Form 8898 Rev October Statement for Individuals Who Begin or End Bona Fide Residence in a U S Possession

What is Form 8898?

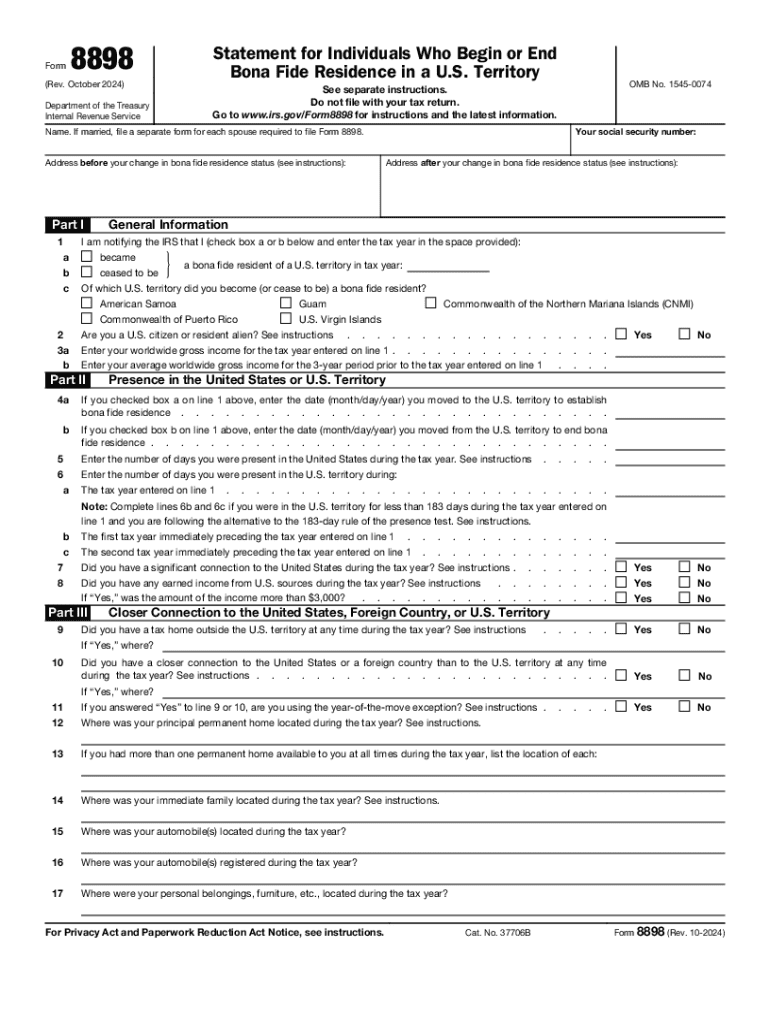

Form 8898 is a statement required by the IRS for individuals who begin or end bona fide residence in a U.S. possession. This form is essential for those who have established residency in specific territories, such as Puerto Rico, Guam, the U.S. Virgin Islands, or the Northern Mariana Islands. It helps to clarify the taxpayer's residency status and ensures compliance with U.S. tax laws. The form captures important details about the individual's residency period and the nature of their presence in the U.S. possession.

How to Use Form 8898

Using Form 8898 involves accurately reporting your residency status to the IRS. Individuals must complete the form when they either start or cease to be a bona fide resident of a U.S. possession. The form requires personal information, including your name, address, and the specific U.S. possession in which you resided. You will also need to indicate the dates of your residency and provide any relevant details that support your status. Proper completion ensures that your tax obligations are correctly assessed based on your residency status.

Steps to Complete Form 8898

Completing Form 8898 involves several key steps:

- Gather necessary personal information, including your Social Security number and residency details.

- Indicate the U.S. possession where you resided and the dates of your residency.

- Provide any additional information that may be required to substantiate your residency claim.

- Review the form for accuracy before submission to avoid any potential issues with the IRS.

Following these steps carefully will help ensure that your form is filled out correctly and submitted on time.

Filing Deadlines for Form 8898

It is important to be aware of the filing deadlines associated with Form 8898. Generally, the form must be filed with your tax return for the year in which you begin or end your bona fide residence in a U.S. possession. The deadline for filing your tax return typically falls on April fifteenth, unless extensions apply. Failure to submit the form by the due date may result in penalties or complications with your tax status.

Legal Use of Form 8898

Form 8898 serves a legal purpose in documenting an individual's residency status for tax purposes. It is crucial for individuals to use this form correctly to comply with U.S. tax laws. By accurately reporting their residency, individuals can ensure they are taxed appropriately based on their status as bona fide residents of a U.S. possession. This form also helps to prevent misunderstandings or disputes with the IRS regarding an individual's tax obligations.

Eligibility Criteria for Form 8898

To be eligible to file Form 8898, individuals must meet specific criteria regarding their residency in a U.S. possession. This includes having established bona fide residency during the tax year in question. The IRS defines bona fide residence as a physical presence in the territory for a significant period, typically at least one year. Individuals must also demonstrate intent to remain in the U.S. possession and meet other relevant criteria as outlined by the IRS.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8898 rev october statement for individuals who begin or end bona fide residence in a u s possession

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the number 8898 in airSlate SignNow?

The number 8898 represents a unique identifier for our service, highlighting our commitment to providing a streamlined eSigning experience. By focusing on the 8898 solution, businesses can easily manage their document workflows and enhance productivity.

-

How does airSlate SignNow pricing work for the 8898 plan?

The 8898 plan offers competitive pricing tailored to meet the needs of businesses of all sizes. With flexible subscription options, you can choose a plan that fits your budget while enjoying the full range of features that airSlate SignNow provides.

-

What features are included in the 8898 package?

The 8898 package includes essential features such as document templates, real-time tracking, and secure eSigning capabilities. These features are designed to simplify the signing process and ensure that your documents are handled efficiently.

-

What are the benefits of using airSlate SignNow with the 8898 solution?

Using the 8898 solution from airSlate SignNow allows businesses to save time and reduce costs associated with traditional document signing. The user-friendly interface and robust features empower teams to collaborate effectively and close deals faster.

-

Can I integrate airSlate SignNow with other applications using the 8898 plan?

Yes, the 8898 plan supports integrations with various applications, including CRM systems and cloud storage services. This flexibility allows you to streamline your workflow and enhance productivity by connecting your favorite tools.

-

Is there a mobile app available for the 8898 solution?

Absolutely! The airSlate SignNow mobile app is available for both iOS and Android devices, allowing you to manage your documents on the go. With the 8898 solution, you can eSign and send documents anytime, anywhere.

-

How secure is the 8898 solution for document signing?

The 8898 solution prioritizes security with advanced encryption and compliance with industry standards. Your documents are protected throughout the signing process, ensuring that sensitive information remains confidential.

Get more for Form 8898 Rev October Statement For Individuals Who Begin Or End Bona Fide Residence In A U S Possession

Find out other Form 8898 Rev October Statement For Individuals Who Begin Or End Bona Fide Residence In A U S Possession

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online