and accuracy in your tax filing process.

-

Can I integrate airSlate SignNow with other software for my Louisiana tax declaration voucher?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including CRM systems and cloud storage services. This means you can easily manage your Louisiana tax declaration voucher alongside other business processes, enhancing your overall workflow. Our integrations help you keep everything organized and accessible.

-

What are the benefits of using airSlate SignNow for my Louisiana tax declaration voucher?

Using airSlate SignNow for your Louisiana tax declaration voucher offers numerous benefits, including time savings, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored securely, minimizing the risk of loss or fraud. Additionally, the convenience of eSigning allows you to complete your tax declaration from anywhere.

-

Is airSlate SignNow compliant with Louisiana tax regulations for declaration vouchers?

Yes, airSlate SignNow is designed to comply with all relevant regulations, including those pertaining to Louisiana tax declaration vouchers. Our platform ensures that your documents meet legal standards, providing peace of mind as you prepare your tax filings. You can trust that your electronic signatures and submissions are valid and secure.

Get more for CIFT 620ES WEB Louisiana Department Of Revenue

Find out other CIFT 620ES WEB Louisiana Department Of Revenue

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading