Use Your Mouse or Tab Key to Move PDFSEARCH IO 2024-2026

Understanding the Illinois ST-1 Form

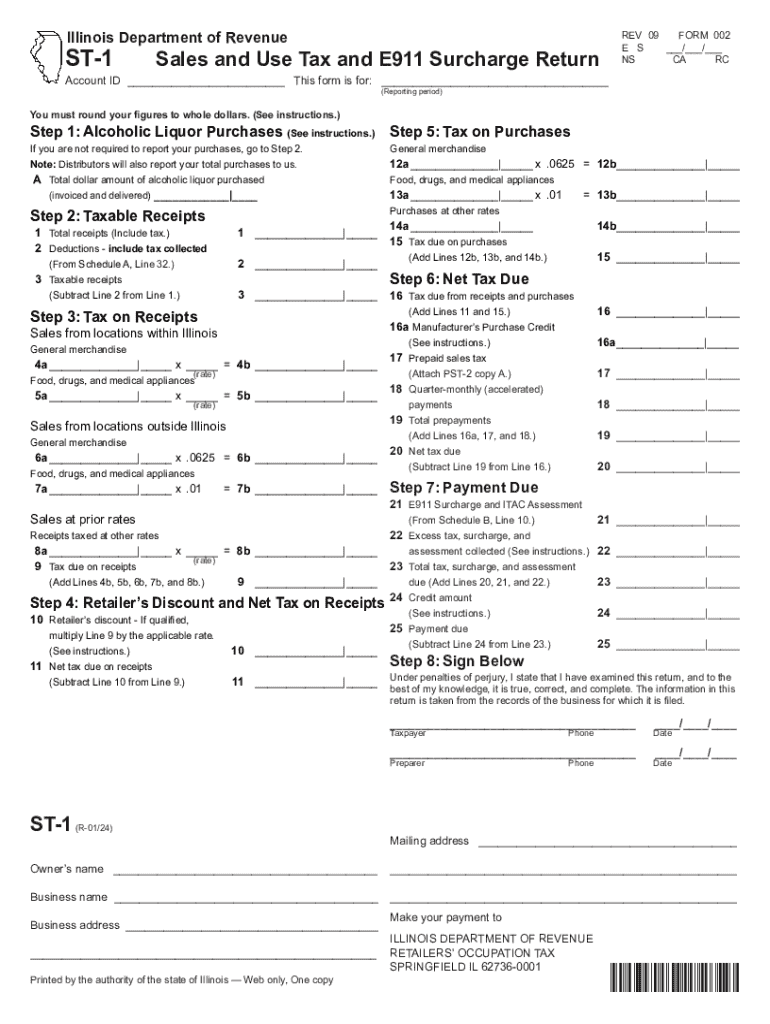

The Illinois ST-1 form is a critical document used for reporting sales and use tax in the state of Illinois. This form is essential for businesses that sell tangible personal property or provide taxable services. It allows businesses to calculate the amount of tax owed to the state based on their sales. The ST-1 form must be completed accurately to ensure compliance with Illinois tax regulations.

Steps to Complete the Illinois ST-1 Form

Completing the Illinois ST-1 form involves several key steps:

- Gather Required Information: Collect all necessary sales data, including total sales, exempt sales, and any deductions.

- Calculate Tax: Use the appropriate tax rate to calculate the total sales tax owed based on your sales figures.

- Fill Out the Form: Enter the calculated figures into the designated sections of the ST-1 form, ensuring accuracy.

- Review and Submit: Double-check all entries for accuracy before submitting the form either online or by mail.

Filing Deadlines for the Illinois ST-1 Form

It is important to be aware of the filing deadlines for the Illinois ST-1 form to avoid penalties. Generally, the form is due on the 20th day of the month following the end of the reporting period. For example, the tax for sales made in January is due by February 20. Businesses should keep track of these deadlines to ensure timely submissions.

Form Submission Methods

The Illinois ST-1 form can be submitted through various methods:

- Online Submission: Businesses can file the ST-1 form electronically through the Illinois Department of Revenue's website.

- Mail Submission: The completed form can also be printed and mailed to the appropriate address provided on the form.

- In-Person Submission: Some businesses may opt to deliver the form in person at designated tax offices.

Penalties for Non-Compliance

Failure to file the Illinois ST-1 form on time can result in penalties and interest charges. The penalties can vary based on the length of the delay and the amount of tax owed. It is advisable for businesses to stay informed about their filing obligations to avoid these financial repercussions.

Eligibility Criteria for Filing

To file the Illinois ST-1 form, businesses must meet certain eligibility criteria. This includes having a valid Illinois sales tax registration and engaging in taxable sales or services within the state. It is essential for businesses to verify their eligibility before attempting to file the form.

Quick guide on how to complete use your mouse or tab key to move pdfsearch io

Effortlessly Prepare Use Your Mouse Or Tab Key To Move PDFSEARCH IO on Any Device

Managing documents online has become increasingly favored by organizations and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents rapidly without delays. Handle Use Your Mouse Or Tab Key To Move PDFSEARCH IO on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to modify and electronically sign Use Your Mouse Or Tab Key To Move PDFSEARCH IO with ease

- Locate Use Your Mouse Or Tab Key To Move PDFSEARCH IO and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive details using tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Use Your Mouse Or Tab Key To Move PDFSEARCH IO to guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct use your mouse or tab key to move pdfsearch io

Create this form in 5 minutes!

How to create an eSignature for the use your mouse or tab key to move pdfsearch io

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois ST-1 form?

The Illinois ST-1 form is a sales tax exemption certificate used by businesses in Illinois to claim exemption from sales tax on certain purchases. By using the Illinois ST-1 form, businesses can streamline their purchasing process and ensure compliance with state tax regulations.

-

How can airSlate SignNow help with the Illinois ST-1 form?

airSlate SignNow simplifies the process of sending and eSigning the Illinois ST-1 form. With our platform, you can easily create, send, and manage your documents, ensuring that your Illinois ST-1 form is completed accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for the Illinois ST-1 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solution allows you to manage the Illinois ST-1 form and other documents without breaking the bank, making it an ideal choice for businesses of all sizes.

-

What features does airSlate SignNow offer for managing the Illinois ST-1 form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for the Illinois ST-1 form. These features enhance your workflow, making it easier to manage and store important documents securely.

-

Can I integrate airSlate SignNow with other software for the Illinois ST-1 form?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing you to streamline your workflow when handling the Illinois ST-1 form. This integration capability ensures that your documents are easily accessible and manageable across different platforms.

-

What are the benefits of using airSlate SignNow for the Illinois ST-1 form?

Using airSlate SignNow for the Illinois ST-1 form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete transactions faster while ensuring that your sensitive information remains protected.

-

How secure is airSlate SignNow when handling the Illinois ST-1 form?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your Illinois ST-1 form and other documents. You can trust that your data is safe while using our platform for eSigning and document management.

Get more for Use Your Mouse Or Tab Key To Move PDFSEARCH IO

Find out other Use Your Mouse Or Tab Key To Move PDFSEARCH IO

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer