IRS Additional Medicare Tax Form 8959 Instructions 2023-2026

What is the IRS Additional Medicare Tax Form 8959?

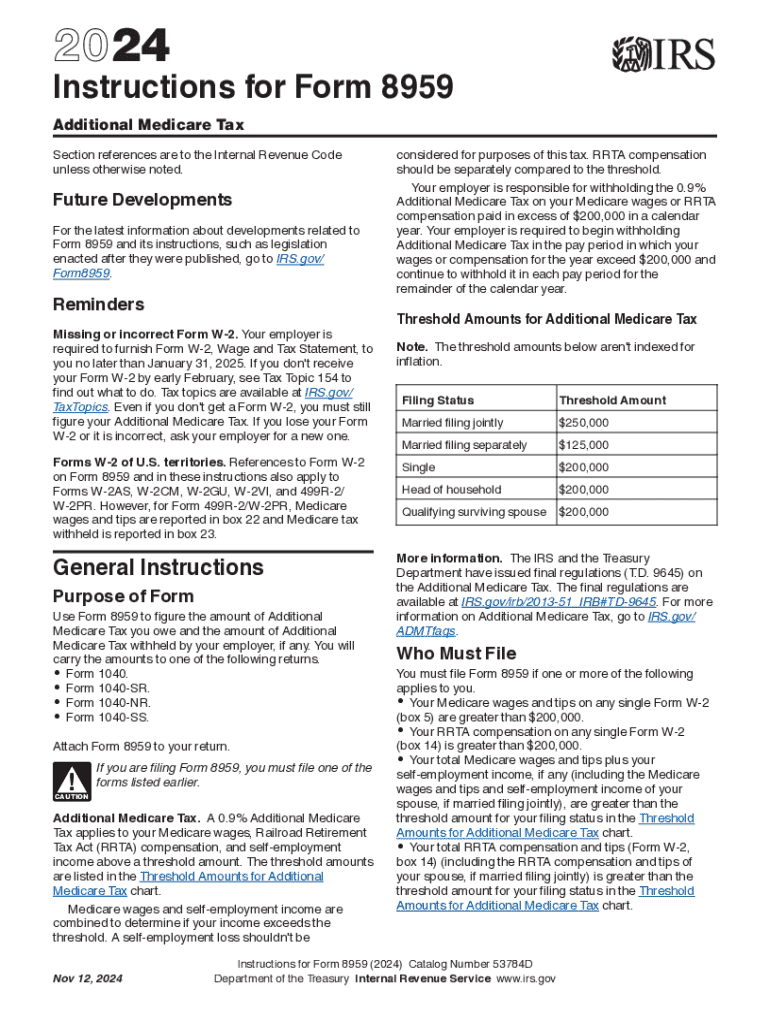

The IRS Additional Medicare Tax Form 8959 is a tax form used to report and calculate the Additional Medicare Tax for high-income earners. This tax applies to individuals whose income exceeds certain thresholds: $200,000 for single filers, $250,000 for married couples filing jointly, and $125,000 for married couples filing separately. The Additional Medicare Tax is calculated at a rate of 0.9% on the income above these thresholds. Understanding this form is essential for compliance with federal tax regulations, ensuring that the correct amount of tax is reported and paid.

Steps to Complete the IRS Additional Medicare Tax Form 8959

Completing Form 8959 involves several key steps:

- Gather necessary information, including your total wages, compensation, and self-employment income.

- Determine if your income exceeds the threshold for Additional Medicare Tax based on your filing status.

- Calculate the Additional Medicare Tax by applying the 0.9% rate to the income above the threshold.

- Fill out the form by entering your calculated amounts in the appropriate sections.

- Review the form for accuracy before submission.

How to Obtain the IRS Additional Medicare Tax Form 8959

Form 8959 can be easily obtained from the IRS website. It is available for download in PDF format, allowing taxpayers to print and complete it manually. Additionally, tax preparation software often includes the form, enabling users to fill it out electronically. It is important to ensure that you are using the most current version of the form to comply with IRS regulations.

Filing Deadlines / Important Dates for Form 8959

The deadline for filing Form 8959 coincides with the federal income tax return due date, typically April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may file for their tax returns, which may affect the submission of Form 8959. Timely filing is crucial to avoid penalties and interest on any unpaid taxes.

Key Elements of the IRS Additional Medicare Tax Form 8959

Form 8959 includes several important sections that taxpayers must complete:

- Part I: This section requires taxpayers to report their total income and determine if it exceeds the applicable thresholds.

- Part II: Here, taxpayers calculate the Additional Medicare Tax owed based on their income above the threshold.

- Signature: A signature is required to validate the form, confirming that the information provided is accurate.

Penalties for Non-Compliance with Form 8959

Failure to file Form 8959 or report the Additional Medicare Tax can result in penalties. The IRS may impose a failure-to-file penalty if the form is not submitted by the due date. Additionally, interest may accrue on any unpaid tax amounts. It is essential for taxpayers to understand their obligations regarding this form to avoid potential financial repercussions.

Create this form in 5 minutes or less

Find and fill out the correct irs additional medicare tax form 8959 instructions

Create this form in 5 minutes!

How to create an eSignature for the irs additional medicare tax form 8959 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8959 and why is it important?

Form 8959 is used to calculate the Additional Medicare Tax for high-income earners. It is important for ensuring compliance with tax regulations and avoiding penalties. By using airSlate SignNow, you can easily eSign and submit form 8959 securely and efficiently.

-

How can airSlate SignNow help with completing form 8959?

airSlate SignNow provides a user-friendly platform to fill out and eSign form 8959. Our solution streamlines the process, allowing you to complete the form quickly and accurately. With our templates, you can ensure that all necessary information is included.

-

Is there a cost associated with using airSlate SignNow for form 8959?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our plans are cost-effective and provide access to features that simplify the eSigning process for documents like form 8959. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing form 8959?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking for form 8959. These features enhance the efficiency of your workflow and ensure that your documents are handled securely. You can also integrate with other tools to streamline your processes.

-

Can I integrate airSlate SignNow with other software for form 8959?

Yes, airSlate SignNow supports integrations with various software applications, making it easy to manage form 8959 alongside your existing tools. This allows for seamless data transfer and improved workflow efficiency. Check our integration options to find the best fit for your needs.

-

What are the benefits of using airSlate SignNow for form 8959?

Using airSlate SignNow for form 8959 offers numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform simplifies the eSigning process, allowing you to focus on your core business activities. Additionally, you can access your documents anytime, anywhere.

-

How secure is airSlate SignNow when handling form 8959?

airSlate SignNow prioritizes security and compliance, ensuring that your form 8959 and other documents are protected. We use advanced encryption and secure storage to safeguard your data. You can trust that your sensitive information is handled with the utmost care.

Get more for IRS Additional Medicare Tax Form 8959 Instructions

- Boston market heat and serve instructions form

- Transnet school of rail form

- Harvard pilgrim fitness reimbursement form 2020

- Cjc application form 2021 pdf download

- Pmrf form 2020 editable

- Trial notebook template form

- Novel outline template chapter by chapter pdf form

- All revere high school roller skating party with mrs revereps mec form

Find out other IRS Additional Medicare Tax Form 8959 Instructions

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast