Instructions for Form 8959 Internal Revenue ServiceInstructions for Form 8959 Internal Revenue ServiceInstructions for Form 8959 2022

Understanding the IRS 8959 Form

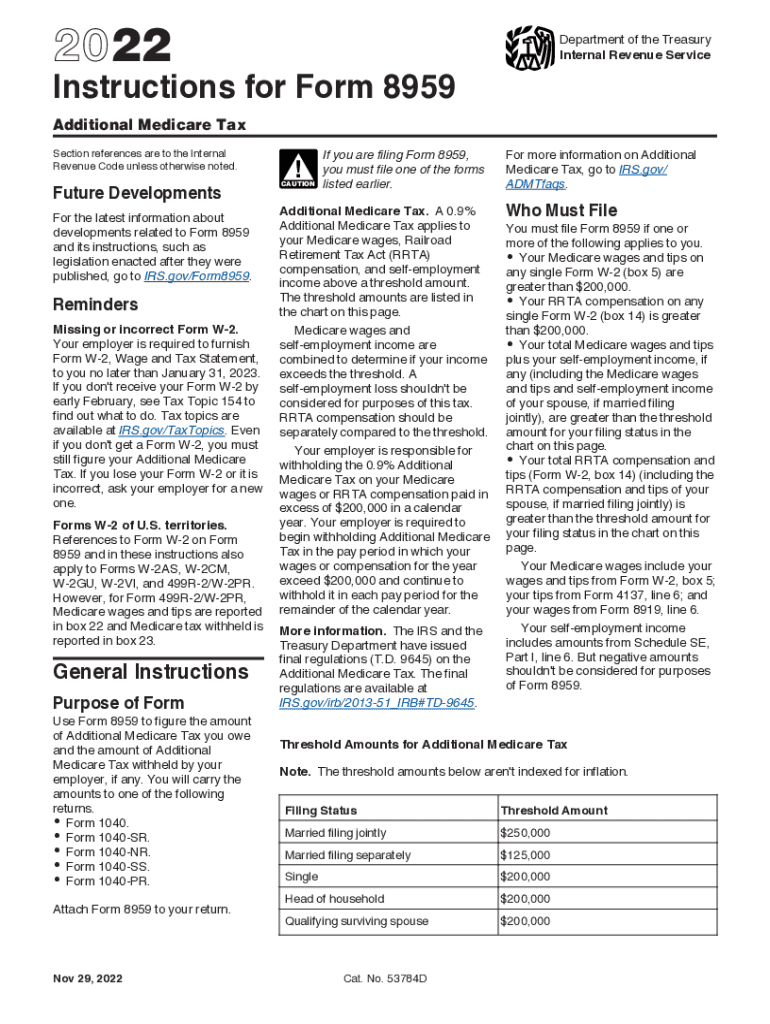

The IRS 8959 form is used to report the Additional Medicare Tax, which applies to high-income earners. This tax is an extra 0.9% on wages, compensation, and self-employment income that exceeds certain thresholds. For single filers, the threshold is $200,000, while for married couples filing jointly, it is $250,000. Understanding the purpose of this form is essential for compliance with federal tax obligations.

Steps to Complete the IRS 8959 Form

Completing the IRS 8959 form involves several steps to ensure accuracy and compliance. First, gather your income information, including wages and self-employment income. Next, determine if your income exceeds the thresholds set by the IRS. If it does, calculate the Additional Medicare Tax owed. Fill out the form by entering your personal information, income details, and the calculated tax. Finally, review the form for accuracy before submission.

Filing Deadlines for the IRS 8959 Form

The IRS 8959 form must be filed along with your annual tax return. For most taxpayers, this means submitting the form by April 15 of the following year. If you are unable to file by this deadline, you may request an extension, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Legal Use of the IRS 8959 Form

The IRS 8959 form is legally binding when completed and submitted according to IRS guidelines. It is essential to ensure that all information is accurate and truthful to avoid potential legal repercussions. Filing this form correctly helps maintain compliance with federal tax laws and prevents issues with the Internal Revenue Service.

Key Elements of the IRS 8959 Form

Key elements of the IRS 8959 form include personal identification information, income details, and the calculation of the Additional Medicare Tax. The form requires you to report your total wages, compensation, and self-employment income, along with the necessary calculations to determine if you owe the Additional Medicare Tax. Understanding these elements is crucial for accurate reporting.

Examples of IRS 8959 Form Usage

Examples of when to use the IRS 8959 form include scenarios where an individual’s income exceeds the filing thresholds. For instance, a self-employed individual earning $300,000 would need to file this form to report the Additional Medicare Tax owed on the income above the threshold. Similarly, an employee with a high salary who receives additional bonuses may also need to file if their total income exceeds the set limits.

Quick guide on how to complete instructions for form 8959 2020internal revenue serviceinstructions for form 8959 2020internal revenue serviceinstructions for

Easily Prepare Instructions For Form 8959 Internal Revenue ServiceInstructions For Form 8959 Internal Revenue ServiceInstructions For Form 8959 on Any Device

Digital document management has surged in popularity among businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly and without issues. Manage Instructions For Form 8959 Internal Revenue ServiceInstructions For Form 8959 Internal Revenue ServiceInstructions For Form 8959 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The Easiest Way to Modify and eSign Instructions For Form 8959 Internal Revenue ServiceInstructions For Form 8959 Internal Revenue ServiceInstructions For Form 8959 Effortlessly

- Obtain Instructions For Form 8959 Internal Revenue ServiceInstructions For Form 8959 Internal Revenue ServiceInstructions For Form 8959 and click on Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to store your changes.

- Choose how you wish to share your form: via email, SMS, or an invitation link, or download it to your computer.

Eliminate the hassles of lost or misplaced documents, exhausting form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign Instructions For Form 8959 Internal Revenue ServiceInstructions For Form 8959 Internal Revenue ServiceInstructions For Form 8959 and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 8959 2020internal revenue serviceinstructions for form 8959 2020internal revenue serviceinstructions for

Create this form in 5 minutes!

People also ask

-

What is the IRS 8959 form and why do I need it?

The IRS 8959 form is used to report additional Medicare tax for high-income earners. If your income exceeds certain thresholds, it's important to file this form to ensure compliance with federal tax laws. Using airSlate SignNow makes it easy to prepare, sign, and send your IRS 8959 form securely and effectively.

-

How can airSlate SignNow help me with the IRS 8959 form?

airSlate SignNow provides a user-friendly platform that simplifies the process of filling out and signing the IRS 8959 form. With our eSignature solution, you can quickly gather signatures from necessary parties, reducing the time spent on paperwork. Plus, our cloud storage ensures that your documents are securely stored and easily accessible.

-

Is airSlate SignNow a cost-effective solution for handling IRS forms like the 8959?

Absolutely! airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes. By choosing our platform, you can save on printing and mailing costs associated with the IRS 8959 form while enjoying a seamless eSigning experience.

-

Can I integrate airSlate SignNow with other applications for IRS form management?

Yes, airSlate SignNow easily integrates with various applications, such as Google Drive, Dropbox, and Salesforce. This means you can manage your IRS 8959 form and other documents directly from your preferred platforms. Our integrations streamline your workflow, making document management more efficient.

-

What are the benefits of using airSlate SignNow for the IRS 8959 form?

Using airSlate SignNow for the IRS 8959 form provides you with multiple benefits, including reduced turnaround time for signatures, enhanced security features, and improved document tracking. Our platform is designed to ensure you never lose track of your important tax documents, allowing for smoother operations during tax season.

-

Is electronic signature on the IRS 8959 form legally binding?

Yes, an electronic signature made using airSlate SignNow is legally binding for the IRS 8959 form. Our platform complies with eSignature laws, ensuring that your signed documents hold up in a court of law. This provides peace of mind as you manage your tax obligations.

-

How secure is airSlate SignNow when handling IRS 8959 form documents?

AirSlate SignNow prioritizes the security of your documents, utilizing advanced encryption methods to protect your IRS 8959 form and all related data. Additionally, our platform complies with industry standards and regulations to ensure your information remains confidential and secure. You can sign and send documents knowing that your sensitive information is protected.

Get more for Instructions For Form 8959 Internal Revenue ServiceInstructions For Form 8959 Internal Revenue ServiceInstructions For Form 8959

- Letter from tenant to landlord about insufficient notice to terminate rental agreement new hampshire form

- New hampshire change form

- Letter from landlord to tenant as notice to remove unauthorized inhabitants new hampshire form

- Letter from tenant to landlord utility shut off notice to landlord due to tenant vacating premises new hampshire form

- Letter from tenant to landlord about inadequacy of heating resources insufficient heat new hampshire form

- New hampshire lien 497318676 form

- Nh disability form

- Nh 30 day form

Find out other Instructions For Form 8959 Internal Revenue ServiceInstructions For Form 8959 Internal Revenue ServiceInstructions For Form 8959

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement