Installment Agreement Request RI Division of Taxation Form

What is the Installment Agreement Request RI Division Of Taxation

The Installment Agreement Request from the Rhode Island Division of Taxation is a formal application that allows taxpayers to request a payment plan for settling their tax liabilities over time. This agreement is particularly beneficial for individuals or businesses that may be facing financial difficulties but want to remain compliant with state tax obligations. By entering into an installment agreement, taxpayers can manage their debts more effectively without incurring additional penalties or interest that can arise from non-payment.

How to use the Installment Agreement Request RI Division Of Taxation

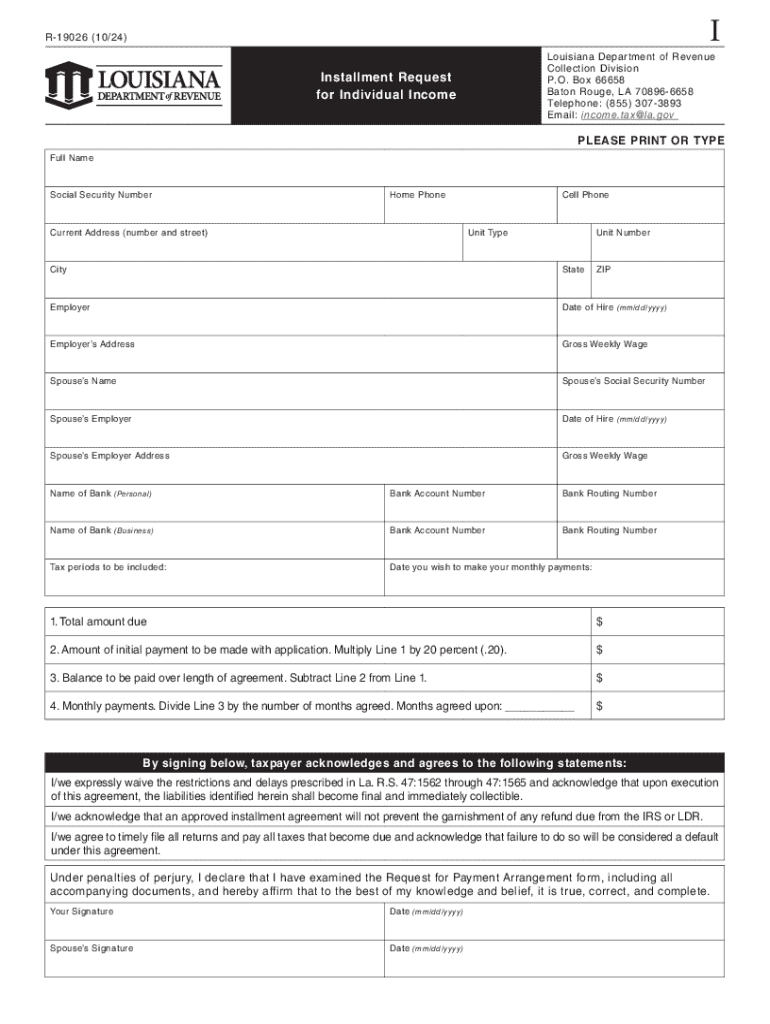

To use the Installment Agreement Request, taxpayers must first complete the designated form provided by the Rhode Island Division of Taxation. This form typically requires detailed information about the taxpayer's financial situation, including income, expenses, and any assets. After filling out the form, it should be submitted to the Division of Taxation for review. It is essential to ensure that all information is accurate and complete to avoid delays in processing the request.

Steps to complete the Installment Agreement Request RI Division Of Taxation

Completing the Installment Agreement Request involves several key steps:

- Gather financial information: Collect details about your income, expenses, and any outstanding debts.

- Obtain the form: Download the Installment Agreement Request form from the Rhode Island Division of Taxation's website.

- Fill out the form: Provide accurate information in all required fields, ensuring clarity and completeness.

- Review your application: Double-check all entries for accuracy before submission.

- Submit the form: Send your completed request to the Rhode Island Division of Taxation via the specified method.

Eligibility Criteria

Eligibility for the Installment Agreement Request generally includes having a tax liability that you cannot pay in full by the due date. Taxpayers must demonstrate a genuine financial hardship and provide documentation supporting their claims. Additionally, individuals must be current with all tax filings to qualify for an installment agreement. The Rhode Island Division of Taxation may also consider the taxpayer's payment history and compliance with previous agreements when assessing eligibility.

Required Documents

When submitting the Installment Agreement Request, taxpayers may need to provide several supporting documents, including:

- Proof of income, such as pay stubs or tax returns.

- A detailed list of monthly expenses.

- Documentation of any assets, including bank statements and property ownership records.

- Any previous correspondence with the Rhode Island Division of Taxation regarding tax liabilities.

Form Submission Methods

The Installment Agreement Request can typically be submitted in several ways to accommodate different preferences. Taxpayers may choose to submit the form online through the Rhode Island Division of Taxation's e-filing system, mail a physical copy to the designated address, or deliver it in person at a local taxation office. Each method has its own processing times, so it is advisable to choose the one that best meets your needs.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the installment agreement request ri division of taxation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Installment Agreement Request for the RI Division Of Taxation?

An Installment Agreement Request for the RI Division Of Taxation allows taxpayers to set up a payment plan for their tax liabilities. This agreement helps individuals manage their tax debts by breaking them into manageable monthly payments, ensuring compliance with state tax regulations.

-

How can airSlate SignNow assist with the Installment Agreement Request for the RI Division Of Taxation?

airSlate SignNow streamlines the process of submitting your Installment Agreement Request for the RI Division Of Taxation by providing an easy-to-use platform for eSigning and sending documents. This ensures that your request is submitted quickly and securely, reducing the hassle of traditional paperwork.

-

What are the costs associated with using airSlate SignNow for my Installment Agreement Request?

airSlate SignNow offers a cost-effective solution for managing your Installment Agreement Request for the RI Division Of Taxation. Pricing plans are flexible and designed to fit various business needs, ensuring you only pay for the features you require.

-

Are there any specific features in airSlate SignNow that support tax-related documents?

Yes, airSlate SignNow includes features specifically designed for tax-related documents, such as customizable templates and secure eSignature options. These features make it easier to prepare and submit your Installment Agreement Request for the RI Division Of Taxation efficiently.

-

Can I track the status of my Installment Agreement Request using airSlate SignNow?

Absolutely! airSlate SignNow provides tracking capabilities that allow you to monitor the status of your Installment Agreement Request for the RI Division Of Taxation. You will receive notifications when your documents are viewed and signed, keeping you informed throughout the process.

-

Is airSlate SignNow compliant with state regulations for tax documents?

Yes, airSlate SignNow is designed to comply with state regulations, including those related to the Installment Agreement Request for the RI Division Of Taxation. Our platform ensures that all eSigned documents meet legal standards, providing peace of mind for users.

-

What integrations does airSlate SignNow offer for tax professionals?

airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your workflow when handling Installment Agreement Requests for the RI Division Of Taxation. These integrations allow for easy data transfer and improved efficiency in managing tax documents.

Get more for Installment Agreement Request RI Division Of Taxation

Find out other Installment Agreement Request RI Division Of Taxation

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple