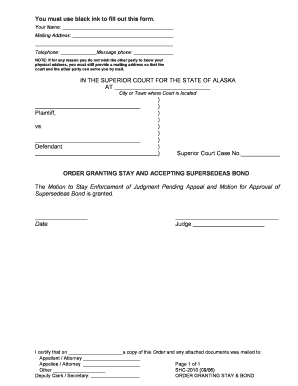

Supersedeas Bond Form

What is the Supersedeas Bond

A supersedeas bond is a type of appeal bond that allows a party to delay the enforcement of a judgment while an appeal is pending. This bond serves as a guarantee that the appellant will pay the judgment amount if the appeal is unsuccessful. It is a crucial tool in the legal process, providing a safeguard for the winning party and ensuring that the appellant has a vested interest in the outcome of the appeal.

How to obtain the Supersedeas Bond

Obtaining a supersedeas bond typically involves several steps. First, the appellant must determine the amount of the bond, which is usually equal to the judgment amount plus any potential interest or costs. Next, the appellant should contact a surety company or an insurance provider that specializes in issuing bonds. The application process may require financial disclosures and a credit check. Once approved, the bond must be filed with the court to formally stay the enforcement of the judgment.

Steps to complete the Supersedeas Bond

Completing a supersedeas bond involves the following steps:

- Determine the total amount required for the bond.

- Choose a reputable surety company.

- Fill out the bond application, providing necessary financial information.

- Pay the premium for the bond, which is typically a percentage of the total bond amount.

- Submit the bond to the court along with any required documentation.

Legal use of the Supersedeas Bond

The legal use of a supersedeas bond is to ensure that the appellant can appeal a court decision without immediate financial repercussions. By filing this bond, the appellant can prevent the enforcement of the judgment until the appeal is resolved. This bond is particularly important in civil cases where the judgment may involve significant financial liabilities, allowing the appellant to maintain their financial stability during the appeal process.

Key elements of the Supersedeas Bond

Key elements of a supersedeas bond include:

- Principal: The party appealing the judgment.

- Obligee: The party who won the initial judgment.

- Surety: The bonding company that guarantees the bond.

- Bond Amount: The total amount that the bond covers, typically the judgment plus interest.

- Conditions: The specific conditions under which the bond is valid, including the requirement to pay if the appeal fails.

State-specific rules for the Supersedeas Bond

Each state in the U.S. has its own rules regarding supersedeas bonds. These rules can dictate the amount required, the process for filing, and any specific forms that must be used. It is essential for appellants to familiarize themselves with their state's regulations to ensure compliance and avoid complications in the appeal process. Consulting with a legal professional can provide clarity on these state-specific requirements.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the supersedeas bond 10989318

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an appeal bond?

An appeal bond is a type of surety bond that a party must post to appeal a court decision. It ensures that the appellant will pay the judgment if they lose the appeal. Understanding the requirements for an appeal bond is crucial for anyone considering an appeal.

-

How does airSlate SignNow facilitate the process of obtaining an appeal bond?

airSlate SignNow streamlines the process of obtaining an appeal bond by allowing users to eSign necessary documents quickly and securely. Our platform simplifies the paperwork involved, ensuring that you can focus on your appeal rather than the logistics of documentation. This efficiency can save you time and reduce stress during the appeal process.

-

What are the costs associated with an appeal bond?

The costs of an appeal bond can vary based on the amount of the bond and the risk assessment by the surety company. Typically, you can expect to pay a premium, which is a percentage of the total bond amount. Using airSlate SignNow can help you manage these costs effectively by providing a transparent pricing structure for document management.

-

What features does airSlate SignNow offer for managing appeal bonds?

airSlate SignNow offers features such as document templates, secure eSigning, and real-time tracking for managing appeal bonds. These tools help ensure that all necessary documents are completed accurately and submitted on time. Our user-friendly interface makes it easy for anyone to navigate the process.

-

Can I integrate airSlate SignNow with other software for managing appeal bonds?

Yes, airSlate SignNow can be integrated with various software applications to enhance your workflow for managing appeal bonds. This includes CRM systems, document management tools, and more. These integrations help streamline your processes and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for appeal bonds?

Using airSlate SignNow for appeal bonds provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to manage all your documents in one place, making it easier to track and organize your appeal bond paperwork. Additionally, the eSigning feature ensures that your documents are signed quickly and securely.

-

Is airSlate SignNow suitable for businesses of all sizes when dealing with appeal bonds?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, making it an ideal solution for managing appeal bonds. Whether you're a small firm or a large corporation, our platform can scale to meet your needs, providing a cost-effective way to handle your documentation.

Get more for Supersedeas Bond

- Itemized list for insurance claim template 210194632 form

- Waltham forest blue badge form

- Writing algebraic expressions from word problems worksheet with answers pdf form

- Ceta assessor registration form

- Meet and greet celebrity format

- Hmsa hmo referral form

- South korea visa application form pdf

- Shames family scoring stage setup sheet form

Find out other Supersedeas Bond

- Sign Arkansas Mortgage Quote Request Online

- Sign Nebraska Mortgage Quote Request Simple

- Can I Sign Indiana Temporary Employment Contract Template

- How Can I Sign Maryland Temporary Employment Contract Template

- How Can I Sign Montana Temporary Employment Contract Template

- How Can I Sign Ohio Temporary Employment Contract Template

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple

- Sign Vermont Independent Contractor Agreement Template Free