Form W 2 VI U S Virgin Islands Wage and Tax Statement

What is the Form W-2 VI U.S. Virgin Islands Wage and Tax Statement

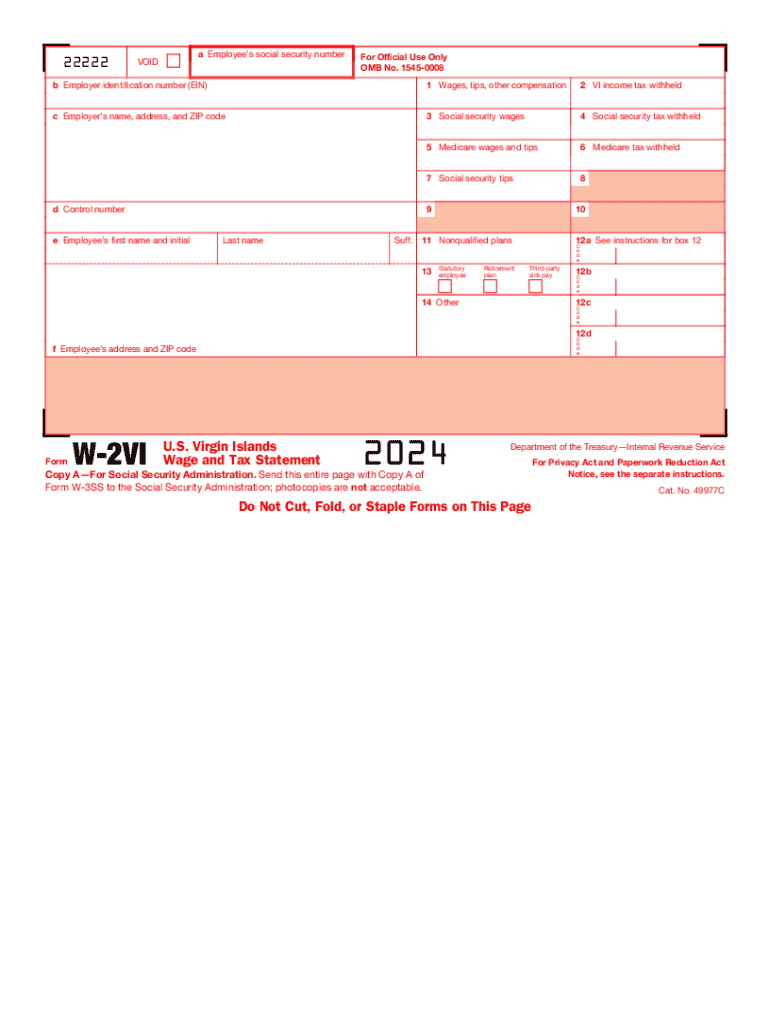

The Form W-2 VI is a wage and tax statement specifically designed for employees working in the U.S. Virgin Islands. This form reports an employee's annual wages and the amount of taxes withheld from their paychecks. It is essential for tax filing purposes, as it provides the necessary information for both the employee and the Internal Revenue Service (IRS). The W-2 VI includes details such as wages, tips, and other compensation, along with federal and state tax withholdings applicable to the U.S. Virgin Islands.

How to use the Form W-2 VI U.S. Virgin Islands Wage and Tax Statement

Using the Form W-2 VI involves a few straightforward steps. First, employees should receive their W-2 VI from their employer by the end of January each year. Once received, employees should review the form for accuracy, ensuring that personal information, wages, and tax withholdings are correct. This form must be included when filing federal and local tax returns. Employees can use the information on the W-2 VI to complete their tax forms, ensuring compliance with both federal and Virgin Islands tax regulations.

Steps to complete the Form W-2 VI U.S. Virgin Islands Wage and Tax Statement

Completing the Form W-2 VI requires accurate reporting of various income and tax details. Employers must fill out the form with the following information:

- Employee's information: Name, address, and Social Security number.

- Employer's information: Business name, address, and Employer Identification Number (EIN).

- Wages and tips: Total compensation paid to the employee during the tax year.

- Tax withholdings: Amounts withheld for federal income tax, Social Security, and Medicare.

Once completed, employers must distribute copies of the W-2 VI to their employees and submit the appropriate copies to the IRS and the Virgin Islands Bureau of Internal Revenue.

Legal use of the Form W-2 VI U.S. Virgin Islands Wage and Tax Statement

The Form W-2 VI is legally required for employers in the U.S. Virgin Islands to report employee wages and tax withholdings. This form must be provided to employees by January 31 of each year, ensuring they have the necessary documentation to file their tax returns. Failure to provide accurate W-2 VI forms can result in penalties for employers, including fines and additional scrutiny from tax authorities.

Key elements of the Form W-2 VI U.S. Virgin Islands Wage and Tax Statement

Key elements of the Form W-2 VI include:

- Employee's wages: Total earnings for the year, including bonuses and tips.

- Withholding amounts: Detailed breakdown of federal and state taxes withheld.

- Employer information: Essential for identifying the source of income and tax obligations.

- Tax year: Clearly indicated to ensure proper reporting for the correct tax period.

These elements are crucial for both employees and tax authorities to ensure accurate reporting and compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form W-2 VI are critical for both employers and employees. Employers must provide employees with their W-2 VI forms by January 31 of each year. Additionally, employers must submit copies of these forms to the IRS and the Virgin Islands Bureau of Internal Revenue by the same date. Employees should aim to file their tax returns by April 15 to avoid penalties and interest on any taxes owed.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 2 vi u s virgin islands wage and tax statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to w2 w?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. With features tailored for managing w2 w forms, it simplifies the process of collecting signatures and ensures compliance with legal standards.

-

How can airSlate SignNow help with w2 w document management?

airSlate SignNow streamlines the management of w2 w documents by providing templates and automated workflows. This ensures that your w2 w forms are processed efficiently, reducing the time spent on paperwork and enhancing productivity.

-

What are the pricing options for using airSlate SignNow for w2 w?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those specifically for managing w2 w forms. You can choose from monthly or annual subscriptions, ensuring you only pay for what you need.

-

Are there any integrations available for w2 w with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, making it easy to manage w2 w forms alongside your existing tools. Popular integrations include CRM systems, cloud storage services, and accounting software, enhancing your workflow.

-

What features does airSlate SignNow offer for w2 w processing?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure storage for w2 w documents. These features ensure that your w2 w forms are handled efficiently and securely, giving you peace of mind.

-

How does airSlate SignNow ensure the security of w2 w documents?

Security is a top priority for airSlate SignNow, especially for sensitive w2 w documents. The platform uses advanced encryption and complies with industry standards to protect your data, ensuring that your w2 w forms are safe from unauthorized access.

-

Can I use airSlate SignNow on mobile devices for w2 w?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to manage and sign w2 w documents on the go. This flexibility ensures that you can handle your w2 w forms anytime, anywhere, increasing your efficiency.

Get more for Form W 2 VI U S Virgin Islands Wage And Tax Statement

Find out other Form W 2 VI U S Virgin Islands Wage And Tax Statement

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word